So, you’re diving into the exciting world of real estate investment through an LLC? Smart move! Using a Limited Liability Company (LLC) to manage your property investments offers significant benefits, shielding your personal assets from business debts and liabilities. But before you start flipping houses or collecting rent checks, there’s a crucial document you need to get right: the operating agreement. Think of it as the constitution for your real estate investment LLC, laying the groundwork for how your business will operate and ensuring everyone is on the same page.

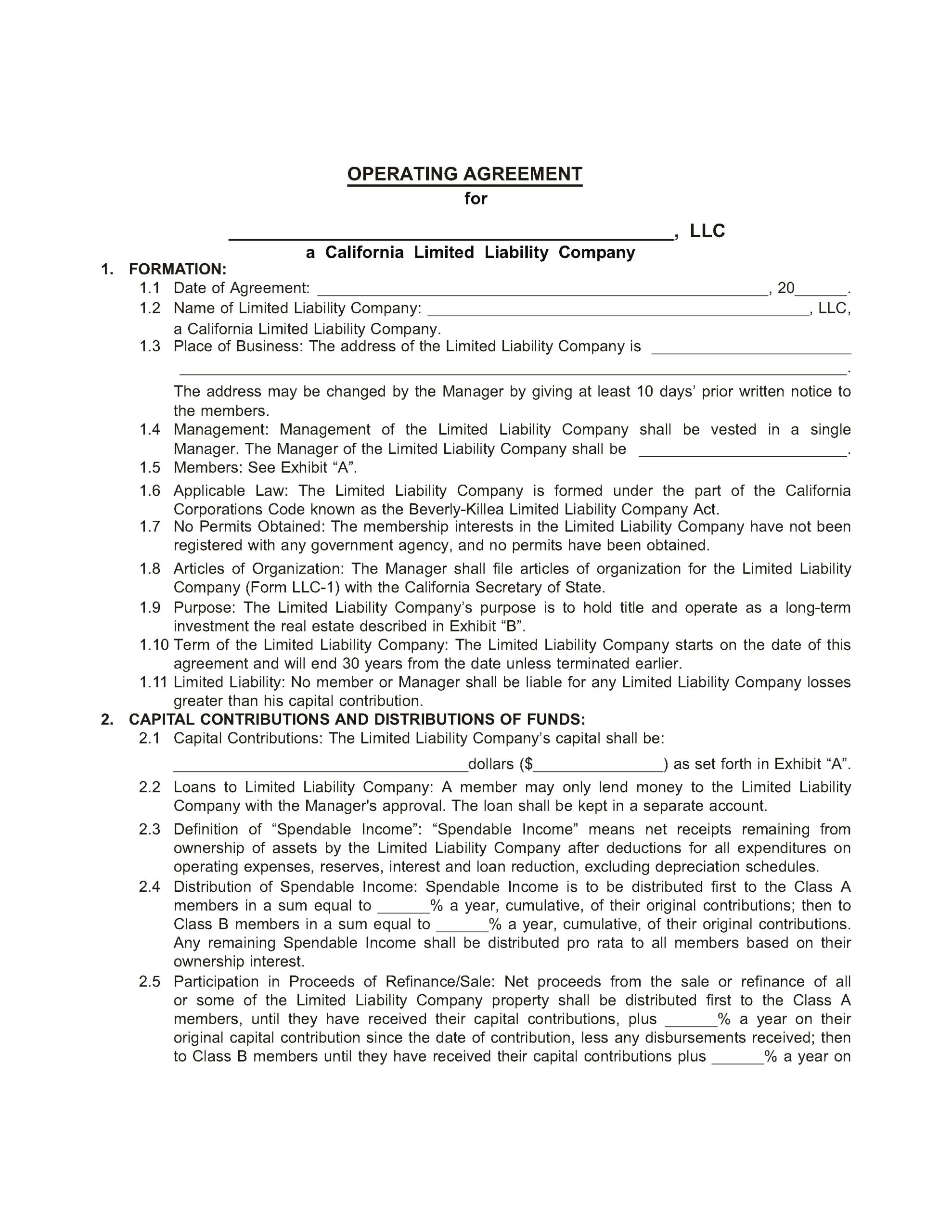

Creating an operating agreement from scratch can feel daunting. That’s where a real estate investment llc operating agreement template comes in handy. A good template provides a solid framework, covering essential aspects like member contributions, profit and loss distribution, management structure, and procedures for adding or removing members. This can save you a ton of time and legal fees compared to drafting one entirely on your own. However, remember that a template is just a starting point; you’ll need to tailor it to fit the specific needs and circumstances of your LLC.

