So, you’re thinking about lending money to a friend or family member, or maybe you’re the one borrowing. That’s fantastic! Helping each other out is what life is all about. But before you just hand over the cash or gratefully accept it, it’s smart to get everything down on paper. That’s where a private personal loan agreement template comes in handy. Think of it as a friendly guide to make sure everyone is on the same page and avoids misunderstandings down the road. No one wants a loan turning into a family feud!

This isn’t about distrust; it’s about clarity and respect. A well-drafted agreement outlines the terms of the loan – how much is being borrowed, the interest rate (if any), the repayment schedule, and what happens if something goes wrong. It’s like creating a roadmap for the loan process, ensuring that both the lender and the borrower are protected. It doesn’t have to be complicated legal jargon; it can be straightforward and easy to understand.

Using a private personal loan agreement template saves you time and potential headaches. It gives you a framework to work with, prompting you to consider all the important details. You can customize it to fit your specific situation, adding or removing clauses as needed. It’s a win-win for everyone involved, fostering transparency and strengthening relationships. It’s much better to deal with potential issues upfront than to let them fester and damage trust.

Why Use a Private Personal Loan Agreement Template?

Let’s face it, lending money to someone you know can be a little awkward. You want to help, but you also need to protect your own financial interests. That’s where a solid private personal loan agreement template steps in. It acts as a neutral party, documenting the agreed-upon terms and conditions in a clear and concise manner. This reduces the risk of miscommunication or disagreements down the line. Imagine a scenario where the borrower forgets the agreed-upon repayment amount or the lender later claims a higher interest rate than initially discussed. With a written agreement, everyone has a reference point to turn to, minimizing the potential for conflict.

Beyond preventing misunderstandings, a loan agreement template also provides legal protection for both the lender and the borrower. It transforms a verbal agreement into a legally binding contract, giving both parties recourse if the other fails to uphold their obligations. This doesn’t mean you’re planning to sue your friend or family member, but it does mean that you have legal options available if necessary. It’s like having an insurance policy for your loan, offering peace of mind and security. Think of it as a safety net in case things don’t go as planned.

Furthermore, a well-structured private personal loan agreement template ensures that you’ve considered all the relevant aspects of the loan. It prompts you to think about things like late payment penalties, default clauses, and the possibility of early repayment. By addressing these issues upfront, you can avoid potential problems later on. It also encourages open communication between the lender and the borrower, as they discuss and negotiate the terms of the loan together. This collaborative process can strengthen their relationship and build trust.

Choosing the right template is crucial. Look for a template that’s easy to understand and customize to your specific needs. Some templates include clauses for collateral, which means the borrower pledges an asset (like a car or a piece of jewelry) as security for the loan. If the borrower defaults, the lender can seize the collateral to recoup their losses. Other templates focus on unsecured loans, where there’s no collateral involved. Select the type of template that best suits the nature of your loan agreement.

Ultimately, using a private personal loan agreement template demonstrates professionalism and respect for both parties involved. It shows that you’re taking the loan seriously and that you’re committed to ensuring a fair and transparent transaction. It’s a small investment of time and effort that can save you a lot of trouble in the long run, preserving your relationships and protecting your financial interests. It truly is the smart move.

