Ever found yourself in a situation where you need to loan money to a family member, a business partner, or another entity you’re closely connected to? These kinds of transactions, known as related party loans, are more common than you might think. But just because you trust the other party doesn’t mean you can skip the paperwork. In fact, formalizing the agreement with a proper document is crucial for protecting both sides and ensuring clarity and accountability.

A related party loan agreement serves as a legally binding record of the loan’s terms, including the amount, interest rate (if any), repayment schedule, and what happens if things don’t go as planned. It’s not just about protecting your money; it’s also about maintaining healthy relationships and avoiding misunderstandings down the line. Imagine the awkwardness if a disagreement arises about the repayment terms – a written agreement can prevent such scenarios.

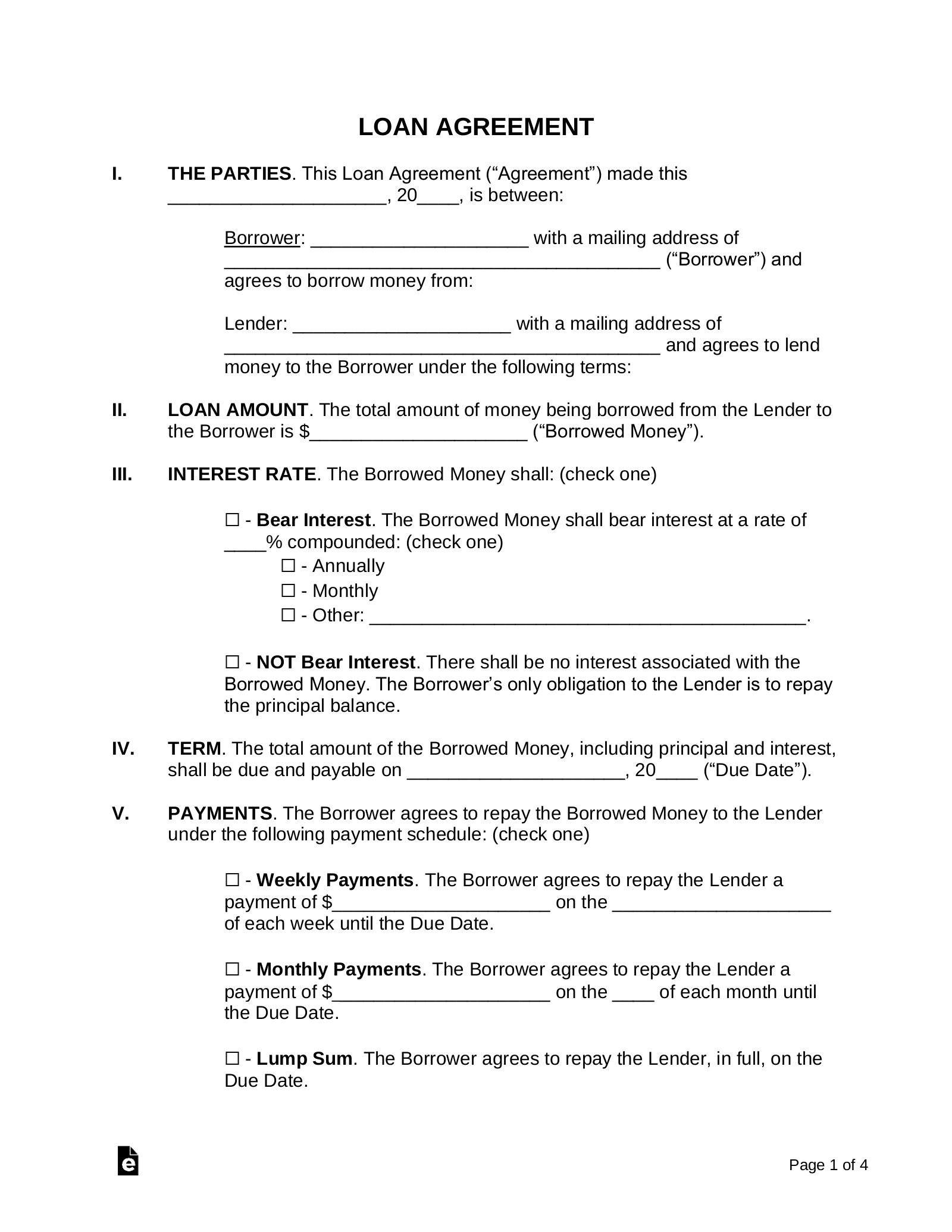

So, where do you start? Crafting a loan agreement from scratch can feel daunting, especially if legal jargon isn’t your forte. That’s where a related party loan agreement template comes in handy. It provides a structured framework, ensuring you cover all the essential elements while allowing you to customize the details to fit your specific situation. Think of it as a starting point, not a rigid script. You still need to understand the implications of each clause and tailor it to your unique circumstances.

