So, you’ve decided to loan some money to a friend or family member, or perhaps you’re on the receiving end of such generosity. That’s fantastic! Lending money can be a real lifesaver, but it’s essential to do it right, especially when personal relationships are involved. Nobody wants a good deed to turn into a source of awkwardness or, worse, a fractured friendship. That’s where a personal loan repayment agreement template comes in handy. It’s not about distrust; it’s about clarity and ensuring everyone is on the same page from the start.

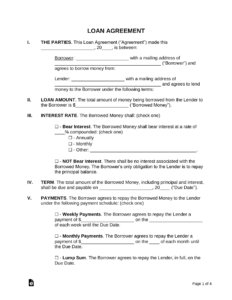

Think of it as a roadmap. A well-defined agreement outlines the terms of the loan, including the amount borrowed, the interest rate (if any), the repayment schedule, and what happens if payments are missed. This way, both the lender and the borrower have a clear understanding of their responsibilities and rights. It avoids misunderstandings later on and protects both parties. It’s far easier to agree on terms upfront than to argue about them when things get complicated.

Essentially, a personal loan repayment agreement template provides a framework for a smooth and respectful financial transaction between individuals. It documents all the important details, making the loan formal and legally sound. This document can prove invaluable if disagreements arise down the road. Remember, clarity is key when lending or borrowing money within personal relationships. Let’s dive deeper into what makes a good personal loan repayment agreement template and how to use it effectively.

Why You Absolutely Need a Personal Loan Repayment Agreement

Let’s face it, lending money to friends or family can be tricky. On one hand, you want to help someone out. On the other, you want to protect your own finances and maintain a healthy relationship. A simple handshake agreement might feel comfortable initially, but it can easily lead to miscommunication and resentment. Memories fade, details get fuzzy, and before you know it, you’re arguing about the interest rate or the payment schedule. That’s where a personal loan repayment agreement template steps in as the ultimate peacekeeper.

This document isn’t just some legal formality; it’s a tool for preserving relationships. By putting everything in writing, you eliminate ambiguity and create a clear record of the agreed-upon terms. This includes the principal loan amount, the interest rate (if any), the start and end dates of the loan, the frequency of payments (weekly, monthly, etc.), and the method of payment (check, electronic transfer, etc.). It’s all spelled out in black and white, leaving no room for interpretation.

Moreover, a well-drafted agreement can help prevent misunderstandings about what happens if the borrower can’t make a payment. It can outline late payment fees, grace periods, and even the lender’s recourse if the borrower defaults on the loan. Addressing these issues upfront, while everyone is on good terms, can save a lot of heartache later on.

Think about it from the borrower’s perspective too. Having a clear agreement provides them with peace of mind. They know exactly what’s expected of them and can plan their finances accordingly. It also gives them a sense of responsibility and encourages them to take the loan seriously. A documented agreement shows that you, as the lender, are also taking the loan seriously, which can strengthen the borrower’s commitment to repayment.

In summary, a personal loan repayment agreement template is a valuable asset for anyone lending or borrowing money within their personal network. It protects both parties, promotes clear communication, and helps maintain healthy relationships. It’s a small investment in time and effort that can pay off big in the long run by preventing conflicts and ensuring a smooth repayment process. The use of a personal loan repayment agreement template can make all the difference.

Key Elements of an Effective Personal Loan Repayment Agreement

Creating an effective personal loan repayment agreement isn’t just about filling in the blanks on a template. It requires careful consideration of the specific circumstances of the loan and the needs of both the lender and the borrower. While every situation is unique, there are several key elements that should be included in every agreement to ensure clarity and enforceability.

