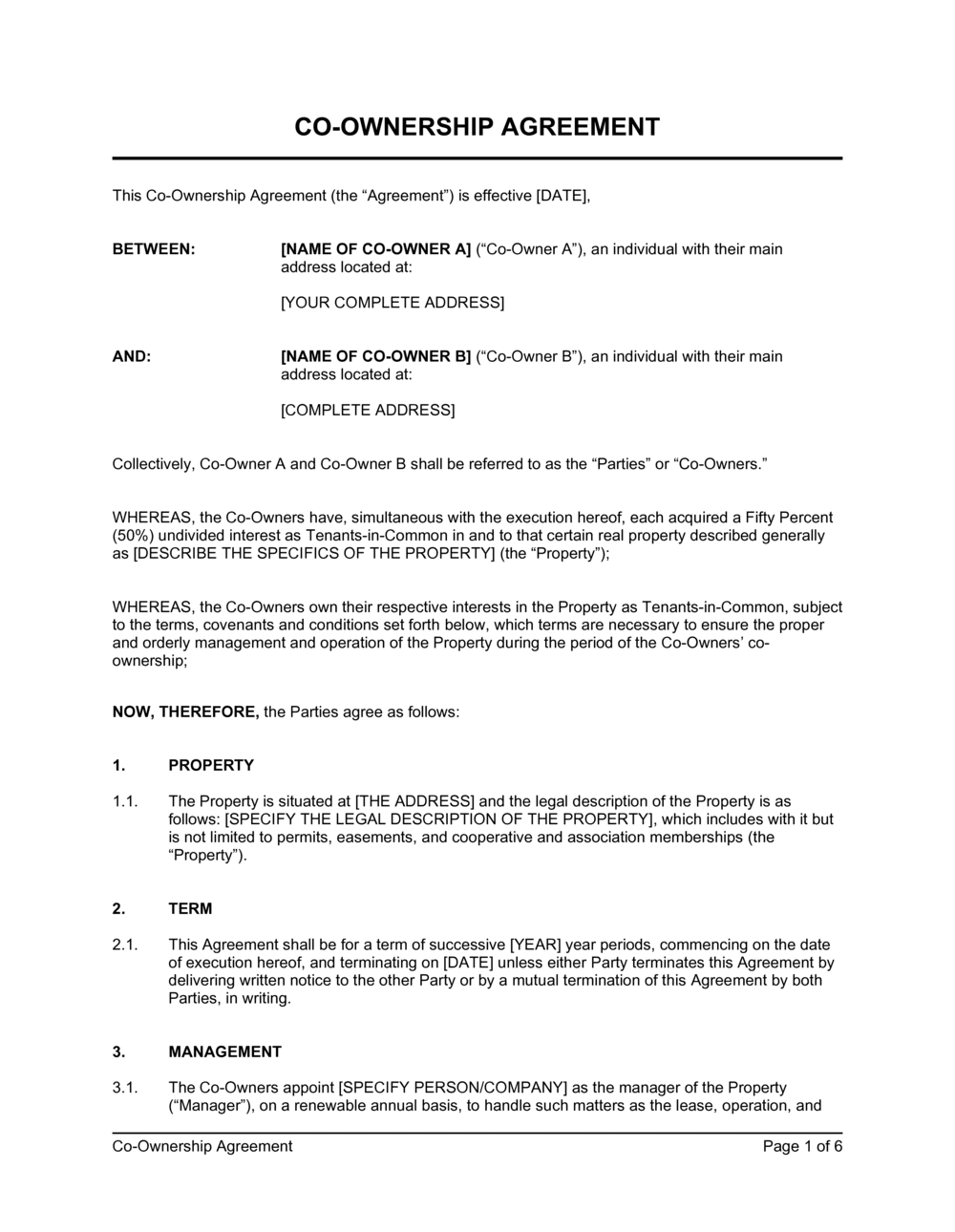

So, you’re thinking about buying property with someone else? Congratulations! That’s a big step and can be a fantastic way to get into the real estate market, build wealth, or simply share the responsibilities of homeownership. Sharing the dream can be a wonderful thing, but like any good partnership, it’s crucial to have a solid plan in place before you jump in. That’s where a property co ownership agreement comes in. It’s not the most glamorous part of buying a house, but it’s arguably one of the most important.

Think of it as a prenuptial agreement for property. No one goes into a marriage expecting it to fail, but a prenup provides clarity and protection just in case. A property co ownership agreement does the same thing. It clearly outlines the rights, responsibilities, and expectations of each co owner, minimizing potential conflicts down the road. It covers everything from who pays for what to what happens if one person wants to sell.

Without a written agreement, you’re relying on verbal understandings and, frankly, a lot of hope. While trust is important, memories can fade, interpretations can differ, and emotions can run high, especially when money is involved. A well-drafted agreement protects everyone involved and provides a framework for resolving disputes amicably. This article will guide you on why you should consider a property co ownership agreement template and how it could save you from future headaches and potential legal battles.

