Buying or selling a home is a huge decision, probably the biggest financial transaction most people make in their lives. It’s a thrilling time, filled with anticipation and the promise of new beginnings. But beneath the excitement, there’s a mountain of paperwork involved, and one of the most crucial documents is the real estate purchase and sale agreement. Think of it as the blueprint for the entire transaction, outlining all the terms and conditions that both buyer and seller need to agree on before the deal can move forward. It’s a legally binding contract, so understanding it is absolutely essential.

This agreement isn’t just a formality; it protects both the buyer and the seller. It spells out exactly what’s being sold (the property address, any included appliances, etc.), the agreed-upon purchase price, the timeline for closing, and what happens if either party fails to hold up their end of the bargain. A well-written agreement can prevent misunderstandings and costly legal battles down the road. While you’ll likely work with real estate agents and attorneys to finalize the agreement, understanding the basics beforehand will put you in a much stronger position.

That’s where a real estate purchase and sale agreement template comes in handy. Using a template can provide a solid starting point, ensuring you don’t overlook any key elements. It provides a framework, a guide, but remember that every real estate transaction is unique, and you’ll almost certainly need to customize the template to fit your specific situation. The right template can save you time and stress, and help ensure your real estate deal goes smoothly.

Understanding the Key Components of a Real Estate Purchase and Sale Agreement

A real estate purchase and sale agreement is a comprehensive document designed to cover all aspects of the transaction. It’s more than just a piece of paper; it’s a legal contract that defines the rights and responsibilities of both the buyer and the seller. Let’s break down some of the key components you’ll typically find in this type of agreement.

