Buying or selling property can feel like navigating a maze. There are so many steps involved, and each one requires careful attention. One of the most crucial steps is the purchase sale agreement. This legally binding document outlines the terms and conditions of the real estate transaction, protecting both the buyer and the seller. It’s where all the important details – price, deadlines, contingencies – get hammered out and put in writing, setting the stage for a smooth and successful closing.

Think of the purchase sale agreement as the blueprint for the entire deal. It’s more than just a formality; it’s a roadmap that guides everyone involved from initial offer to the final transfer of ownership. Without a clear and comprehensive agreement, misunderstandings can easily arise, potentially leading to disputes, delays, or even the collapse of the transaction. That’s why it’s so important to get it right from the start.

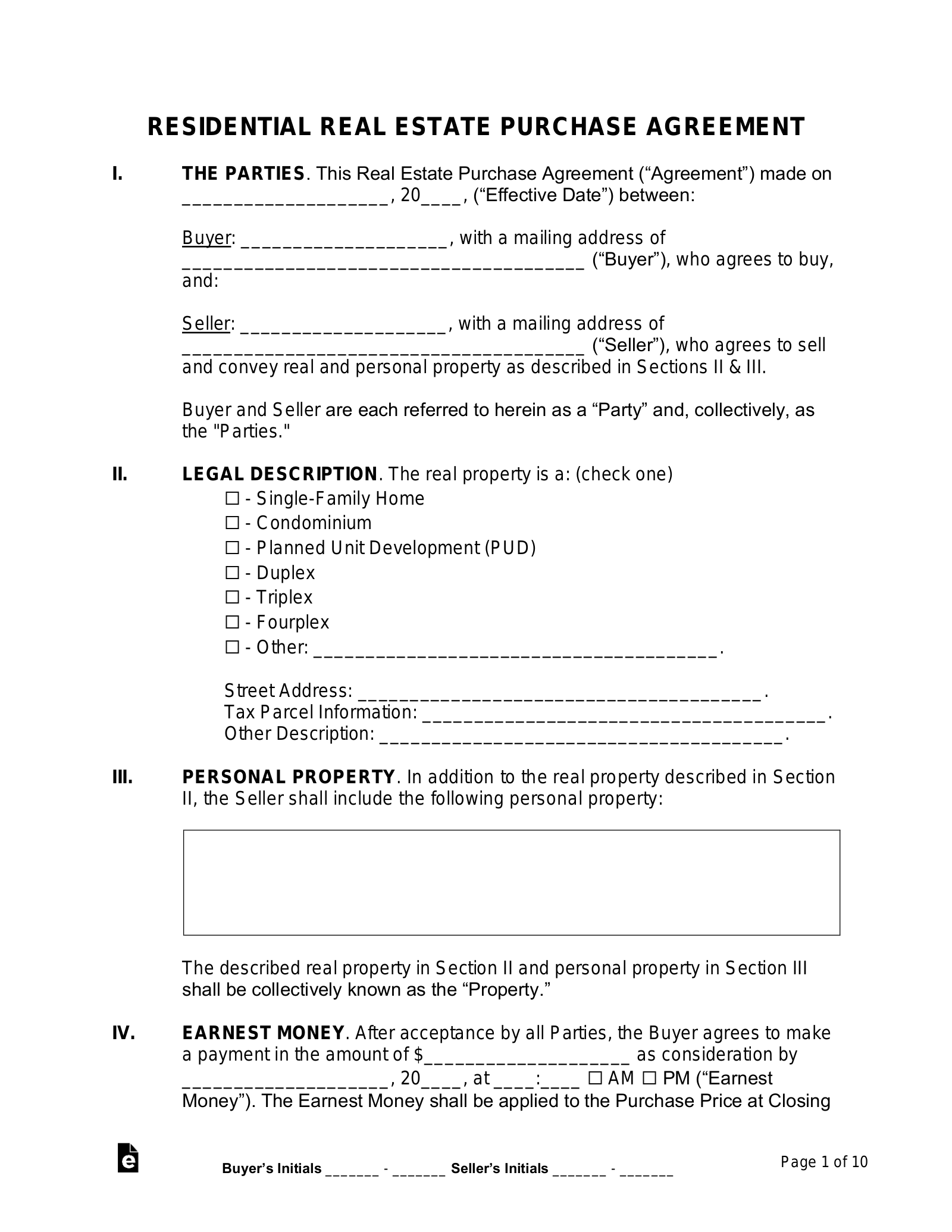

Using a purchase sale agreement template real estate can be a great starting point, but it’s essential to remember that every transaction is unique. The template provides a framework, but you’ll need to customize it to reflect the specific details of your situation. Consulting with a real estate attorney is always a wise move, as they can help you navigate the legal complexities and ensure that your interests are fully protected throughout the process. They can tailor the template to your exact needs, adding clauses and provisions that address any potential issues or concerns.

