So, you’re diving into the world of real estate, huh? Maybe you’re buying your dream home, investing in a rental property, or even lending money to someone else for their real estate ventures. Whatever the case, you’ve probably realized that a solid real estate loan agreement is absolutely crucial. It’s the foundation upon which the whole transaction rests, ensuring everyone is on the same page and protected in case things don’t go exactly as planned.

Think of a real estate loan agreement as a detailed roadmap. It lays out all the terms and conditions of the loan, leaving no room for ambiguity or misinterpretation. Without it, you’re basically navigating uncharted territory, which can lead to misunderstandings, disputes, and even legal battles down the road. Nobody wants that, right?

That’s where a good real estate loan agreement template comes in handy. It provides a framework to start with, saving you time and effort compared to drafting one from scratch. Of course, it’s always a good idea to tailor the template to your specific situation and consult with legal professionals to ensure everything is airtight. But having a solid template as a starting point can make the whole process much less daunting.

Why a Solid Real Estate Loan Agreement Template Matters

Alright, let’s get into the nitty-gritty of why you absolutely need a well-crafted real estate loan agreement template. It’s not just a formality; it’s a shield that protects both the lender and the borrower. Think of it as a comprehensive insurance policy for your financial investment and peace of mind.

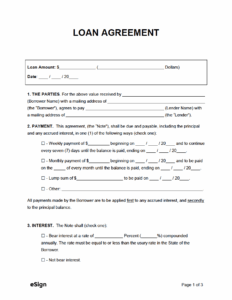

First and foremost, a real estate loan agreement template clearly defines the terms of the loan. This includes the principal amount, the interest rate, the repayment schedule, and any late payment penalties. By spelling out these details in black and white, you eliminate any potential for confusion or disagreement down the line. Imagine lending a significant amount of money without specifying the interest rate. That’s a recipe for disaster!

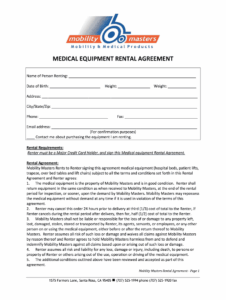

Furthermore, a good template will address what happens if the borrower defaults on the loan. This is a crucial aspect that should never be overlooked. It outlines the lender’s recourse in such a situation, which may include foreclosure or other legal actions. While nobody wants to think about the possibility of default, it’s essential to have a plan in place to protect your investment.

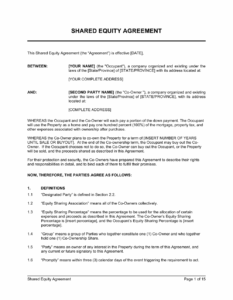

Beyond the financial aspects, a real estate loan agreement template also covers other important considerations, such as property insurance requirements, property tax obligations, and any restrictions on the use of the property. It ensures that the borrower maintains the property in good condition and complies with all applicable laws and regulations. This helps to preserve the value of the property and protect the lender’s investment.

In essence, a comprehensive real estate loan agreement template acts as a central reference point for all parties involved in the transaction. It clarifies expectations, minimizes misunderstandings, and provides a clear roadmap for the entire loan process. So, don’t underestimate the importance of having a well-drafted agreement in place. It’s an investment that can save you a lot of headaches and heartaches in the long run. When you are considering the legalities of a mortgage, you have to remember that the real estate loan agreement template is important.

Key Components of a Real Estate Loan Agreement

Now that you understand the importance of a real estate loan agreement, let’s break down the key components that should be included in your template. While the specifics may vary depending on the nature of the loan and the parties involved, there are some fundamental elements that should always be addressed.

First, you’ll need to clearly identify the parties involved in the agreement. This includes the lender, the borrower, and any guarantors. Be sure to include their full legal names, addresses, and contact information. This seems obvious, but it’s a crucial step to ensure that everyone is properly identified and accountable.

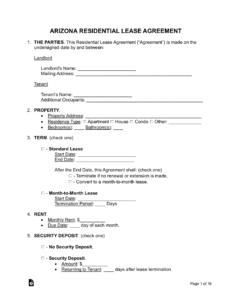

Next, you’ll need to describe the property that is being used as collateral for the loan. This should include the property address, legal description, and any other relevant details that accurately identify the property. A clear and precise description of the property is essential for avoiding any disputes over ownership or boundaries.

The loan terms should be outlined in detail, including the principal amount, the interest rate, the repayment schedule, and any late payment penalties. It’s also important to specify whether the interest rate is fixed or variable and how it will be calculated. Transparency is key when it comes to loan terms. Everything should be clearly explained and easy to understand.

The agreement should also address any covenants or restrictions that the borrower must adhere to. This may include requirements to maintain property insurance, pay property taxes, and comply with any applicable zoning regulations. These covenants are designed to protect the lender’s investment and ensure that the property is properly maintained.

Finally, the agreement should include provisions for default and remedies. This outlines what happens if the borrower fails to make payments or violates any other terms of the agreement. It specifies the lender’s recourse, which may include foreclosure, repossession, or other legal actions. Having a clear plan in place for dealing with default is essential for protecting the lender’s interests. Using a proper real estate loan agreement template helps you with this.

In conclusion, remember to tailor your template to your specific situation and consult with legal professionals to ensure that it complies with all applicable laws and regulations. You can even consider using online services to guide you through these processes. Real estate transactions can be complex. Using a real estate loan agreement template is a good idea.

Creating an understanding between both lender and borrower is one of the most important things to consider when making a real estate loan agreement. If this is done well, then there should be no misunderstanding or issues in the future.