So, you’re thinking about getting married in the Empire State? Congratulations! Marriage is a big step, and it’s fantastic that you’re being proactive about protecting your future. Part of that protection might involve considering a prenuptial agreement, especially if you and your partner have significant assets, separate businesses, or unique financial circumstances. A prenuptial agreement, often called a “prenup,” is a legally binding contract created before a marriage. It outlines how assets and debts will be divided if the marriage ends in divorce or death. It’s not the most romantic topic, we know, but it’s a responsible one.

Finding the right prenuptial agreement template New York can feel daunting. There are so many options online, and it’s crucial to find one that’s both legally sound and tailored to your specific situation. After all, a poorly drafted prenup could be challenged in court, rendering it useless. That’s why it’s so important to approach this process with care and attention to detail. You need to consider all your assets, debts, and future earnings to make sure that all your concerns are addressed in the agreement.

While it might be tempting to grab a free, generic template, remember that New York has specific laws regarding prenuptial agreements. These laws are there to ensure fairness and transparency. This article will guide you through some key considerations when looking for a prenuptial agreement template New York and help you understand why seeking legal advice is always a smart move. Let’s dive in and see what steps you can take to ensure a happy and secure future.

Understanding Prenuptial Agreements in New York

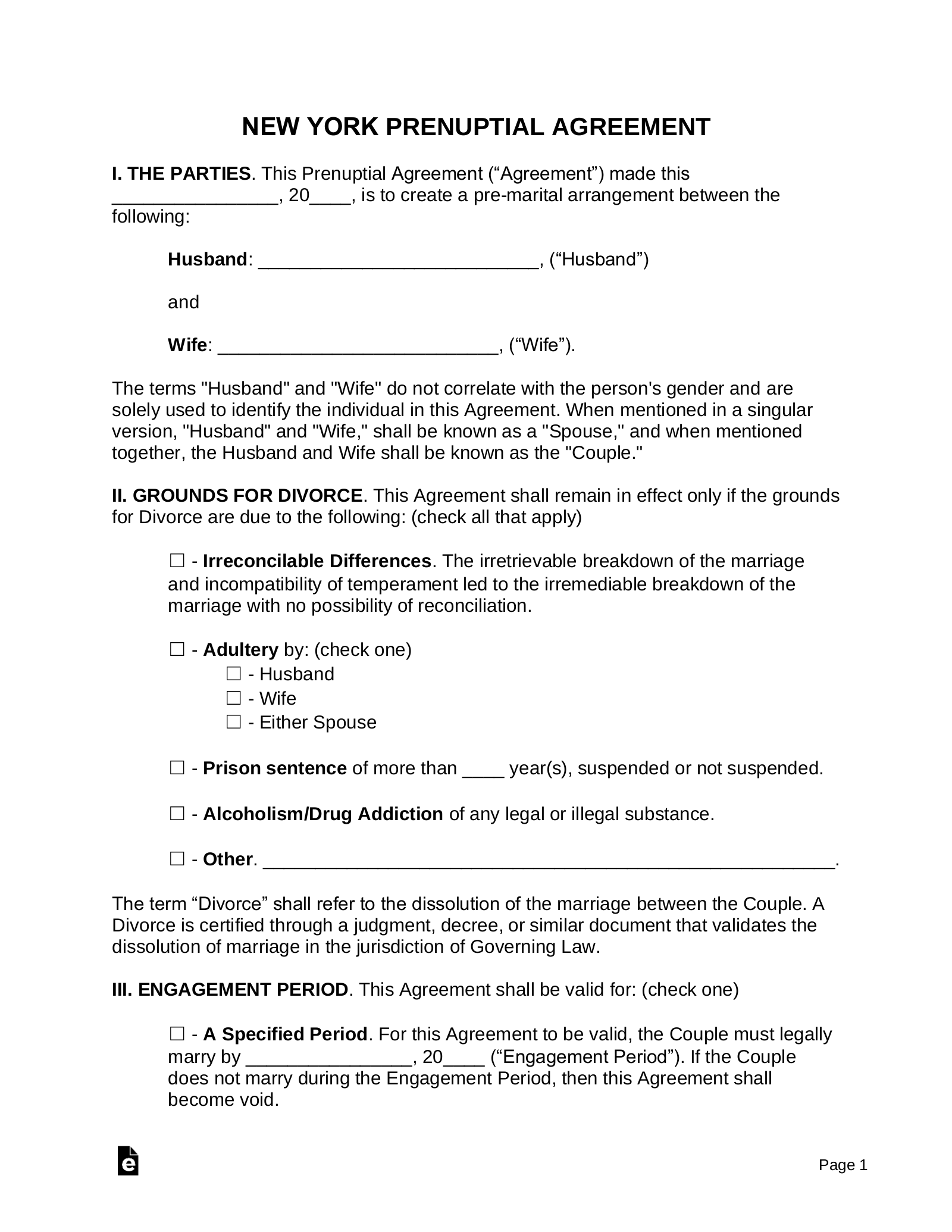

In New York, prenuptial agreements are governed by specific laws designed to protect both parties. The agreement must be in writing, signed by both parties, and acknowledged before a notary public. This last step is crucial because it verifies the identities of the people signing and ensures that the signatures are genuine. Furthermore, the agreement must be entered into voluntarily, meaning neither party can be coerced or pressured into signing. Sounds simple, right? However, there’s much more to it.

