So, you’re diving into the world of private business loans. Fantastic! Whether you’re a budding entrepreneur needing a capital injection or a seasoned business owner looking to expand, securing a private loan can be a game-changer. But before you shake hands and celebrate, it’s absolutely crucial to have a solid agreement in place. That’s where a private business loan agreement template comes in. Think of it as your business’s financial roadmap, clearly outlining the terms and conditions for everyone involved.

This isn’t just some formality to tick off a checklist. A well-drafted loan agreement protects both the lender and the borrower, preventing misunderstandings and potential legal battles down the line. It establishes clear expectations regarding repayment schedules, interest rates, and what happens if things don’t go as planned. It’s about setting a foundation of trust and transparency between the parties involved, ensuring a smoother and more predictable borrowing experience.

The beauty of using a private business loan agreement template is that it provides a framework. You don’t have to start from scratch, wracking your brain over every single clause and contingency. Instead, you can customize a pre-existing template to fit the unique circumstances of your loan. This saves you time, money, and a whole lot of headaches. Let’s delve into why having a solid loan agreement is so important, and what you should consider when choosing and using a template.

Why a Solid Private Business Loan Agreement Template is Non-Negotiable

Let’s face it, business deals can sometimes turn sour, even between people you trust. While everyone might have the best intentions at the start, unforeseen circumstances can arise. That’s why a meticulously crafted private business loan agreement is your safety net. It protects your interests, clarifies obligations, and provides a legally binding document that can be referenced if disputes occur.

Imagine lending a significant sum of money to a friend’s startup without a formal agreement. What happens if their business struggles and they can’t repay the loan as agreed? Without a written contract, recovering your money could be an uphill battle. A loan agreement spells out the repayment terms, including the amount, frequency, and due dates, leaving no room for ambiguity.

Furthermore, a comprehensive loan agreement addresses potential default scenarios. What constitutes a default? What are the consequences of defaulting on the loan? These clauses outline the lender’s recourse, such as the ability to seize collateral or take legal action to recover the outstanding debt. Having these contingencies clearly defined protects the lender’s investment and provides a clear path forward in difficult situations.

