Buying or selling a home is a big deal, right? It’s probably one of the largest financial transactions you’ll ever make. Because so much money is involved, and because the process can be complex, it’s essential to have safeguards in place to protect everyone involved. That’s where an escrow agreement comes in handy. Think of it as a neutral holding zone, ensuring everything goes smoothly and according to plan. In essence, a real estate escrow agreement template offers a framework for secure and transparent transactions.

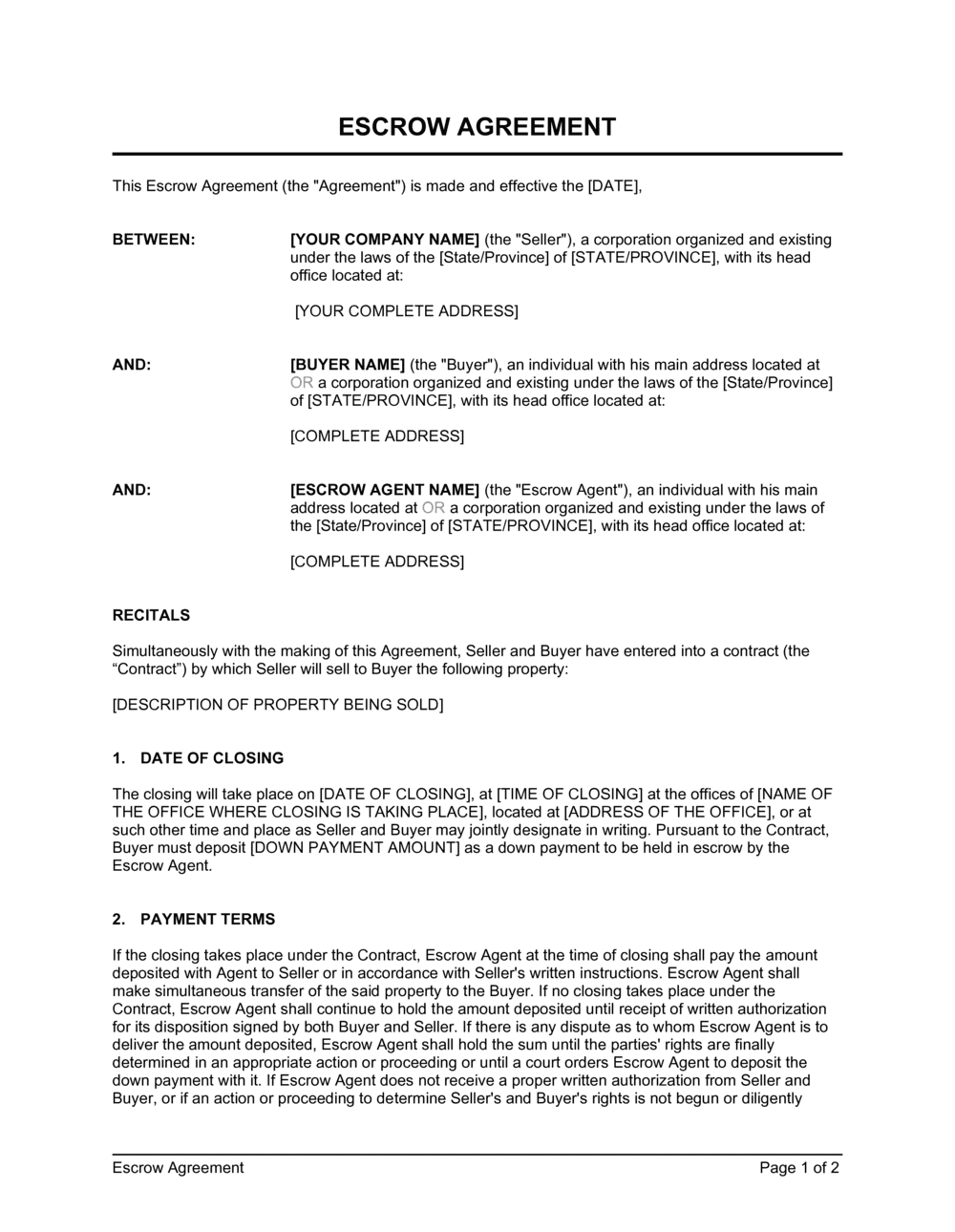

An escrow agreement, in the context of real estate, is a legal document that outlines the terms and conditions under which a neutral third party, the escrow agent, will hold funds or documents until specific conditions are met. This agreement acts as a shield, protecting both the buyer and the seller by ensuring that funds are only released when all the agreed-upon obligations have been fulfilled. It gives everyone peace of mind during what can be a stressful process.