Understanding the Key Components of a Purchase Sale Agreement

A purchase sale agreement is not just a single form; it’s a compilation of various clauses, provisions, and contingencies that collectively define the terms of the transaction. Understanding these components is crucial for both buyers and sellers, as it allows you to make informed decisions and protect your interests throughout the process. Let’s delve into some of the essential elements that you’ll typically find in a purchase sale agreement template real estate.

One of the first and most important aspects is the identification of the parties involved. This includes the full legal names and addresses of both the buyer and the seller. It’s also crucial to accurately describe the property being sold, including its address, legal description, and any included fixtures or appliances. This eliminates any ambiguity about exactly what is being transferred as part of the transaction. The purchase price and the method of payment are also clearly outlined, detailing the amount of earnest money deposit, financing arrangements, and the closing date when the final payment will be made.

Contingencies play a significant role in protecting both parties. These are conditions that must be met before the sale can proceed. Common contingencies include financing contingency, which allows the buyer to back out if they cannot secure a mortgage, inspection contingency, which gives the buyer the right to have the property professionally inspected, and appraisal contingency, which ensures that the property appraises for at least the purchase price. These contingencies provide a safety net for the buyer, allowing them to withdraw from the deal if certain issues arise.

The agreement will also specify the closing date, which is the date when the property ownership is officially transferred from the seller to the buyer. It will also outline who is responsible for paying for various closing costs, such as title insurance, escrow fees, and recording fees. The agreement might also cover aspects like property taxes and homeowner association fees, specifying how these costs will be divided between the buyer and the seller. Any special agreements or conditions, such as the seller’s agreement to make certain repairs or the buyer’s need to sell their existing home, will also be documented in the agreement.

Finally, the agreement must include clauses addressing potential breaches of contract. These clauses outline the remedies available to each party if the other party fails to fulfill their obligations. For example, if the buyer backs out of the deal without a valid reason, the seller may be entitled to keep the earnest money deposit. Conversely, if the seller fails to deliver a clear title to the property, the buyer may be able to sue for damages. These breach of contract clauses provide a framework for resolving disputes and ensuring that both parties are held accountable for their commitments.

Tips for Using a Purchase Sale Agreement Template Effectively

While a purchase sale agreement template real estate offers a convenient starting point, it’s crucial to use it wisely to ensure a smooth and legally sound transaction. Here are some tips to help you navigate the process effectively. First and foremost, always read the entire template carefully and thoroughly. Don’t skim over any sections, even if they seem straightforward. Pay close attention to the fine print and ensure that you understand the implications of each clause and provision.

Next, customize the template to reflect the specific details of your transaction. Every real estate deal is unique, and the template needs to be tailored to address the specific circumstances. This may involve adding or modifying clauses, deleting irrelevant sections, or including additional terms and conditions that are specific to your situation. Don’t assume that the template perfectly captures every aspect of your agreement.

Seek professional advice from a real estate attorney. While a template can be a useful tool, it’s not a substitute for legal counsel. A real estate attorney can review the template, identify any potential issues, and ensure that your interests are fully protected. They can also help you negotiate the terms of the agreement with the other party and advise you on the legal implications of your decisions. Investing in legal advice can save you time, money, and headaches in the long run.

Pay close attention to deadlines and contingencies. The purchase sale agreement will typically include various deadlines for completing specific tasks, such as obtaining financing, conducting inspections, and securing title insurance. It’s essential to adhere to these deadlines to avoid breaching the agreement. Similarly, carefully review the contingencies and ensure that you understand your rights and obligations under each contingency clause.

Keep detailed records of all communication and documentation related to the transaction. This includes emails, letters, phone calls, and any other correspondence. These records can be invaluable in resolving any disputes that may arise. Also, be sure to retain copies of all important documents, such as the purchase sale agreement, inspection reports, appraisal reports, and title insurance policies. These documents will serve as a record of the transaction and can be helpful if you need to refer to them in the future.

It’s essential to approach the purchase sale agreement with care and attention to detail. It’s a legally binding contract, and its terms will govern the entire transaction. Don’t hesitate to ask questions, seek professional advice, and take your time to ensure that you are comfortable with every aspect of the agreement.

Ultimately, a well-drafted and carefully considered purchase sale agreement can help ensure a successful and stress-free real estate transaction. By understanding the key components of the agreement, customizing it to your specific needs, and seeking professional advice, you can protect your interests and navigate the buying or selling process with confidence.