Thinking about buying or selling something significant, like a house, a car, or even a business? That’s exciting! But before you pop the champagne or start packing, there’s a crucial piece of paperwork you need to get right: the purchase and sales agreement. It might sound intimidating, but it’s really just a written promise between a buyer and a seller, outlining all the details of the transaction. It’s what keeps everyone on the same page and helps avoid misunderstandings down the road. Think of it as the rulebook for your big deal.

Without a solid purchase and sales agreement, you’re essentially relying on good faith and handshake deals. While that might work with close friends or family, it’s incredibly risky when larger sums of money and complex transactions are involved. This document spells out everything from the price and payment terms to the closing date and any contingencies that need to be met. It protects both the buyer and the seller by providing a clear roadmap and legal recourse if things go sideways.

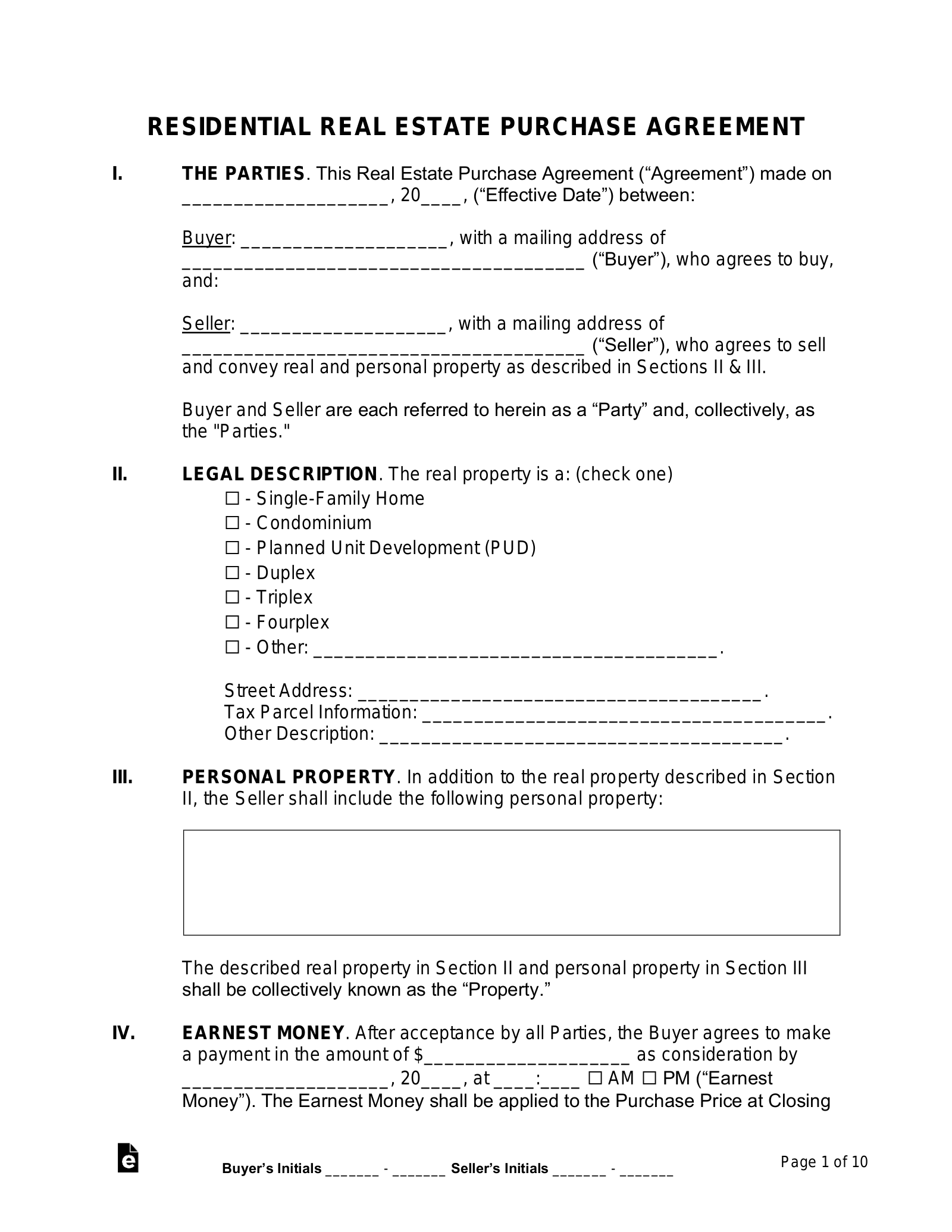

So, where do you even start? Creating one from scratch can be a daunting task. Luckily, there are readily available resources to simplify the process. A purchase and sales agreement template can be a lifesaver. It provides a framework, ensuring you cover all the necessary bases and don’t accidentally leave out any crucial details. Let’s dive into what these templates are all about and how they can make your next transaction a whole lot smoother.

