So, you’re married, and life has thrown you a curveball. Maybe you’ve inherited a business, started a new venture, or simply want to define how your assets will be handled down the road. That’s where a post nuptial financial agreement comes in. Think of it as a financial roadmap created *after* you’ve already said “I do.” It outlines how your assets and debts will be divided in the event of a separation or divorce, providing clarity and security for both partners.

It’s perfectly normal for circumstances to change after marriage. A post nuptial agreement can be a proactive way to address these shifts and ensure that both spouses are on the same page regarding their financial future. It’s not about assuming the worst, but rather about planning responsibly and protecting your individual interests, while simultaneously strengthening the foundation of your marriage through open communication and mutual understanding.

A post nuptial agreement isn’t a sign of distrust or impending doom. Instead, it’s a practical and mature decision that can provide peace of mind. It’s a way to address potentially difficult financial issues constructively, before they become sources of conflict. And, let’s be honest, having a clear understanding of your financial rights and responsibilities can only be a good thing for any relationship.

Understanding Post Nuptial Agreements: More Than Just a Document

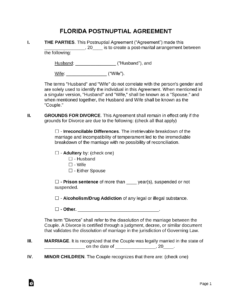

At its core, a post nuptial agreement is a legally binding contract entered into by a married couple. Unlike a prenuptial agreement, which is signed *before* the marriage, a post nuptial agreement is created *during* the marriage. Its primary purpose is to define each spouse’s rights and responsibilities regarding assets, debts, and property division in the event of separation, divorce, or even death. This can include everything from bank accounts and real estate to business interests and retirement funds.

There are many reasons why a couple might choose to enter into a post nuptial agreement. Perhaps one spouse started a business during the marriage and wants to protect it from potential division. Maybe one spouse received a significant inheritance and wants to ensure it remains separate property. Or, perhaps the couple simply wants to create a clear and documented agreement about how their finances will be managed moving forward. Whatever the reason, it’s crucial that both parties enter into the agreement voluntarily and with full understanding of its implications.

A key element of a valid post nuptial agreement is full and honest disclosure. Both spouses must completely disclose all of their assets, debts, and financial information to each other. Hiding assets or misrepresenting financial information can render the agreement unenforceable. Furthermore, the agreement must be fair and equitable to both parties. A court may refuse to enforce an agreement that is deemed unconscionable or that appears to unfairly benefit one spouse over the other.

It’s essential to consult with independent legal counsel before signing a post nuptial agreement. Each spouse should have their own attorney who can review the agreement, explain its terms, and advise them on their legal rights and obligations. This ensures that both parties are fully informed and that the agreement is entered into knowingly and voluntarily. Think of it as getting a second opinion from a doctor – you want to make sure you’re making the best possible decision for your individual circumstances.

The process of creating a post nuptial agreement involves open and honest communication between the spouses. It requires a willingness to discuss potentially sensitive financial matters and to compromise in order to reach a mutually agreeable solution. It’s not always easy, but it can be a valuable exercise in strengthening the foundation of your marriage by fostering transparency and trust. Seeking professional mediation can often help navigate these discussions and facilitate a fair and balanced outcome for both individuals.

What Should a Post Nuptial Financial Agreement Template Include?

A comprehensive post nuptial financial agreement template should include detailed information about the following:

- Separate property: Assets owned by each spouse before the marriage, or received during the marriage as a gift or inheritance.

- Marital property: Assets acquired during the marriage through the efforts of either spouse.

- Debt allocation: How debts incurred during the marriage will be divided.

- Spousal support: Whether spousal support will be paid, and if so, the amount and duration.

- Business interests: How business interests owned by either spouse will be handled.

- Retirement accounts: How retirement accounts will be divided.

- Life insurance: Who will be the beneficiary of life insurance policies.

