Buying or selling property can feel like navigating a maze, right? There are so many steps, so much jargon, and so many opportunities for things to go sideways. One of the most crucial documents in this entire process is the property purchase and sale agreement. It’s the roadmap that outlines the terms and conditions of the deal, protecting both the buyer and the seller. Think of it as the rulebook for a very important game – the game of real estate!

Without a clear, well-defined agreement, misunderstandings can easily arise, leading to disputes, delays, and even the collapse of the entire transaction. That’s why having a solid property purchase and sale agreement template is so important. It helps ensure everyone is on the same page, and it can save you a lot of headaches in the long run.

So, where do you start? What are the key elements you need to include in your agreement? How can you be sure you’re protecting your interests? Let’s dive into the world of property purchase and sale agreements and explore how a good template can be your best friend in the real estate process.

Understanding the Core Components of a Property Purchase and Sale Agreement

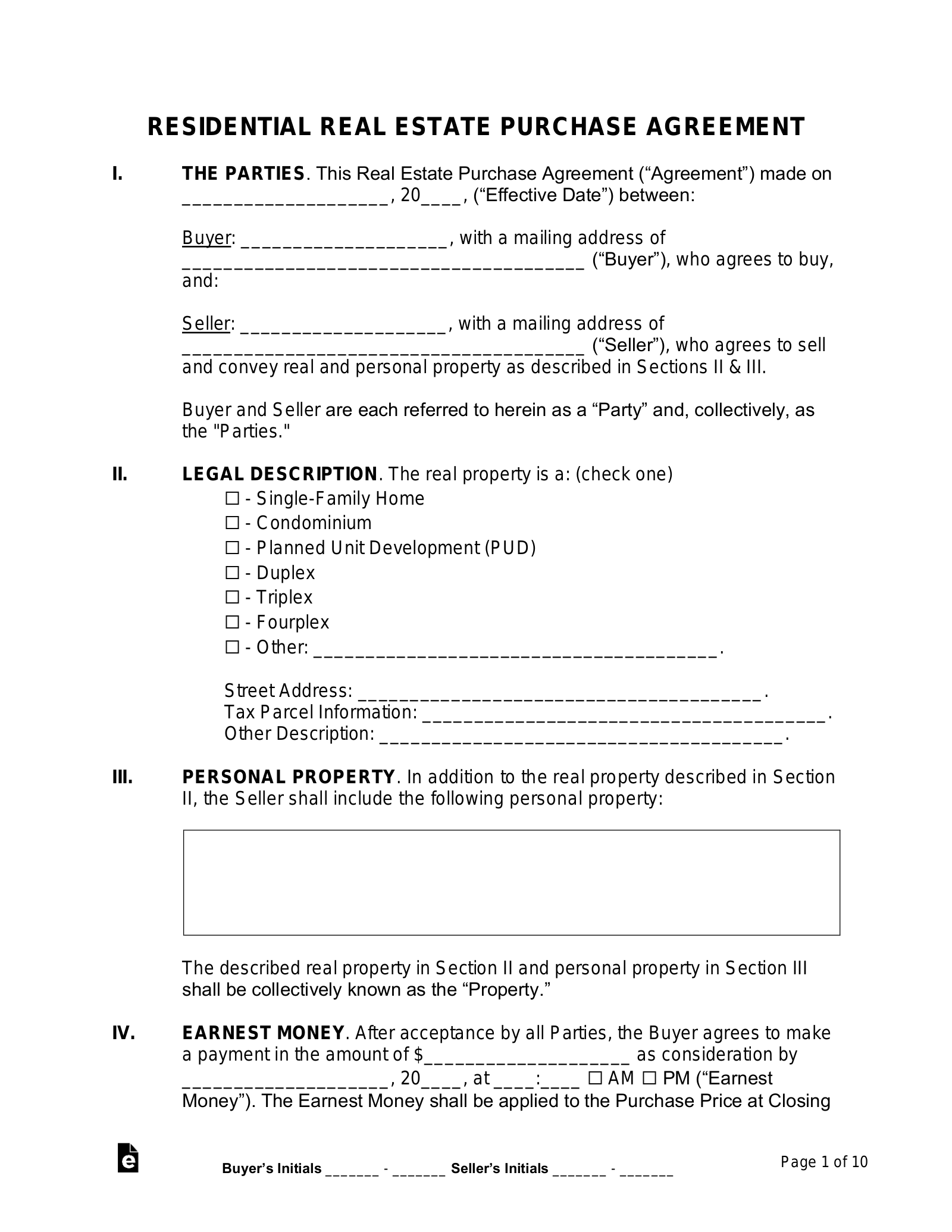

A property purchase and sale agreement is more than just a piece of paper; it’s a legally binding contract that spells out the rights and responsibilities of both the buyer and the seller. It covers everything from the property’s address and purchase price to the closing date and contingency clauses. Let’s break down some of the essential elements that you’ll typically find in a comprehensive property purchase and sale agreement template.

First and foremost, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the buyer and the seller. Accurate identification is crucial to avoid any confusion or disputes later on. The property itself must also be clearly described. This should include the full address, legal description (often found in the property deed), and any included fixtures or personal property that are part of the sale, such as appliances or furniture.

The purchase price is, of course, a critical component. The agreement should specify the total purchase price, the amount of any earnest money deposit, how the remaining balance will be financed (e.g., through a mortgage or cash), and any details about financing contingencies. Financing contingencies give the buyer a way out of the agreement if they are unable to secure the necessary financing within a specified timeframe.

Another important aspect is the closing date, which is the date when ownership of the property officially transfers from the seller to the buyer. This date should be clearly stated in the agreement, along with any provisions for extending the closing date if necessary. The agreement should also outline who is responsible for paying various closing costs, such as title insurance, escrow fees, and recording fees.

