So, you’re thinking about lending or borrowing money for a car from someone you know? That’s fantastic! Buying or selling a car privately can often lead to better deals for both parties involved. But before you hand over the keys or the cash, it’s absolutely crucial to get everything in writing. That’s where a well-crafted agreement comes in, protecting everyone’s interests and preventing potential headaches down the road.

Think of a private car loan agreement template as a roadmap for your financial arrangement. It clearly outlines the terms of the loan, including the loan amount, interest rate (if any), repayment schedule, and what happens if either party fails to uphold their end of the bargain. Without this kind of documentation, misunderstandings can easily arise, potentially straining personal relationships. A clear, legally sound agreement can help avoid these issues. It’s a sign of good faith and respect for the other person.

This document doesn’t need to be complicated, and you don’t necessarily need to hire a lawyer to draft one (although consulting with one is always a good idea, especially for larger loan amounts). The purpose of this article is to provide you with a clear understanding of what should be included in a private car loan agreement, and how using a private car loan agreement template can streamline the process. We’ll walk you through the essential elements, helping you create a legally sound and mutually beneficial agreement.

Why You Need a Private Car Loan Agreement

Imagine lending your friend a substantial amount of money for a car based purely on a verbal agreement. Everything seems fine initially, but then disagreements start to arise about the repayment schedule. Your friend claims you agreed to smaller monthly payments, while you recall a different arrangement. Without a written agreement, it becomes a he-said-she-said situation, potentially damaging your friendship and leaving you with an uncertain financial future. This scenario highlights the critical importance of having a clear, legally binding agreement in place.

A private car loan agreement isn’t just about protecting your money; it’s also about fostering transparency and trust between the lender and the borrower. By clearly outlining the terms of the loan, everyone knows their rights and responsibilities. This can prevent misunderstandings and ensure a smoother, more predictable repayment process. It also provides a clear record of the transaction for tax purposes and other legal obligations.

Furthermore, a well-drafted agreement protects both parties if unforeseen circumstances arise. What happens if the borrower loses their job and can’t make payments? What if the car is totaled in an accident? A comprehensive agreement should address these potential scenarios and outline the steps that will be taken to resolve them. This foresight can prevent costly legal battles and protect both the lender’s investment and the borrower’s creditworthiness.

Think of the agreement as an insurance policy for your financial relationship. It provides a framework for resolving disputes and ensures that everyone is on the same page. While it might seem like an unnecessary formality, especially when dealing with friends or family, it’s a crucial step in protecting your interests and preserving your relationships.

Using a private car loan agreement template simplifies the process of creating this essential document. These templates provide a structured format and include all the necessary clauses, ensuring that you don’t overlook any important details. They also save you time and effort by providing a starting point that you can customize to your specific needs.

Key Elements of a Private Car Loan Agreement

When crafting your private car loan agreement, several key elements must be included to ensure its legal validity and effectiveness. Omitting these elements could render the agreement unenforceable, leaving you vulnerable to financial loss or legal disputes. Let’s break down the essential components:

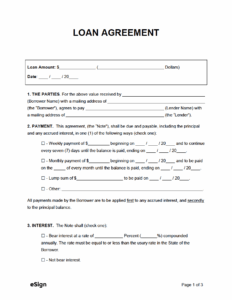

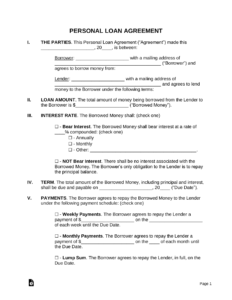

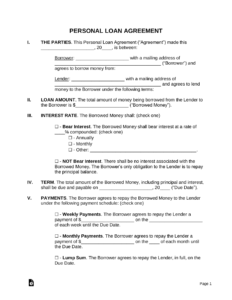

First and foremost, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the lender and the borrower. This information is crucial for establishing the identity of the individuals bound by the agreement.

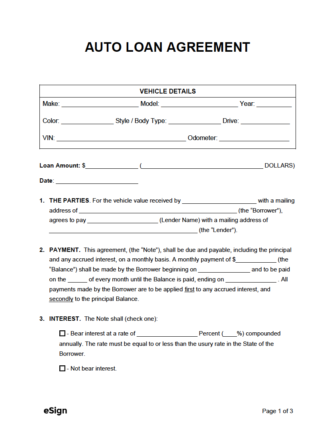

Next, the agreement should provide a detailed description of the vehicle being financed. This includes the make, model, year, VIN (Vehicle Identification Number), and any other identifying features. This ensures that there is no ambiguity about which vehicle is subject to the loan agreement.

The agreement must also specify the principal loan amount, the interest rate (if any), and the repayment schedule. The repayment schedule should outline the amount of each payment, the frequency of payments (e.g., monthly, bi-weekly), and the due date for each payment. It’s also important to specify the method of payment (e.g., check, electronic transfer) and where payments should be sent.

Late payment penalties should also be addressed. The agreement should clearly state the consequences of late payments, such as late fees or increased interest rates. This incentivizes timely payments and protects the lender from financial loss due to delays.

Finally, the agreement should address what happens in the event of default. This includes outlining the lender’s rights and remedies, such as repossession of the vehicle. The agreement should also specify the process for repossession, including any notice requirements. By including these key elements, you can create a comprehensive and legally sound private car loan agreement that protects both parties involved.

Taking the time to fill out a private car loan agreement template thoroughly can give you peace of mind.

Ultimately, a car loan agreement between private parties should be clear, concise, and cover all bases. It’s an investment in your financial health and your relationships.