Finding and Using a Post Nuptial Financial Agreement Template

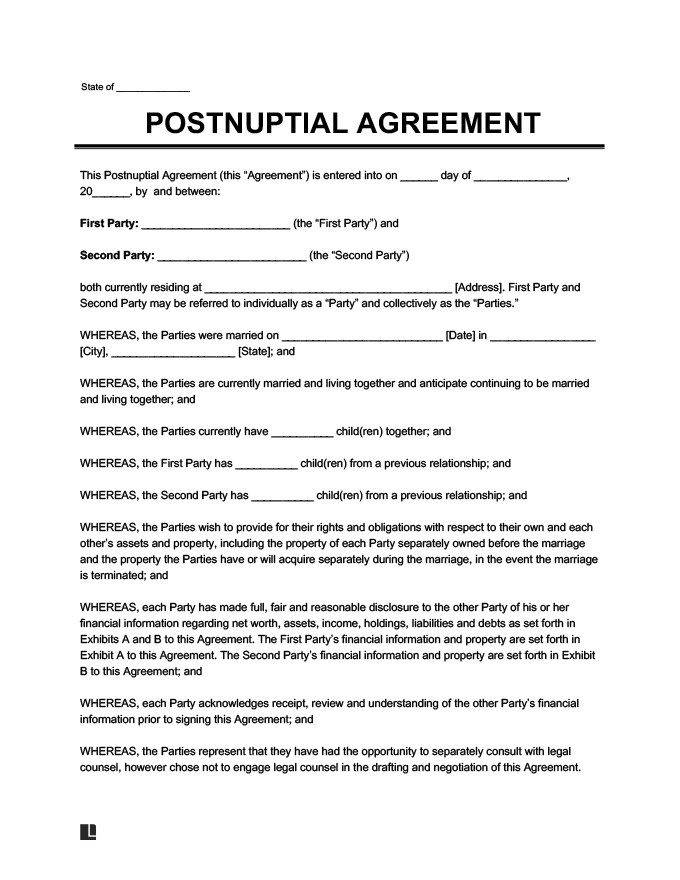

If you’re considering a post nuptial agreement, you might be tempted to start with a template. While a post nuptial financial agreement template can be a helpful starting point, it’s crucial to understand its limitations. A template is a generic document and may not adequately address your specific circumstances. Laws regarding marital agreements vary significantly from state to state, so it’s essential to ensure that any template you use is compliant with the laws of your jurisdiction. Using a generic template without legal advice can be risky and may result in an agreement that is unenforceable.

There are several places you can find a post nuptial financial agreement template. Online legal document providers often offer a variety of templates, including those for post nuptial agreements. Your state or local bar association might also offer resources or referrals to attorneys who specialize in family law and can provide you with a tailored post nuptial financial agreement template, or custom document generation.

Before using any post nuptial financial agreement template, it’s essential to carefully review it and understand its terms. Pay attention to any clauses that seem confusing or unclear. Don’t hesitate to seek clarification from an attorney. Remember, you’re signing a legally binding document, so it’s crucial to fully understand its implications.

The best approach is to use a template as a starting point for discussion with your attorney. They can help you customize the template to meet your specific needs and ensure that it complies with applicable laws. They can also advise you on the fairness and enforceability of the agreement. While using a template can save you time and money, it’s not a substitute for professional legal advice.

Ultimately, a post nuptial financial agreement is a significant legal document that should be approached with careful consideration and professional guidance. While a template can be a useful tool, it’s crucial to remember its limitations and to seek the advice of an attorney to ensure that your agreement is valid, enforceable, and tailored to your specific circumstances. By working with an attorney, you can create an agreement that protects your interests and provides peace of mind for both you and your spouse. Searching specifically for a “post nuptial financial agreement template” online will yield many examples but ensure any template you use aligns with local laws.

Taking the time to create this agreement demonstrates a commitment to open communication and transparency within the marriage. It signifies a desire to address potential challenges proactively, rather than avoiding them. This level of planning can foster greater trust and security in the relationship.

Ultimately, a post nuptial agreement is an investment in your future, both individually and as a couple. It provides a framework for navigating potential financial challenges with clarity and fairness, and can contribute to a stronger and more resilient marriage.