Finally, the agreement should include contingency clauses to protect both parties. These clauses allow either the buyer or the seller to terminate the agreement under certain circumstances, such as if the property fails to pass a home inspection or if the buyer is unable to sell their current home. Common contingencies include inspection contingencies, appraisal contingencies, and financing contingencies. A well-drafted property purchase and sale agreement template will cover all these essential elements, providing a solid foundation for a smooth and successful real estate transaction.

Key Considerations When Using a Property Purchase and Sale Agreement Template

While a property purchase and sale agreement template can be a great starting point, it’s crucial to remember that every real estate transaction is unique. You can’t just download a generic template and expect it to perfectly fit your specific situation. There are several key considerations to keep in mind when using a template to ensure it adequately protects your interests and accurately reflects the agreed-upon terms.

Firstly, it’s essential to carefully review and customize the template to match the specific details of your transaction. This includes accurately filling in all the blanks with the correct information about the property, the parties involved, the purchase price, and the closing date. Pay close attention to any pre-written clauses and make sure they align with your understanding of the agreement. If you’re unsure about any of the language or provisions, don’t hesitate to seek legal advice.

Secondly, be aware of any local or state laws that may affect the terms of the agreement. Real estate laws vary from place to place, and a template designed for one state may not be suitable for another. You may need to modify the template to comply with local regulations or include additional clauses to address specific legal requirements. Consulting with a real estate attorney who is familiar with the laws in your area is always a good idea.

Thirdly, consider adding any specific clauses that are relevant to your particular transaction. For example, if the property is being sold “as is,” you’ll want to include a clause that clearly states this and outlines the buyer’s responsibilities for any necessary repairs. Or, if the seller is retaining certain personal property, such as a valuable chandelier, this should be explicitly stated in the agreement to avoid any misunderstandings.

Finally, remember that a template is just a starting point. It’s not a substitute for professional advice. Engaging a qualified real estate attorney can help you ensure that your property purchase and sale agreement is comprehensive, legally sound, and tailored to your specific needs. Don’t be afraid to invest in legal counsel to protect your interests and avoid potential problems down the road.

The process of buying or selling real estate involves many moving parts, so taking the time to craft the right agreement will pay dividends later.

Having a clear, well-written purchase agreement helps minimize potential future conflict. Take the time to understand what each section means so there are fewer misunderstandings.