So, what exactly does this agreement cover? Well, it spells out all the details: who the buyer and seller are, what property is being transferred, the amount of money being held in escrow, and the specific conditions that must be met before the funds or documents are released. It’s a roadmap to a successful closing, laying out all the steps and responsibilities involved. Using a real estate escrow agreement template can help simplify this process by providing a pre-structured document, but remember, it’s always best to have it reviewed by a legal professional to ensure it accurately reflects your specific needs and situation.

Understanding the Key Components of a Real Estate Escrow Agreement Template

Let’s break down what usually goes into a real estate escrow agreement template. Think of it like building blocks – each piece is crucial for a solid foundation. First and foremost, you’ll find clearly defined parties involved. This section explicitly names the buyer, the seller, and the escrow agent. Their roles and responsibilities are stated, ensuring everyone knows what they are supposed to do.

Next, the agreement will detail the property being transferred. This includes the legal address, any parcel numbers, and a clear description of the real estate. This helps avoid any confusion about which property the agreement pertains to.

The heart of the agreement lies in the section outlining the funds or documents held in escrow. This specifies the exact amount of money being held by the escrow agent, or any other pertinent documents like the deed or insurance policies. It’s vital to ensure accuracy here, as this is what the escrow agent is responsible for protecting.

Perhaps the most important section outlines the conditions for release. These are the specific criteria that must be met before the escrow agent can release the funds or documents to the appropriate party. Common conditions include completion of inspections, securing financing, and title clearance. These conditions protect both the buyer and the seller, ensuring that everyone fulfills their obligations before the deal is finalized.

Finally, the agreement will include provisions for dispute resolution, should any disagreements arise. It will also outline the escrow agent’s fees and responsibilities, and any other relevant terms and conditions, such as deadlines and contingencies. Having a well-defined real estate escrow agreement template ensures clarity and transparency, making the whole process much smoother.

Benefits of Using a Real Estate Escrow Agreement

Using a real estate escrow agreement provides a multitude of benefits for both buyers and sellers involved in a property transaction. The primary benefit is undoubtedly the added layer of security it provides. By entrusting funds and important documents to a neutral third party, both parties can rest assured that their interests are protected. The buyer knows their money won’t be released until all the necessary conditions are met, while the seller knows the buyer is serious and committed to the purchase.

Escrow agreements also streamline the closing process. The escrow agent takes on the responsibility of coordinating the various steps involved, such as collecting documents, disbursing funds, and ensuring all requirements are fulfilled. This helps to avoid delays and complications, making the transaction smoother and more efficient for everyone involved. Imagine trying to juggle all those tasks yourself – the escrow agent is the quarterback of the deal!

Another major advantage is the peace of mind it offers. Knowing that a neutral third party is overseeing the transaction and ensuring that all conditions are met can significantly reduce stress and anxiety for both the buyer and the seller. This is especially important in complex transactions or situations where there might be concerns about trust or communication.

Furthermore, an escrow agreement helps to protect against potential fraud or scams. By having a reputable escrow agent involved, both parties can be confident that the transaction is legitimate and that their funds and documents are safe. This is particularly important in today’s world, where real estate fraud is unfortunately a growing concern.

Ultimately, a real estate escrow agreement promotes transparency and fairness throughout the transaction. By clearly outlining the terms and conditions and providing a neutral party to oversee the process, it helps to ensure that both the buyer and the seller are treated fairly and that the transaction is conducted in a legal and ethical manner. This fosters trust and confidence, leading to a more positive and successful outcome for all parties involved. Seeking a suitable real estate escrow agreement template is therefore a worthwhile exercise.

Navigating the world of real estate can seem overwhelming, especially with all the paperwork involved. The key takeaway is that having a well-drafted agreement, customized to your specific transaction, can make a significant difference.

Don’t hesitate to seek professional advice from a real estate attorney or escrow agent to ensure that your agreement adequately protects your interests and complies with all applicable laws and regulations. A little extra care and attention can go a long way in ensuring a smooth and successful real estate transaction.