One of the most important aspects of a valid prenuptial agreement is full and fair disclosure. Both parties must fully disclose their assets, liabilities, and income to each other before signing the agreement. This means being completely transparent about everything you own, from your bank accounts and real estate to your stocks and retirement funds. Hiding assets or providing false information can invalidate the agreement. Remember, honesty is the best policy, not just in marriage but also in preparing for it legally.

Consideration is another element to keep in mind. This means that each party must receive something of value in exchange for entering into the agreement. While this doesn’t necessarily have to be a financial benefit, it must be something that a court would consider fair. However, in New York, the presence of consideration is often less scrutinized than the factors of voluntariness and full disclosure. The focus is much more on ensuring the agreement was entered into fairly and with complete understanding.

Furthermore, the prenuptial agreement must be fair and reasonable at the time it is signed and also at the time of enforcement. This means that the terms of the agreement cannot be so one-sided that they would be considered unconscionable by a court. For instance, an agreement that leaves one party with absolutely nothing while the other party retains all the assets is likely to be deemed unfair and unenforceable. New York courts are particularly sensitive to agreements that disproportionately benefit one party over the other, especially if there was a significant imbalance of power or knowledge between the parties when the agreement was signed.

It’s important to note that prenuptial agreements can also address matters beyond just the division of assets. They can specify how property acquired during the marriage will be treated, whether spousal support (alimony) will be paid, and even certain lifestyle expectations during the marriage. However, New York law prohibits prenuptial agreements from dictating matters related to child custody or support. These issues are always decided by the court based on the best interests of the child at the time of any separation or divorce. This is because the rights of the child cannot be bargained away by the parents in advance.

When a Template Might Not Be Enough

While a prenuptial agreement template New York can provide a starting point, it’s essential to recognize its limitations. Every couple’s financial situation is unique, and a generic template may not adequately address all the specific issues and concerns. High-net-worth individuals, business owners, or those with complex financial arrangements should always seek the advice of an experienced family law attorney to ensure their interests are fully protected.

Key Clauses to Include in Your Prenup

When drafting or reviewing a prenuptial agreement, several key clauses should be carefully considered. These clauses will determine how your assets and debts are handled in the event of a divorce or death. The goal is to create a clear and comprehensive document that reflects your wishes and protects your financial future.

One crucial clause is the property division clause, which specifies how assets acquired before and during the marriage will be divided. This can include real estate, bank accounts, stocks, retirement funds, and personal property. The agreement can state that certain assets will remain separate property, meaning they belong solely to one party, while others will be considered marital property, subject to division. This distinction is important for high-net-worth individuals who have significant assets prior to getting married. The agreement must specifically state the character of the property and how it should be divided.

Another essential clause is the spousal support or alimony clause. This clause determines whether spousal support will be paid in the event of a divorce, and if so, the amount and duration of the payments. The agreement can waive spousal support altogether or specify a formula for calculating the amount based on factors such as the length of the marriage, the income of each party, and their respective contributions to the marriage. In New York, waivers of spousal support are common but carefully scrutinized by the courts to ensure they are fair and not unconscionable.

Debt allocation is also a significant consideration. The prenuptial agreement should specify how debts incurred before and during the marriage will be handled. This can include student loans, credit card debt, and mortgages. The agreement can state that each party is responsible for their pre-marital debts and how marital debts will be divided. Absent such a clause, New York law dictates how debt is allocated and it may not be how the parties want it to happen.

Confidentiality clauses are becoming increasingly common, especially for high-profile individuals or business owners. These clauses aim to protect sensitive financial information and prevent either party from disclosing confidential details about the marriage or their respective businesses. This can be particularly important in the event of a contentious divorce, where the disclosure of financial information could damage a party’s reputation or business interests. While not strictly financial, it’s a clause to consider when thinking about the future.

Finally, a choice of law clause can specify which state’s laws will govern the interpretation and enforcement of the agreement. This can be important if the parties move to a different state during the marriage. New York courts will generally honor a choice of law clause as long as it’s reasonable and does not violate public policy. Be sure you agree with your partner on which state’s laws should govern your agreement. It can make a big difference in how your agreement is interpreted.

Planning for the future doesn’t mean you’re expecting the worst; it means you’re being responsible and prepared. By discussing your financial expectations and creating a prenuptial agreement, you’re setting a solid foundation for a lasting and secure marriage.

It’s always recommended that both parties obtain independent legal counsel to ensure they fully understand their rights and obligations under the agreement. This can help prevent disputes down the road and ensure that the prenuptial agreement is valid and enforceable. Using a prenuptial agreement template New York is a good starting point, but getting legal advice tailored to your specific situation is always a wise move.