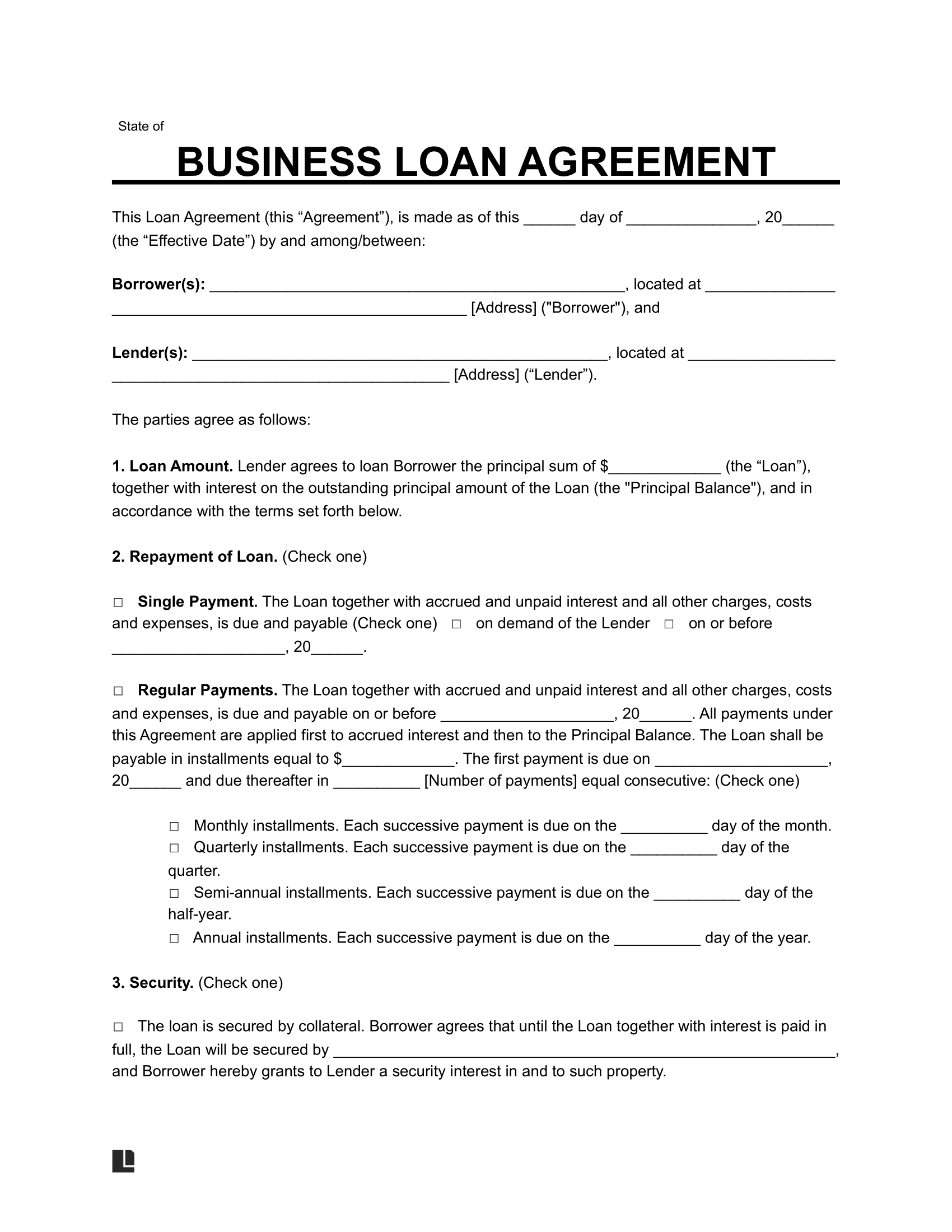

Beyond just the repayment terms, a good private business loan agreement template also details other important aspects of the loan, such as the interest rate, any associated fees, and whether the loan is secured or unsecured. A secured loan is backed by collateral, such as equipment or property, which the lender can claim if the borrower defaults. An unsecured loan, on the other hand, is not backed by any specific asset, making it riskier for the lender. The loan agreement should clearly state whether the loan is secured or unsecured and, if secured, describe the collateral being used.

Think of your private business loan agreement as more than just a legal document; it’s a tool for clear communication and mutual understanding. By addressing potential issues upfront, you can minimize the risk of misunderstandings and maintain a positive relationship between the lender and the borrower. A well-defined agreement fosters trust and transparency, creating a solid foundation for a successful lending arrangement.

Key Elements to Include in Your Private Business Loan Agreement Template

When choosing or creating a private business loan agreement template, certain elements are absolutely essential. Leaving out key provisions can leave you vulnerable to disputes and financial losses. Let’s break down some of the most important components you should include.

First and foremost, clearly identify the parties involved. This includes the full legal names and addresses of both the lender and the borrower. This may seem obvious, but it’s crucial for legal clarity. Next, meticulously describe the loan amount. Specify the exact amount of money being loaned, the currency, and the date the loan was disbursed. A clear statement of the principal amount is the cornerstone of the entire agreement.

Then, delve into the details of the repayment schedule. This is where you’ll outline the frequency of payments (weekly, monthly, quarterly), the amount of each payment, and the due date for each payment. If there’s a balloon payment (a large lump sum payment at the end of the loan term), be sure to clearly specify the amount and the date it’s due. Consider including an amortization schedule as an attachment to provide a clear breakdown of each payment, including the principal and interest portions.

The interest rate is another critical element. State the annual interest rate being charged on the loan. Specify whether the interest rate is fixed (remains the same throughout the loan term) or variable (can fluctuate based on market conditions). If the interest rate is variable, explain how it will be calculated and how often it will be adjusted. Clarity about the interest rate is essential to avoid misunderstandings and disputes.

Finally, address default and remedies. Clearly define what constitutes a default on the loan. This could include missing payments, failing to maintain insurance on collateral, or violating other terms of the agreement. Then, specify the lender’s remedies in the event of a default. This could include accelerating the loan (demanding immediate repayment of the entire outstanding balance), seizing collateral (if the loan is secured), or taking legal action to recover the debt. A well-defined default and remedies section protects the lender’s interests and provides a clear path forward in case things go wrong. Remember, a comprehensive private business loan agreement template should leave no room for ambiguity, protecting both the lender and the borrower.

Having a robust private business loan agreement template in place gives both the lender and the borrower peace of mind, knowing that their interests are protected.

By using a template and adapting it to your specific needs, you can establish a foundation for a healthy and transparent lending relationship.