So, you’re thinking about buying property with someone else? That’s fantastic! Co-ownership can be a brilliant way to get your foot on the property ladder, invest in real estate, or share a vacation home. But before you pop the champagne and sign on the dotted line, it’s absolutely crucial to have a solid agreement in place. Think of it as the relationship counseling for your property venture – preventing headaches and disagreements down the road.

This is where a property joint ownership agreement template comes in. It’s not just some legal formality; it’s the roadmap that guides you and your co-owners through the ins and outs of shared ownership. It clearly outlines each person’s rights, responsibilities, and what happens if things don’t go exactly as planned. Without one, you’re essentially navigating uncharted waters with a leaky boat – risky, to say the least.

We’re here to guide you through why having a solid joint ownership agreement is so vital and how a property joint ownership agreement template can simplify the process of creating one. Let’s explore the key components and what you need to consider when drafting yours. This will help ensure a smooth and successful co-ownership experience.

Why You Absolutely Need a Property Joint Ownership Agreement

Imagine buying a house with your best friend. You both contribute to the down payment, mortgage, and upkeep. Initially, everything is sunshine and roses. But what happens five years down the line when one of you wants to sell, but the other doesn’t? Or what if one person stops contributing to the mortgage payments? Or worse, what if you both have different ideas on how the property should be used or maintained? These are the types of scenarios a well-crafted joint ownership agreement anticipates and addresses.

Without an agreement, you’re essentially leaving these critical decisions up to chance – and potentially the courts. This can lead to costly legal battles, strained relationships, and a lot of unnecessary stress. A property joint ownership agreement acts as a proactive measure, preventing misunderstandings and providing a clear framework for resolving disputes. It’s like having a prenuptial agreement for your property partnership – it might not be the most romantic thing to think about upfront, but it can save you a world of pain later on.

A comprehensive agreement should cover several key areas, including:

Ownership percentages:

Clearly define each owner’s percentage of ownership. This directly impacts how profits, expenses, and voting rights are divided.

Financial responsibilities:

Outline who is responsible for mortgage payments, property taxes, insurance, and maintenance costs. Specify how these expenses will be split and what happens if someone fails to meet their obligations.

Decision-making process:

Establish a clear process for making decisions about the property, such as renovations, rentals, or selling. This could involve majority voting or requiring unanimous consent for certain actions.

Dispute resolution:

Include a mechanism for resolving disagreements, such as mediation or arbitration. This can help avoid costly and time-consuming court battles.

By addressing these critical areas upfront, you and your co-owners can create a solid foundation for a successful and harmonious property partnership. A property joint ownership agreement template can be a fantastic starting point, providing a structured framework that you can customize to fit your specific circumstances.

Key Elements to Include in Your Template

Choosing the right property joint ownership agreement template is the first step, but understanding what key elements should be included is crucial. A good template will act as a comprehensive guide, ensuring you cover all the important bases and avoid potential pitfalls.