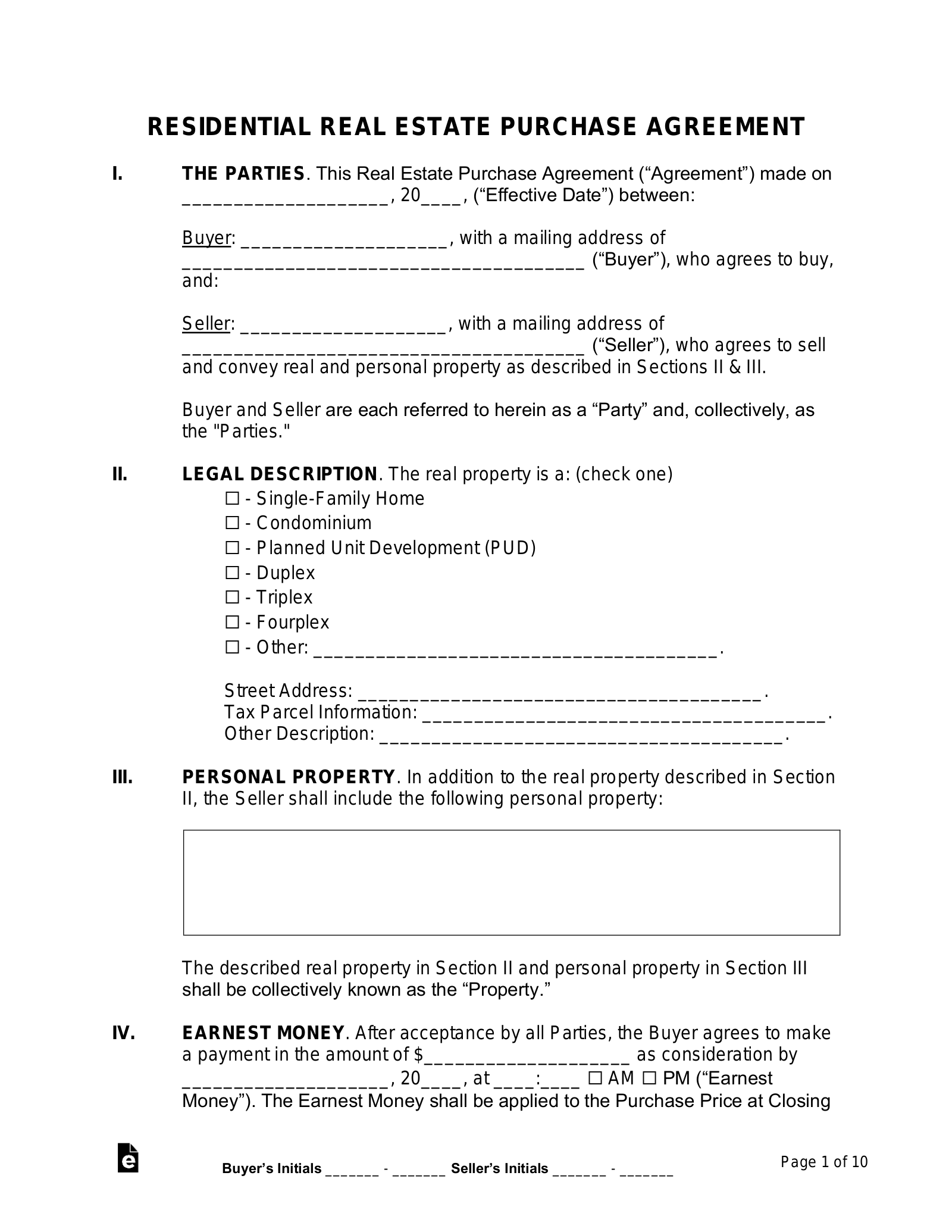

First, there’s the identification of the parties involved. This seems obvious, but it’s crucial to accurately list the full legal names and addresses of both the buyer and the seller. Any discrepancies here could potentially cause problems later on. Next comes a clear and detailed description of the property being sold. This includes the street address, the legal description (which can be found on the property deed), and any personal property included in the sale, such as appliances, fixtures, or furniture. Be specific to avoid any confusion about what’s included.

Of course, the purchase price is a critical element. This is the agreed-upon amount the buyer will pay for the property. The agreement will also detail the earnest money deposit, which is a sum of money the buyer puts down to show their serious intention to purchase the property. The agreement should specify how the earnest money will be held (usually by an escrow company) and under what circumstances it will be refunded or forfeited.

Financing terms are also essential. If the buyer is obtaining a mortgage, the agreement will outline the type of financing, the loan amount, the interest rate, and the deadline for securing financing. This section often includes a financing contingency, which allows the buyer to back out of the deal if they’re unable to obtain a mortgage within a specified timeframe. Inspection contingencies are also common. These allow the buyer to have the property inspected by professionals and to request repairs or renegotiate the purchase price if significant issues are discovered.

Finally, the agreement will include the closing date, which is the date when ownership of the property officially transfers from the seller to the buyer. It will also outline any specific closing procedures, such as who is responsible for paying certain closing costs (title insurance, recording fees, etc.). This document is legally binding and should be reviewed by all parties with legal counsel before signing.

Using a Real Estate Purchase and Sale Agreement Template Effectively

While a real estate purchase and sale agreement template provides a great starting point, it’s vital to use it correctly. Think of it as a framework, not a one-size-fits-all solution. The key is to understand how to customize it to accurately reflect the specifics of your transaction.

First, carefully review the entire template. Don’t just skim it; read each section thoroughly. Make sure you understand the meaning of every clause and how it applies to your situation. If you’re unsure about anything, don’t hesitate to seek clarification from a real estate attorney. A template is only as good as your understanding of it.

Next, tailor the template to fit your specific needs. Every real estate transaction is unique, so you’ll likely need to modify certain sections. For example, if you’re including specific personal property in the sale (a riding lawnmower, patio furniture, etc.), make sure to list them clearly in the agreement. If there are any special conditions or contingencies you want to include, add them to the appropriate section. This is where you add the specific protections you need.

Pay close attention to the dates and deadlines outlined in the template. Ensure they are realistic and achievable. The closing date, financing deadline, and inspection period should all be carefully considered and adjusted to fit your timeline. Rushing through these dates can lead to problems down the road.

Finally, remember that a template is not a substitute for professional legal advice. It’s always a good idea to have a real estate attorney review the agreement before you sign it. An attorney can identify potential risks and ensure that the agreement protects your interests. They can also help you negotiate any changes with the other party. Remember, a real estate purchase and sale agreement template is a helpful tool, but it’s essential to use it wisely and seek expert guidance when needed.

Navigating the real estate market can seem daunting, with its complexities and the sheer volume of paperwork involved. But by familiarizing yourself with the key documents and seeking professional assistance when necessary, you can approach the process with confidence.

Remember, whether you’re buying your first home or selling a property you’ve owned for years, taking the time to understand the details of the agreement is always a worthwhile investment. A well-understood and carefully crafted real estate purchase and sale agreement can provide peace of mind and help ensure a smooth and successful transaction for everyone involved.