Ever loaned money to a friend, family member, or even a business associate and felt a little uneasy about the repayment? It happens to the best of us. While trust is important, sometimes putting things in writing can save a lot of headaches down the road. That’s where a promise to pay agreement comes in handy. It’s basically a written commitment that outlines the terms of a loan or debt, ensuring everyone is on the same page about how and when the money will be repaid. Think of it as a friendly reminder, legally binding, that protects both the lender and the borrower.

A promise to pay agreement, at its core, is a simple document. But its simplicity belies its importance. It spells out crucial details like the amount borrowed, the interest rate (if any), the repayment schedule, and what happens if a payment is missed. Without a clear agreement, misunderstandings can easily arise, leading to strained relationships and potential legal disputes. It’s like having a roadmap for repayment, guiding both parties through the process smoothly and fairly.

So, why should you consider using a promise to pay agreement template? Well, for starters, it provides clarity and security. It documents the terms of the loan, reducing the risk of confusion or disagreements later on. Plus, it can serve as evidence in case legal action becomes necessary. A solid promise to pay agreement template offers a framework, ensuring all necessary information is included and formatted correctly. It’s a proactive step to protect your financial interests and maintain healthy relationships.

Understanding the Key Elements of a Promise To Pay Agreement

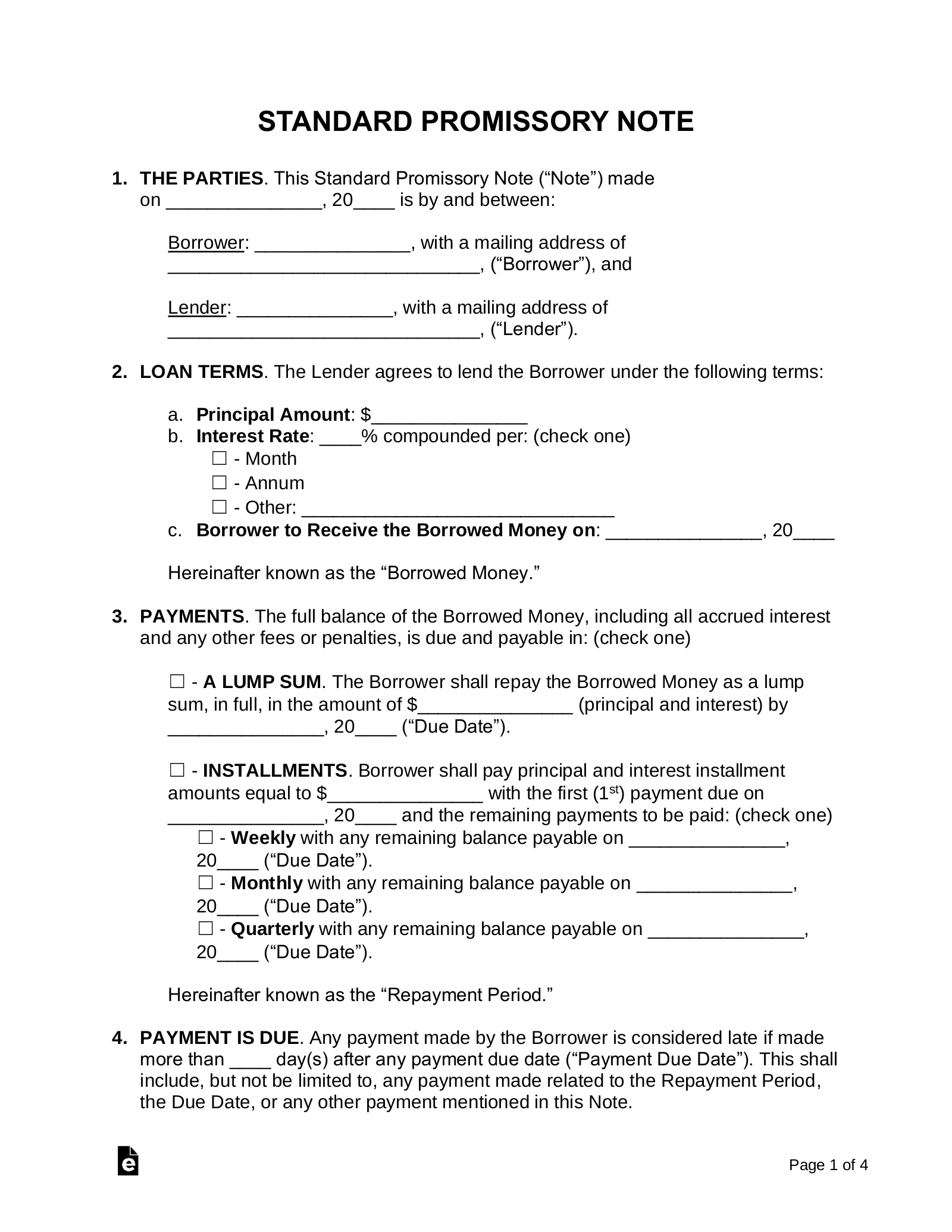

A comprehensive promise to pay agreement template will contain several essential elements. These elements work together to create a clear and legally sound document that protects both the lender and the borrower. Let’s break down some of the most important components:

First and foremost, the agreement should clearly identify the parties involved. This includes the full legal names and addresses of both the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Accuracy is key here to avoid any ambiguity or potential disputes later on.

Next, the agreement must specify the principal amount of the loan. This is the total amount of money being borrowed. It should be stated clearly and unambiguously, using both numerical and written forms (e.g., $1,000.00 – One Thousand Dollars). This ensures there is no room for misinterpretation regarding the exact amount being lent.

The agreement should also outline the interest rate, if any. If the loan is subject to interest, the annual interest rate must be clearly stated. The agreement should also specify how the interest is calculated and compounded. In addition, it is important to confirm the legality of any interest rate, as jurisdictions may have limitations on maximum interest rates.

Perhaps one of the most crucial sections is the repayment schedule. This section details how the loan will be repaid, including the frequency of payments (e.g., weekly, monthly, quarterly), the amount of each payment, and the due date for each payment. It should also specify the method of payment (e.g., check, electronic transfer, cash). A well-defined repayment schedule ensures that both parties understand the repayment obligations.