Why You Need a Solid Purchase and Sales Agreement Template

Imagine agreeing to buy a house, only to find out later that the seller promised to leave the refrigerator, but now they’re taking it with them. Or perhaps you’re selling a business, and the buyer expects you to train their staff, but that wasn’t part of your initial understanding. These kinds of disputes can be avoided with a well-drafted purchase and sales agreement. It’s the ultimate clarity provider, preventing headaches and potential legal battles.

A comprehensive purchase and sales agreement template acts as a guide, prompting you to consider and document all essential aspects of the transaction. This includes not just the price, but also the method of payment, the schedule for payments, any deposits required, and the closing date when ownership officially transfers. It also delves into important details like warranties, representations, and any specific conditions that must be satisfied before the deal can close.

Furthermore, a good purchase and sales agreement template will outline what happens if either party fails to meet their obligations. What are the consequences if the buyer can’t secure financing? What if the seller discovers a hidden defect in the property? The agreement should spell out the remedies available to the non-breaching party, such as the right to terminate the agreement, seek monetary damages, or even pursue specific performance (a court order requiring the breaching party to fulfill their obligations).

Using a template doesn’t mean you can just fill in the blanks and be done with it. It’s crucial to carefully review each section and adapt it to your specific situation. You might need to add clauses to address unique circumstances or consult with an attorney to ensure the agreement fully protects your interests. Think of the template as a starting point, not a finished product.

In short, a solid purchase and sales agreement template provides peace of mind. It protects your investment, clarifies expectations, and reduces the risk of misunderstandings or disputes. It’s a small price to pay for the security it provides, especially when dealing with significant transactions.

Key Components of a Purchase and Sales Agreement

Every purchase and sales agreement, regardless of what’s being bought or sold, needs to cover certain essential elements. Think of these as the non-negotiables – the things that simply must be included for the agreement to be legally sound and effective. These components ensure that both parties are crystal clear on their rights and responsibilities.

First and foremost, the agreement must clearly identify the parties involved. This means including the full legal names and addresses of both the buyer and the seller. It should also include a detailed description of the asset being sold. For real estate, this would include the property address, legal description, and any included fixtures or appliances. For a business, it would include the name of the business, its location, and a list of all assets being transferred (e.g., inventory, equipment, intellectual property).

Next, the purchase price and payment terms need to be clearly stated. This includes the total purchase price, the amount of any deposit, the method of payment (e.g., cash, financing), and the schedule for payments. If financing is involved, the agreement should specify who is responsible for obtaining financing and what happens if the buyer is unable to secure it. It’s also common to include a section on contingencies, which are conditions that must be met before the sale can be finalized. Common contingencies include inspections, appraisals, and financing approval.

The agreement should also address the closing date, which is the date on which ownership officially transfers from the seller to the buyer. It should specify the location for the closing and who is responsible for paying closing costs. Other important clauses to consider include those related to warranties, representations, and indemnification. Warranties are guarantees made by the seller about the condition of the asset. Representations are statements of fact made by the seller. Indemnification clauses protect the buyer from certain liabilities or losses.

Finally, the agreement should include provisions for dispute resolution. This might include mediation, arbitration, or litigation. It’s also important to include a choice of law provision, which specifies which state’s laws will govern the interpretation and enforcement of the agreement. Carefully considering and including all these key components will help ensure that your purchase and sales agreement is comprehensive, legally sound, and effectively protects your interests. If unsure about any of these elements, seek legal advice.

Drafting a purchase and sales agreement doesn’t have to be intimidating. With a good template and careful attention to detail, you can create a document that protects your interests and ensures a smooth transaction. Remember, clarity and thoroughness are your best friends in this process.