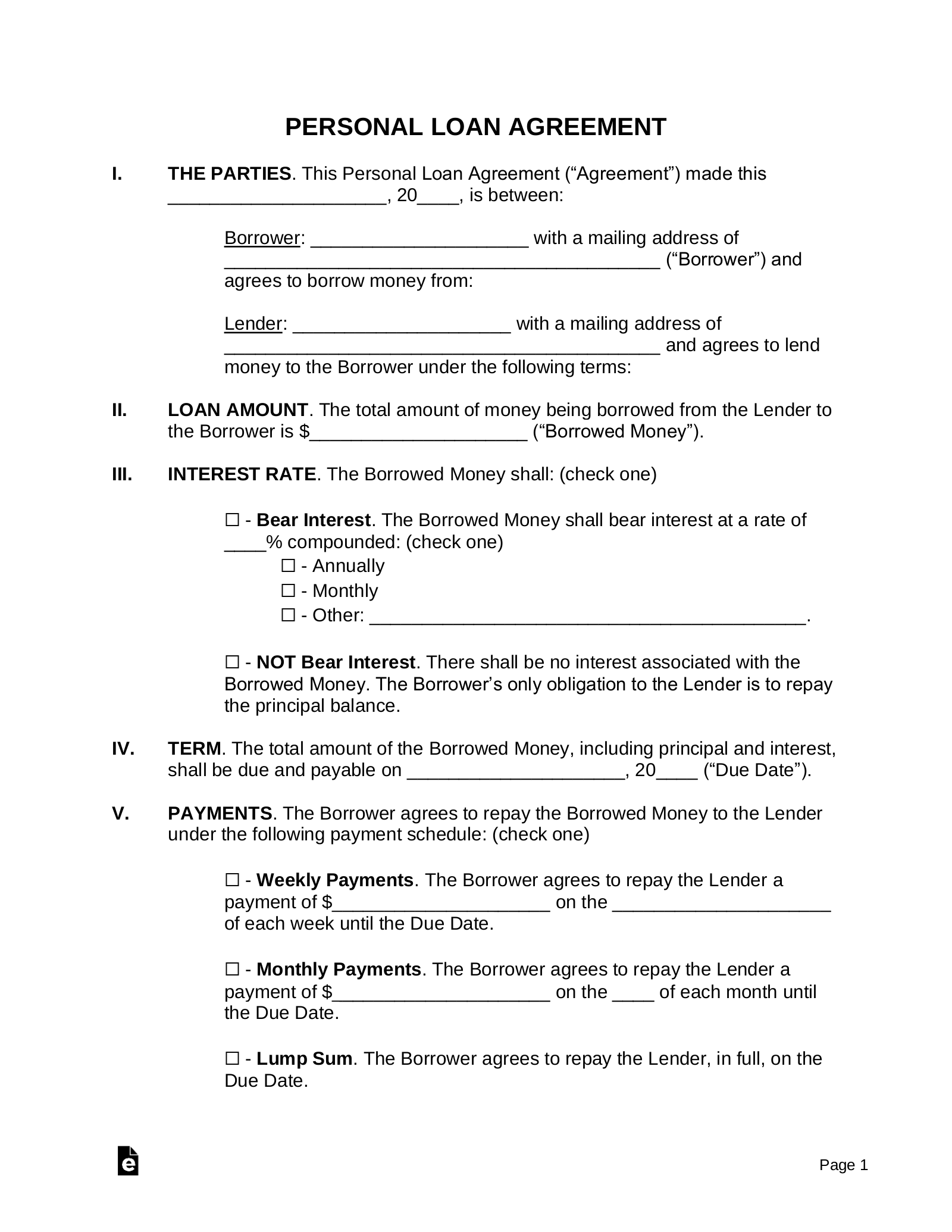

First and foremost, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the lender and the borrower. This may seem obvious, but it’s crucial for establishing who is responsible for fulfilling the terms of the agreement. Next, the agreement must specify the principal loan amount. This is the exact amount of money being borrowed, expressed in a clear and unambiguous manner. Be sure to state the currency as well (e.g., US dollars, Euros, etc.).

Another critical element is the interest rate, if applicable. While some personal loans are interest-free, many lenders choose to charge interest to compensate for the risk involved. If interest is being charged, the agreement must clearly state the interest rate (expressed as a percentage per year) and how it will be calculated. It should also specify whether the interest is simple or compound interest.

The repayment schedule is perhaps the most important part of the agreement. This section should detail the amount of each payment, the frequency of payments (e.g., weekly, monthly, quarterly), and the due date for each payment. It should also specify the method of payment (e.g., check, electronic transfer, cash). Be as specific as possible to avoid any confusion about when and how payments should be made.

Finally, the agreement should include provisions for late payments and default. This section should outline any late payment fees that will be charged, as well as any grace periods that are allowed. It should also specify what constitutes default (e.g., missing a certain number of payments) and what recourse the lender has in the event of default (e.g., the right to demand immediate repayment of the entire loan balance). Addressing these issues upfront can help prevent misunderstandings and protect the lender’s interests.

Using a personal loan repayment agreement template that includes all of these elements will create a much better situation for both lender and borrower.

Ultimately, the goal is to ensure a transparent and mutually agreeable lending arrangement. When both parties feel secure and confident in the terms, the likelihood of successful repayment and a maintained relationship significantly increases.