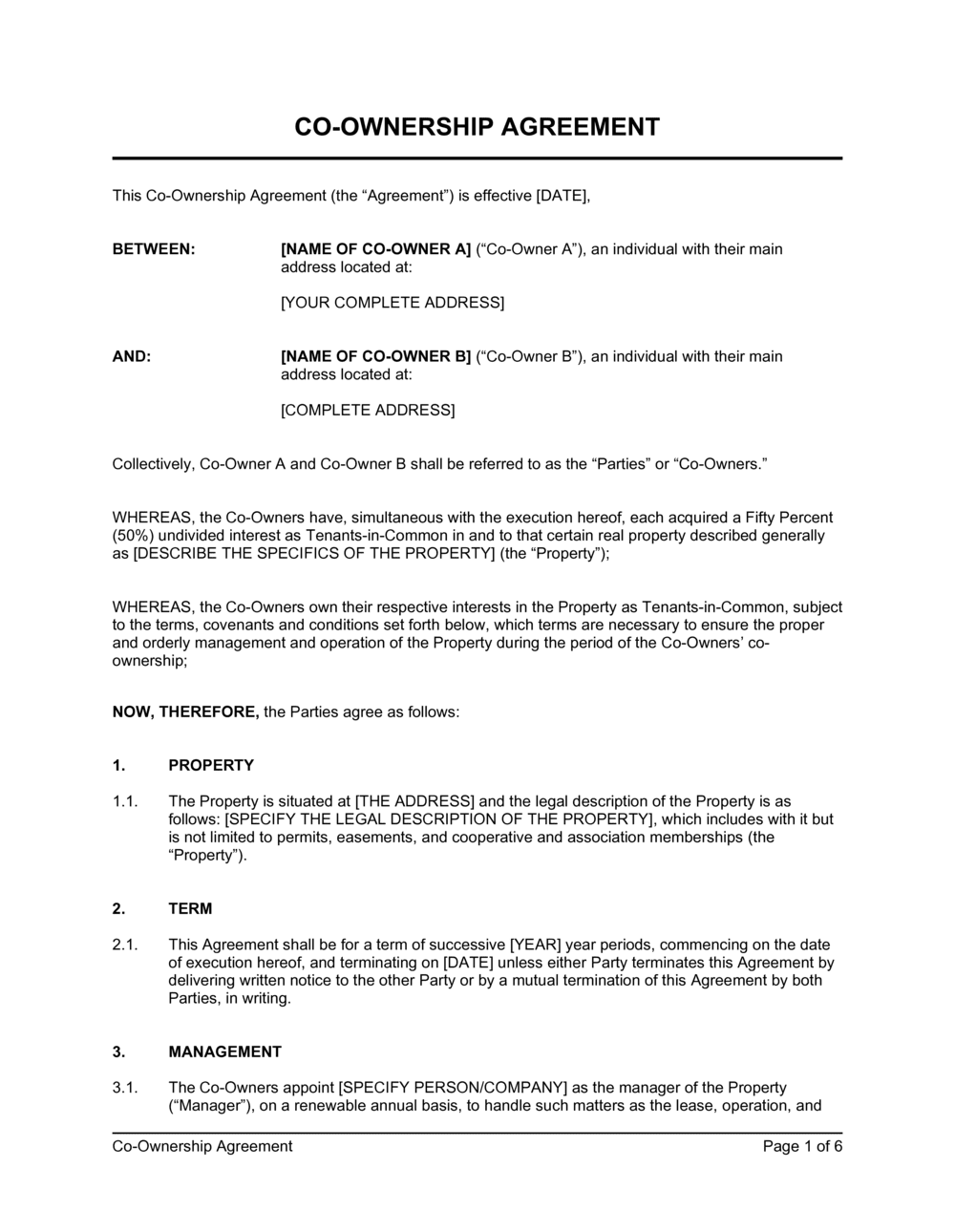

First and foremost, the template should clearly define the parties involved, including their full legal names and addresses. It should also provide a detailed description of the property, including its address, legal description, and any relevant parcel numbers. Accuracy is paramount here; any discrepancies can lead to confusion and legal challenges down the road.

Beyond the basics, the agreement needs to address how the property will be used. Will it be a primary residence, a rental property, or a vacation home? Are there any restrictions on how the property can be used, such as limitations on pets or short-term rentals? Clearly outlining these details will prevent disagreements and ensure everyone is on the same page.

Furthermore, the agreement should include provisions for what happens if one owner wants to sell their share. Does the other owner have the right of first refusal? What is the process for determining the fair market value of the property? A well-defined exit strategy is essential to protect everyone’s interests and avoid disputes if one owner decides to move on.

Finally, consider including clauses related to insurance coverage, liability, and indemnification. Ensure the property is adequately insured and that each owner is protected from potential liabilities. Addressing these issues upfront can provide peace of mind and protect your financial well-being.

Taking the time to customize your property joint ownership agreement template to reflect your specific circumstances is an investment that will pay off in the long run. It can prevent misunderstandings, protect your interests, and ensure a smooth and successful co-ownership experience. Consulting with a legal professional to review your agreement is always a wise decision, providing expert guidance and ensuring compliance with local laws.

Remember to consider all possible scenarios and plan accordingly. This will ensure that if unexpected situations arise, you have a clear path to resolution, protecting your investment and your relationships. A well-thought-out agreement is the key to a harmonious and profitable co-ownership experience.