Ever thought about owning something, like a piece of property or a bunch of shares, but weren’t quite ready to commit fully? Or maybe you wanted to lock in a price for a future transaction? That’s where put and call options come into play. They’re like a financial safety net, offering the flexibility to buy or sell an asset at a predetermined price within a specific timeframe. Instead of diving headfirst into a purchase or sale, you can secure the right to do so, giving you breathing room and potentially big advantages.

Think of it like this: you’re eyeing a vintage car, but you’re not sure if you can get financing. A call option would give you the right, but not the obligation, to buy the car at an agreed-upon price within the next month. If you secure the financing, you exercise your option and buy the car. If not, you simply let the option expire, losing only the premium you paid for the option itself. On the other hand, if you had to sell your house and a buyer was uncertain, you could give them a put option. This would give them the right, but not the obligation, to sell the house to you at an agreed price within a month. If they found another buyer, they wouldn’t exercise the option. If they were stuck, you’d buy the house at the agreed price.

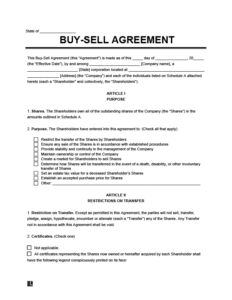

Of course, these agreements aren’t just sketched on a napkin. They require a formal document, and that’s where a put and call option agreement template becomes essential. It provides the framework for outlining all the crucial details, protecting both parties involved. So, let’s dive into what these templates are all about and how they can simplify the process of creating a legally sound agreement.

Understanding Put and Call Option Agreements

At their core, put and call options agreements are legally binding contracts that give one party the right, but not the obligation, to either buy (call option) or sell (put option) an asset to another party at a predetermined price (the strike price) within a specified period. These agreements are widely used in finance, real estate, and even commodity trading to manage risk, speculate on price movements, or facilitate potential future transactions.

The key difference between a put and a call option lies in the direction of the anticipated price movement. A call option is typically used when the buyer believes the price of the underlying asset will increase. They pay a premium for the right to buy the asset at the strike price. If the price does indeed rise above the strike price, they can exercise the option, buy the asset at the lower strike price, and immediately sell it at the higher market price, making a profit. Conversely, a put option is used when the buyer believes the price of the underlying asset will decrease. They pay a premium for the right to sell the asset at the strike price. If the price falls below the strike price, they can exercise the option, buy the asset at the lower market price, and sell it to the option seller at the higher strike price, again making a profit. It’s all about anticipating which way the market will swing.

A well-drafted put and call option agreement template will outline all the critical aspects of the agreement. This includes the identification of the parties involved (the option buyer and the option seller, sometimes called the grantor), a clear description of the underlying asset (e.g., shares of stock, a specific piece of real estate, or a quantity of a commodity), the strike price, the expiration date (the date after which the option is no longer valid), the premium paid for the option, and any specific conditions or limitations associated with the agreement.

It is also very important to clearly define how and when the option can be exercised. It is vital to understand the exact steps that the option buyer must take to formally exercise their right to buy or sell the asset. This process should be explicitly laid out in the agreement to avoid any ambiguity or disputes down the line. Furthermore, the template should address what happens if the option is not exercised by the expiration date. Generally, the option simply expires, and the option buyer loses the premium they paid. However, the agreement should confirm this and address any potential scenarios where the premium might be refundable or transferable.

Choosing the right put and call option agreement template can save you significant time and legal costs. However, make sure that the template you select is comprehensive, easy to understand, and compliant with the relevant laws in your jurisdiction. Consulting with an attorney is always recommended to ensure that the agreement accurately reflects your specific needs and circumstances.

Key Elements of a Put and Call Option Agreement Template

Navigating the world of options agreements can feel daunting, but a solid template breaks down the complexities into manageable sections. Let’s explore the essential components you’ll typically find in a put and call option agreement template.

First and foremost, the template will clearly identify the parties involved. This includes the full legal names and addresses of both the option holder (the buyer, who has the right to buy or sell) and the option writer (the seller, who is obligated to fulfill the agreement if the option is exercised). Accurate identification is crucial for ensuring the enforceability of the agreement.

Next, the template will meticulously describe the underlying asset. This section needs to be incredibly specific. If it’s stock, it should state the company name, the class of shares, and the number of shares covered by the option. If it’s real estate, it requires a full legal description of the property, including its address and any relevant identifying numbers. If the asset is a commodity, the description should include the type of commodity, the quantity, and the standard of measurement.

The strike price is another crucial element. It’s the predetermined price at which the asset can be bought or sold if the option is exercised. The template will clearly state the strike price and the currency in which it is denominated. The expiration date is equally important, as it marks the deadline for exercising the option. The template will specify the exact date and time after which the option becomes worthless.

The premium, which is the price the option buyer pays to the option seller for the right to buy or sell the asset, will also be explicitly stated in the template. The agreement should outline the payment terms, including the method of payment and the deadline for payment. Furthermore, a well-structured template will include clauses addressing governing law, dispute resolution (such as arbitration or mediation), and any other special conditions or considerations relevant to the specific transaction. Remember, a thorough and well-defined agreement minimizes the risk of misunderstandings and legal complications down the road. Ensuring that the put and call option agreement template covers all your needs is paramount.

A comprehensive put and call option agreement template will also address potential contingencies and scenarios, such as what happens if the underlying asset is subject to a stock split, a merger, or some other corporate action. It will also define the specific procedures for exercising the option, including the required notifications and documentation. Finally, it should include provisions for amending the agreement, ensuring that any changes are made in writing and signed by both parties.

The beauty of put and call options lies in their versatility. They can be used for a wide range of purposes, from hedging against potential losses to speculating on future price movements.

Ultimately, a clear and comprehensive option agreement protects everyone involved.