Key Elements to Include

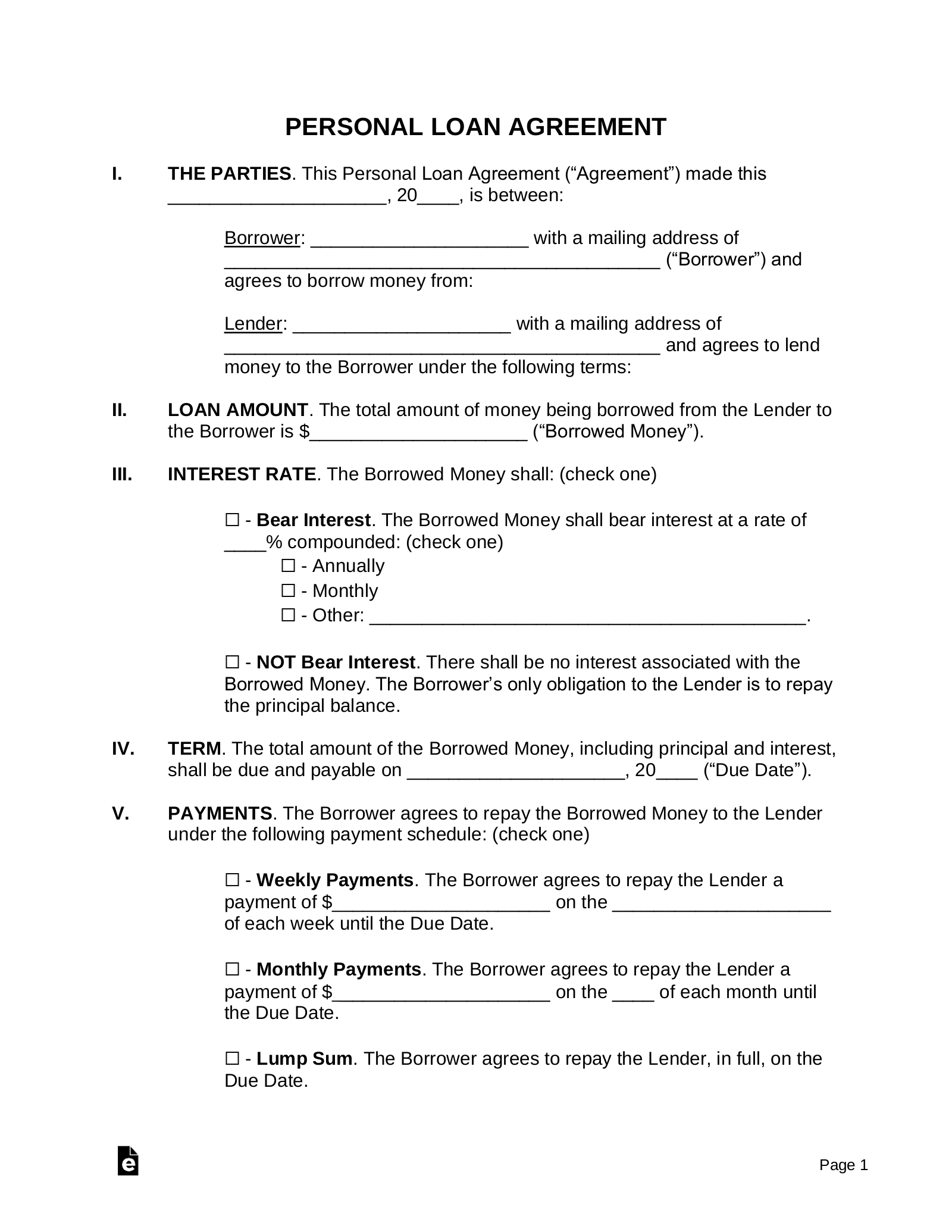

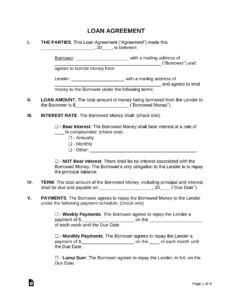

When selecting or crafting your own agreement, be sure it contains the full legal names of both parties (lender and borrower), the loan amount (clearly stated in numbers and words), the interest rate (if applicable), the repayment schedule (including the amount and frequency of payments), the due date of the first payment, any late payment penalties, and default clauses. You may also want to include clauses for prepayment options and any security or collateral offered.

What to Include in Your Private Personal Loan Agreement Template

Crafting a comprehensive private personal loan agreement template requires careful consideration of various essential components. First and foremost, you must clearly identify the parties involved – the lender and the borrower – by including their full legal names and addresses. This eliminates any ambiguity and ensures that both individuals are legally bound by the agreement. Next, the agreement should specify the exact amount of the loan, expressed in both numerical and written form, to avoid any potential discrepancies. It’s also crucial to state the currency in which the loan is being made, especially if the parties reside in different countries.

Another critical element is the interest rate, if applicable. If you’re charging interest, clearly state the percentage and how it will be calculated (e.g., simple interest, compound interest). The repayment schedule is equally important. This section should outline the frequency of payments (e.g., weekly, monthly, quarterly), the amount of each payment, and the due date for each payment. It’s also wise to include information on how payments should be made (e.g., check, electronic transfer). A clear repayment schedule helps the borrower manage their finances and ensures that the lender receives timely payments.

Late payment penalties are another important consideration. Specify the amount of any late fees that will be charged if the borrower fails to make a payment on time. You might also want to include a grace period (e.g., a few days after the due date) before late fees are applied. Default clauses outline what happens if the borrower fails to make payments for an extended period. This might include the lender’s right to demand immediate repayment of the entire loan balance, take possession of any collateral, or pursue legal action.

Furthermore, it’s beneficial to include a section on prepayment options. Does the borrower have the right to repay the loan early without penalty? If so, specify the terms of early repayment. If collateral is involved, clearly describe the asset being pledged and the conditions under which the lender can take possession of it. The agreement should also include a section on governing law, specifying which state or jurisdiction’s laws will govern the agreement. Finally, both the lender and the borrower should sign and date the agreement in the presence of a notary public to ensure its legal validity.

By including these key elements in your private personal loan agreement template, you can create a legally sound document that protects the interests of both the lender and the borrower. Remember to review the template carefully and customize it to fit your specific needs and circumstances. It’s also advisable to consult with an attorney to ensure that the agreement complies with all applicable laws and regulations.

Even if you’re lending to a relative or close friend, taking these steps is still important. Think about it – your relationship with the borrower might change, or they might encounter unforeseen financial hardship. Having a written agreement makes navigating these issues less stressful.

When things go wrong with repayment, it’s easy to point fingers or make assumptions about intent. However, with the loan terms clearly defined, there is less room for interpretation and more incentive for both parties to adhere to the agreement. This helps everyone maintain a positive relationship.