Purchase and Sale Agreement Template Maine

Buying or selling property in Maine? Navigating the real estate landscape can feel like traversing a dense forest. There are so many details, regulations, and forms to consider. One of the most crucial documents in any real estate transaction is the purchase and sale agreement. This legally binding contract outlines the terms and conditions of the sale, protecting both the buyer and the seller.

Think of a purchase and sale agreement as the roadmap for your real estate deal. It spells out everything, from the agreed-upon price and closing date to the responsibilities of each party involved. Having a solid agreement in place can prevent misunderstandings and disputes down the road, ensuring a smoother, less stressful transaction.

While you might be tempted to tackle this on your own, it’s generally a good idea to consult with a real estate professional or attorney. However, understanding the basics and having access to a reliable purchase and sale agreement template maine can give you a significant head start. Let’s dive into what this agreement entails and why it’s so important.

Understanding the Core Components of a Maine Purchase and Sale Agreement

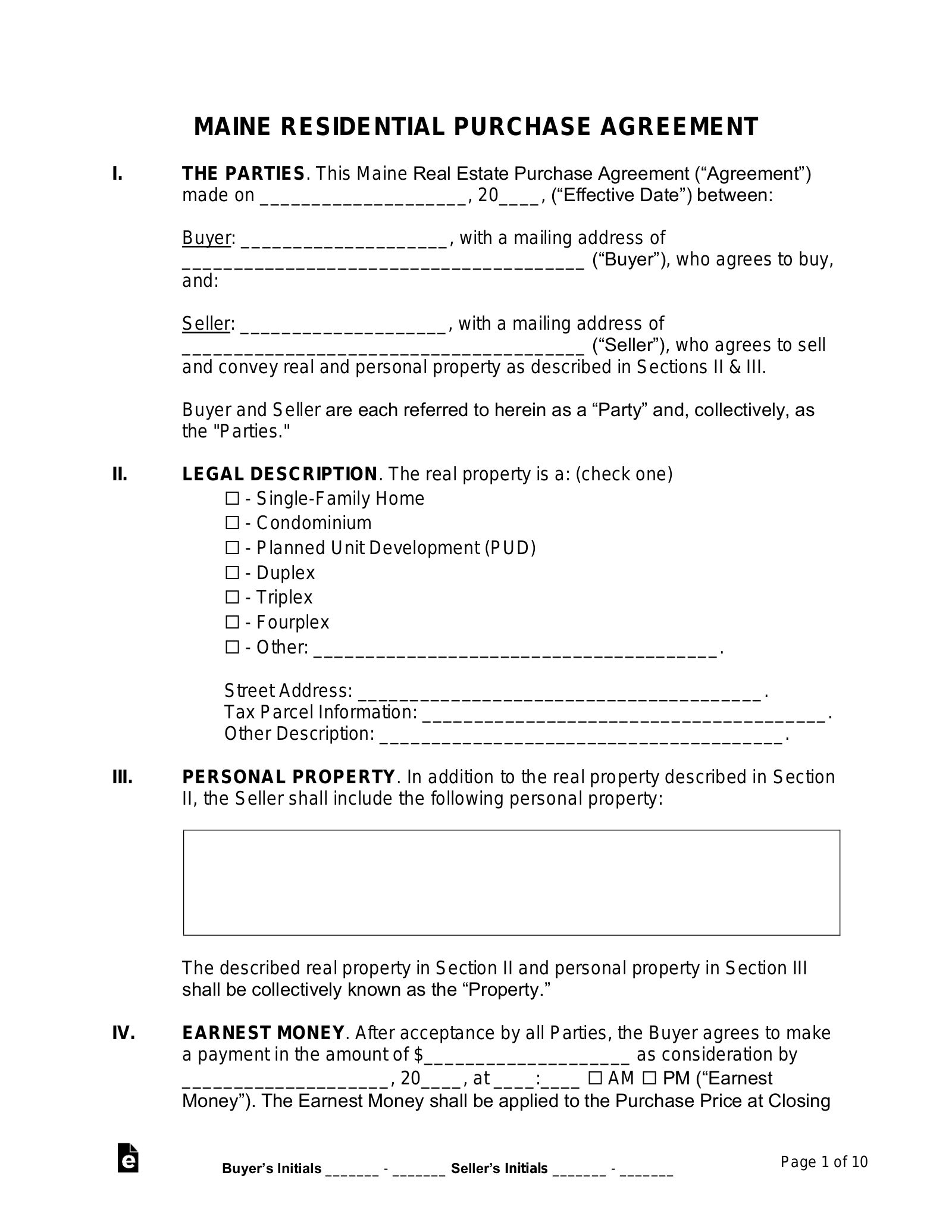

A purchase and sale agreement, often abbreviated as PSA, is the backbone of any real estate transaction in Maine. It’s a legally binding contract that details all the aspects of the deal, from the initial offer to the final closing. To ensure you’re fully protected, it’s essential to understand the key components that typically make up this document. These agreements aim to be comprehensive, covering virtually every aspect of the property sale. Let’s explore the essential ingredients of a standard Maine purchase and sale agreement template.

First and foremost, the agreement needs to clearly identify the parties involved: the buyer and the seller. This includes their full legal names and addresses. The property in question must also be accurately described, often including its street address, legal description, and any included fixtures or personal property. A detailed description helps avoid any confusion about what exactly is being bought and sold.

The purchase price is, of course, a critical element. The agreement should specify the agreed-upon price for the property, as well as how the buyer intends to finance the purchase. This might involve a mortgage, cash payment, or other financing arrangements. The agreement will typically outline the earnest money deposit, which is a sum of money the buyer puts down to show their good faith and commitment to the purchase. The amount of the deposit, how it will be held (usually in an escrow account), and under what conditions it can be forfeited are all important details.

Another essential component is the closing date. This is the date when the ownership of the property officially transfers from the seller to the buyer. The agreement should specify the exact date, time, and location of the closing. It should also outline any contingencies, which are conditions that must be met before the sale can proceed. Common contingencies include financing approval, satisfactory property inspection, and clear title.