Finally, a good promise to pay agreement template should include provisions for default. This section outlines what happens if the borrower fails to make payments as agreed. It may specify late payment penalties, acceleration of the loan (meaning the entire balance becomes due immediately), and the lender’s right to pursue legal action to recover the debt. Including these provisions protects the lender’s interests in case of default. Many templates for a promise to pay agreement are available to help with this.

Benefits of Using a Promise To Pay Agreement Template

Using a promise to pay agreement template offers several advantages over creating a document from scratch. These benefits can save you time, money, and potential legal headaches. Here are some key reasons why using a template is a smart choice:

Templates save time and effort. Instead of starting from a blank page and trying to figure out what to include, a template provides a pre-structured document with all the necessary sections and clauses already in place. This allows you to simply fill in the blanks with the specific details of your agreement, saving you valuable time and effort.

Templates ensure completeness. A well-designed template includes all the essential elements of a legally sound promise to pay agreement. This ensures that you don’t accidentally omit any important information that could weaken your agreement or lead to disputes later on. By using a template, you can be confident that your agreement is comprehensive and covers all the necessary bases.

Templates offer legal protection. While a template is not a substitute for legal advice, it can provide a basic level of legal protection. Templates are typically drafted by legal professionals and are designed to comply with applicable laws and regulations. This can help protect your rights and interests in case of a dispute. However, it’s always a good idea to have an attorney review your agreement to ensure it meets your specific needs and complies with local laws.

Templates are cost-effective. Hiring an attorney to draft a promise to pay agreement can be expensive. Using a template offers a more affordable alternative. You can find many free or low-cost templates online that provide a solid foundation for your agreement. If you are unsure, have a professional review a promise to pay agreement template before using it.

Templates promote clarity and understanding. A well-formatted template makes it easier for both parties to understand the terms of the agreement. The clear and organized structure of a template helps to avoid confusion and misunderstandings, which can prevent disputes from arising in the first place. This is especially important when dealing with friends or family members, where clear communication is essential for maintaining good relationships. Using a promise to pay agreement template also protects both parties involved from potential legal issues.

Having a well-documented agreement protects everyone involved. It provides a clear path forward, outlining responsibilities and expectations. This minimizes the chance of misunderstandings and ensures everyone is on the same page regarding repayment.

By taking the time to create a solid promise to pay agreement, you’re not only protecting your financial interests, but also fostering trust and transparency. It shows that you’re serious about the transaction and committed to ensuring a smooth and successful repayment process.