In this article, we’ll explore the importance of an operating agreement for your real estate investment LLC, discuss what key elements to include, and show you how a real estate investment llc operating agreement template can make the process much easier. We’ll also touch on the vital considerations of customizing the template for your specific situation, ensuring it provides optimal protection and clarity for your venture. Get ready to solidify the foundation of your real estate empire!

Why a Solid Operating Agreement is Essential for Your Real Estate Investment LLC

Imagine building a house without a blueprint. Chaos, right? That’s what running a real estate investment LLC without a proper operating agreement can feel like. It’s more than just a formality; it’s a crucial document that sets the rules of the game for your business. Without it, disagreements among members can easily escalate into legal battles, threatening the stability and success of your investments. A well-drafted agreement provides clarity and structure, preventing misunderstandings and ensuring everyone is on the same page.

One of the primary reasons to have an operating agreement is to solidify the limited liability protection that an LLC offers. By clearly outlining the separation between the LLC and its members, you reinforce the legal distinction that shields your personal assets from business liabilities. Without a written agreement, a court might question the legitimacy of the LLC, potentially exposing your personal wealth to creditors or lawsuits. This is particularly important in the world of real estate, where significant financial risks are often involved.

The operating agreement also defines the roles and responsibilities of each member. Who’s in charge of finding properties? Who manages the finances? Who handles tenant relations? Clearly defining these roles prevents overlap, confusion, and potential conflicts. It also establishes decision-making procedures, outlining how major decisions will be made, whether by unanimous consent, majority vote, or through a designated manager. This is especially important if your LLC has multiple members, as disagreements are inevitable.

Furthermore, the operating agreement addresses how profits and losses will be distributed among the members. Will it be based on their initial contributions? Will some members receive a larger share for their management efforts? The operating agreement clearly spells out these details, ensuring fairness and preventing future disputes. It also outlines procedures for handling capital calls, or requests for additional investment from members, which can be crucial for financing new projects or covering unexpected expenses.

Finally, an operating agreement details the process for adding or removing members, transferring ownership interests, and dissolving the LLC. These are critical considerations that can significantly impact the future of your business. Without clear guidelines, these events can lead to messy legal battles and jeopardize your investments. A well-drafted agreement provides a roadmap for these scenarios, ensuring a smooth and orderly transition.

Key Elements to Include in Your Real Estate Investment LLC Operating Agreement

So, you understand the importance of an operating agreement, but what exactly should it include? While the specific content will vary depending on your LLC’s unique circumstances, there are several key elements that should be addressed in every agreement. Failing to include these could leave your LLC vulnerable to disputes and legal challenges.

First and foremost, your operating agreement should clearly identify the name and purpose of your LLC. It should also specify the registered agent, who is responsible for receiving legal notices on behalf of the business. This might seem basic, but it’s essential for establishing the legal existence of your LLC and ensuring it can be properly served if necessary.

The agreement should then detail the contributions of each member, both in terms of capital and services. How much money did each member contribute initially? Will members be contributing their time and expertise? Clearly outlining these contributions is crucial for determining each member’s ownership percentage and their share of profits and losses. Additionally, the agreement should specify the process for making additional contributions in the future, whether through capital calls or other means.

A crucial section of the operating agreement addresses management and decision-making. Will the LLC be managed by its members, or will a designated manager be responsible for day-to-day operations? If a manager is appointed, the agreement should clearly define their powers and responsibilities. It should also outline the procedures for making major decisions, such as purchasing new properties, taking out loans, or selling assets. This section should also address how disputes among members will be resolved, whether through mediation, arbitration, or other methods.

The operating agreement must also specify how profits and losses will be allocated among the members. Will it be based on their ownership percentages? Will some members receive a larger share for their management efforts? The agreement should clearly define the allocation method, ensuring fairness and preventing future disputes. Furthermore, the agreement should outline the procedures for distributing profits to the members, including the frequency and method of distribution. Finally, the agreement should address the tax implications of the profit and loss allocation, ensuring compliance with relevant tax laws.

Finally, the operating agreement should address the process for transferring membership interests, adding or removing members, and dissolving the LLC. What happens if a member wants to sell their ownership stake? What happens if a member dies or becomes incapacitated? The agreement should provide clear guidelines for these scenarios, ensuring a smooth and orderly transition. It should also outline the procedures for dissolving the LLC, including the distribution of assets and the payment of debts.

We have covered key concepts that can assist with using a real estate investment llc operating agreement template for your real estate journey. Remember to consult legal counsel so your operating agreement can be beneficial in your situation.

Having a solid real estate investment llc operating agreement template can assist with a strong foundation to avoid any kind of issues that may come. With a strong foundation you can minimize disputes with any of your partners and can ensure that everything runs smoothly.