Why You Need a Related Party Loan Agreement

Lending or borrowing money from related parties – think family members, business partners, or affiliated companies – can be convenient. However, these transactions also come with unique risks and potential complications. Without a formal agreement, these arrangements can easily become sources of conflict, misunderstanding, and even legal trouble. A well-drafted related party loan agreement addresses these concerns head-on, providing clarity and protection for both the lender and the borrower.

One of the primary reasons to use a loan agreement is to clearly define the terms of the loan. This includes the principal amount, the interest rate (if applicable), the repayment schedule, and any collateral securing the loan. Specifying these details upfront avoids ambiguity and ensures that both parties are on the same page. Imagine lending a significant amount of money to a family member without specifying when and how it should be repaid. This could easily lead to strained relationships and resentment.

Furthermore, a loan agreement can help protect the lender’s interests. By documenting the loan terms and securing it with collateral (if necessary), the lender has a legal recourse in case the borrower defaults. This is particularly important in business contexts, where loans to related parties can be subject to scrutiny from tax authorities and other regulatory bodies. A formal agreement demonstrates that the loan was made on commercially reasonable terms, minimizing the risk of adverse tax consequences.

From the borrower’s perspective, a loan agreement provides clarity and predictability. It ensures that the loan terms are fair and transparent, and it protects the borrower from arbitrary changes or demands from the lender. This can be especially important when dealing with family members or close friends, where personal relationships can sometimes overshadow business considerations.

Finally, a loan agreement serves as a valuable record for accounting and tax purposes. It provides documentation of the loan transaction, which is essential for accurately reporting income, expenses, and assets. This is crucial for both the lender and the borrower, as it helps them comply with tax regulations and avoid potential penalties. Using a related party loan agreement template simplifies this process by providing a standardized format that includes all the necessary information.

Key Elements of a Robust Loan Agreement

A comprehensive related party loan agreement should include the following essential elements:

* **Identification of Parties:** Clearly identify the lender and the borrower, including their legal names and addresses.

* **Loan Amount:** Specify the principal amount of the loan.

* **Interest Rate:** State the interest rate (if any) and how it is calculated.

* **Repayment Schedule:** Outline the repayment schedule, including the amount and frequency of payments.

* **Collateral (if any):** Describe any collateral securing the loan.

* **Default Provisions:** Define what constitutes a default and the remedies available to the lender.

* **Governing Law:** Specify the governing law of the agreement.

* **Signatures:** Include the signatures of both the lender and the borrower.

What to Consider When Using a Related Party Loan Agreement Template

While a related party loan agreement template provides a solid foundation, it’s crucial to remember that it’s not a one-size-fits-all solution. You need to carefully review and adapt the template to fit your specific circumstances. This involves considering the nature of the relationship between the parties, the purpose of the loan, and the potential risks involved. Don’t just blindly fill in the blanks; take the time to understand each clause and how it applies to your situation.

One important consideration is the interest rate. While you may be tempted to offer a loan with no interest to a family member or friend, this could have tax implications. The IRS may consider the foregone interest to be a gift, which could trigger gift tax obligations. It’s generally advisable to charge an interest rate that is at least equal to the applicable federal rate (AFR), which is published by the IRS each month. This helps ensure that the loan is treated as a legitimate transaction for tax purposes.

Another key aspect is the repayment schedule. Consider the borrower’s ability to repay the loan and structure the repayment schedule accordingly. A realistic repayment plan will help avoid defaults and maintain a positive relationship between the parties. You might consider allowing for some flexibility in the repayment schedule, such as the ability to defer payments in case of financial hardship.

If the loan is secured by collateral, it’s essential to accurately describe the collateral in the agreement and take the necessary steps to perfect your security interest. This may involve filing a financing statement with the appropriate government agency. Failure to properly secure the loan could jeopardize your ability to recover your money in case of default.

Finally, it’s always a good idea to consult with an attorney or financial advisor before entering into a related party loan agreement. They can help you understand the legal and tax implications of the transaction and ensure that the agreement is properly drafted to protect your interests. While a related party loan agreement template is a useful tool, it’s not a substitute for professional advice. A carefully considered related party loan agreement template can save time and money, but professional guidance provides essential peace of mind.

Regardless of your relationship, lending money always carries risks. Don’t assume that because you trust someone, things can’t go wrong. Protect yourself and maintain clear boundaries.

Ultimately, by using a related party loan agreement template and tailoring it to your specific needs, you can minimize the risks and ensure that your loan transaction is conducted fairly and transparently. This can help preserve your relationships and protect your financial interests.