Furthermore, the agreement will address various other important considerations, such as who is responsible for paying for certain closing costs, including property taxes, insurance, and recording fees. It will also outline what happens if either party defaults on the agreement. A well-written purchase and sale agreement template maine is a crucial tool for a successful real estate transaction, ensuring that everyone is on the same page and protected throughout the process.

Navigating the Fine Print: Key Clauses and Considerations

While a purchase and sale agreement template maine provides a solid foundation, it’s essential to understand the specific clauses and considerations that can significantly impact your real estate transaction. These often-overlooked details can be the difference between a smooth closing and a drawn-out legal battle.

One crucial area to examine is the property disclosure. Maine law requires sellers to disclose certain information about the property, such as any known defects, environmental hazards, or past problems. The purchase and sale agreement should clearly state what disclosures have been made and provide the buyer with an opportunity to review them. Buyers should carefully scrutinize these disclosures and conduct their own due diligence, including a thorough property inspection, to uncover any potential issues.

Another important clause addresses title insurance. Title insurance protects the buyer against any defects in the property’s title, such as liens, encumbrances, or ownership disputes. The purchase and sale agreement should specify who is responsible for obtaining title insurance and paying the associated costs. Buyers should insist on obtaining title insurance to safeguard their investment.

The agreement should also address the issue of personal property. While fixtures (items permanently attached to the property, such as light fixtures and built-in appliances) are typically included in the sale, personal property (items that are not permanently attached, such as furniture and decorations) may not be. The purchase and sale agreement should clearly list any personal property that is intended to be included in the sale to avoid any misunderstandings.

Furthermore, the agreement should outline the remedies available to each party in case of a breach. For example, if the buyer fails to obtain financing and cannot proceed with the purchase, the seller may be entitled to retain the earnest money deposit as compensation. Conversely, if the seller breaches the agreement by refusing to close, the buyer may be able to sue for specific performance, which would force the seller to complete the sale. A well-drafted purchase and sale agreement template maine clearly defines these remedies to protect both parties’ interests.

Finally, remember that even the best template is just a starting point. Real estate transactions are complex, and every deal is unique. Consulting with a qualified real estate attorney can help you tailor the agreement to your specific circumstances and ensure that your rights are fully protected.

Whether you are buying your first home or selling an investment property, carefully review all aspects of the purchase and sale agreement. Understand your rights and responsibilities, and don’t hesitate to seek professional advice when needed.

Ultimately, a purchase and sale agreement is there to protect everyone involved. It provides a clear plan of action and can drastically reduce the likelihood of disagreements down the line, making the entire real estate transaction significantly less stressful.