Why You Absolutely Need a Co Ownership Agreement

Let’s dive into the nitty-gritty of why having a co ownership agreement is so vital. Imagine buying a house with your sibling, a friend, or even a business partner. Everyone’s on the same page initially, excited about the prospect of owning property together. But what happens when life throws a curveball? What if one person loses their job and can’t contribute to the mortgage? What if someone wants to renovate the kitchen, but the other doesn’t agree? Or what if one party decides they want to sell, but the other wants to stay?

These scenarios, while uncomfortable to think about, are precisely why a co ownership agreement is essential. It anticipates potential disagreements and provides a clear path forward. Without it, you’re essentially playing a game of real estate roulette, and the odds aren’t always in your favor. Legal battles can be costly, time-consuming, and emotionally draining. A comprehensive agreement can prevent these issues by clearly defining each owner’s responsibilities and rights.

A good agreement also clarifies how decisions regarding the property will be made. Will decisions be based on a majority vote? Does each owner have equal say, regardless of their ownership percentage? How will disputes be resolved – through mediation, arbitration, or other means? By addressing these questions upfront, you can avoid power struggles and ensure that everyone feels heard and respected.

Consider, too, the unexpected. What happens if one of the owners passes away? Does their share of the property automatically transfer to the surviving owner(s), or does it become part of their estate? A co ownership agreement can specify these details, ensuring that the wishes of all parties are honored and that the transfer of ownership is smooth and legally sound. It also helps with estate planning and ensures that the property is handled according to everyone’s intentions.

Ultimately, a property co ownership agreement template is about protecting your investment and your relationships. It’s about creating a framework for a successful and harmonious co ownership experience. While finding the right property co ownership agreement template might seem like an extra step in the buying process, it’s an investment in peace of mind and a safeguard against potential future disputes.

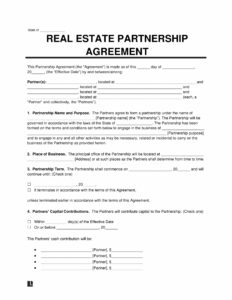

Key Elements to Include in Your Agreement

A robust property co ownership agreement should address several key elements. First, clearly define the ownership percentages of each co owner. This will impact everything from profit sharing to responsibility for expenses. Second, outline the process for handling expenses, including mortgage payments, property taxes, insurance, and maintenance costs. Third, specify how decisions regarding the property will be made, including renovations, rentals, and sales. Fourth, detail the procedure for one owner to sell their share of the property, including right of first refusal for the other owners. Finally, include a dispute resolution mechanism, such as mediation or arbitration, to resolve disagreements efficiently and cost-effectively. Addressing these areas provides a comprehensive framework for co ownership.

What Happens Without an Agreement?

Now, let’s talk about the flip side. What are the potential consequences of not having a co ownership agreement in place? The answer is simple: you’re relying on state law and the interpretation of judges, which can be unpredictable and unfavorable. In most jurisdictions, co ownership defaults to a tenancy in common, meaning that each owner has the right to sell their share of the property without the consent of the other owners. This can lead to messy situations, especially if one owner decides to sell to a third party who is not compatible with the other owner(s).

Without a clear agreement on decision-making, disagreements can escalate quickly and lead to legal battles. Imagine trying to decide on a major renovation or whether to rent out the property when you can’t agree on the best course of action. Without a predefined process for resolving disputes, you could end up spending significant amounts of money on legal fees and damaging your relationships with your co owners.

Furthermore, without an agreement addressing what happens if one owner defaults on their financial obligations, the other owners may be forced to shoulder the entire burden. This can create significant financial strain and resentment. A co ownership agreement can specify how to handle such situations, such as allowing the other owners to buy out the defaulting owner’s share or selling the property to cover the outstanding debt.

Another potential issue arises when one owner wants to sell their share but the other owner(s) don’t want to buy them out or sell the entire property. Without a right of first refusal or a predetermined valuation method, the selling owner may be forced to sell their share to a third party at a lower price or endure a lengthy and costly legal battle to force a sale. A well-drafted agreement can provide a fair and efficient process for handling such situations.

In short, foregoing a property co ownership agreement is a gamble with high stakes. While it may seem like an unnecessary expense upfront, it can save you significant amounts of time, money, and stress in the long run. It’s an investment in protecting your property, your finances, and your relationships with your co owners.

It’s better to be prepared than to be caught off guard. Having a plan in place, even if you never need to use it fully, offers substantial reassurance. Thinking through different scenarios ahead of time ensures you’ve considered all possible outcomes.

In the grand scheme of things, taking the time to create a property co ownership agreement template is an act of responsibility and foresight. It demonstrates a commitment to open communication and a willingness to address potential challenges proactively.