Have you finally paid off that loan? Congratulations! It’s a fantastic feeling to be free from debt. But before you completely celebrate, there’s one crucial step you shouldn’t overlook: obtaining a formal release of the loan agreement. This document serves as official proof that you’ve fulfilled your financial obligation, protecting you from potential future claims related to the loan. Think of it as the final seal of approval, the “mission accomplished” certificate for your loan journey.

In essence, a release of loan agreement template is a pre-designed document that outlines the terms of the loan’s cancellation. It confirms that the lender acknowledges the full repayment of the loan, including principal and any accrued interest, and releases the borrower from any further liability under the original loan agreement. Using a template simplifies the process, ensuring all necessary information is included and properly worded. It’s a convenient and efficient way to finalize the loan closure.

Why is this release so important? Imagine a scenario where, years down the line, the lender claims you still owe them money. Without a formal release, you might face a lengthy and stressful legal battle to prove you’ve already paid. A well-drafted release of loan agreement template acts as your shield, providing irrefutable evidence of your fulfillment of the loan terms. It’s peace of mind in paper form.

Understanding the Importance of a Formal Release

When you borrow money, you and the lender enter into a legally binding agreement. This agreement outlines the terms of the loan, including the amount borrowed, the interest rate, the repayment schedule, and the consequences of default. Once the loan is fully repaid, it’s crucial to formally document the satisfaction of that agreement. This is where the release of loan agreement template becomes invaluable.

A release isn’t just a formality; it’s a crucial safeguard for your financial well-being. Without it, the lender could theoretically claim that the loan is still outstanding, even if you have paid it off. This could lead to unpleasant disputes, legal action, and damage to your credit score. The release document provides concrete evidence that you have met your obligations and are no longer liable for the debt.

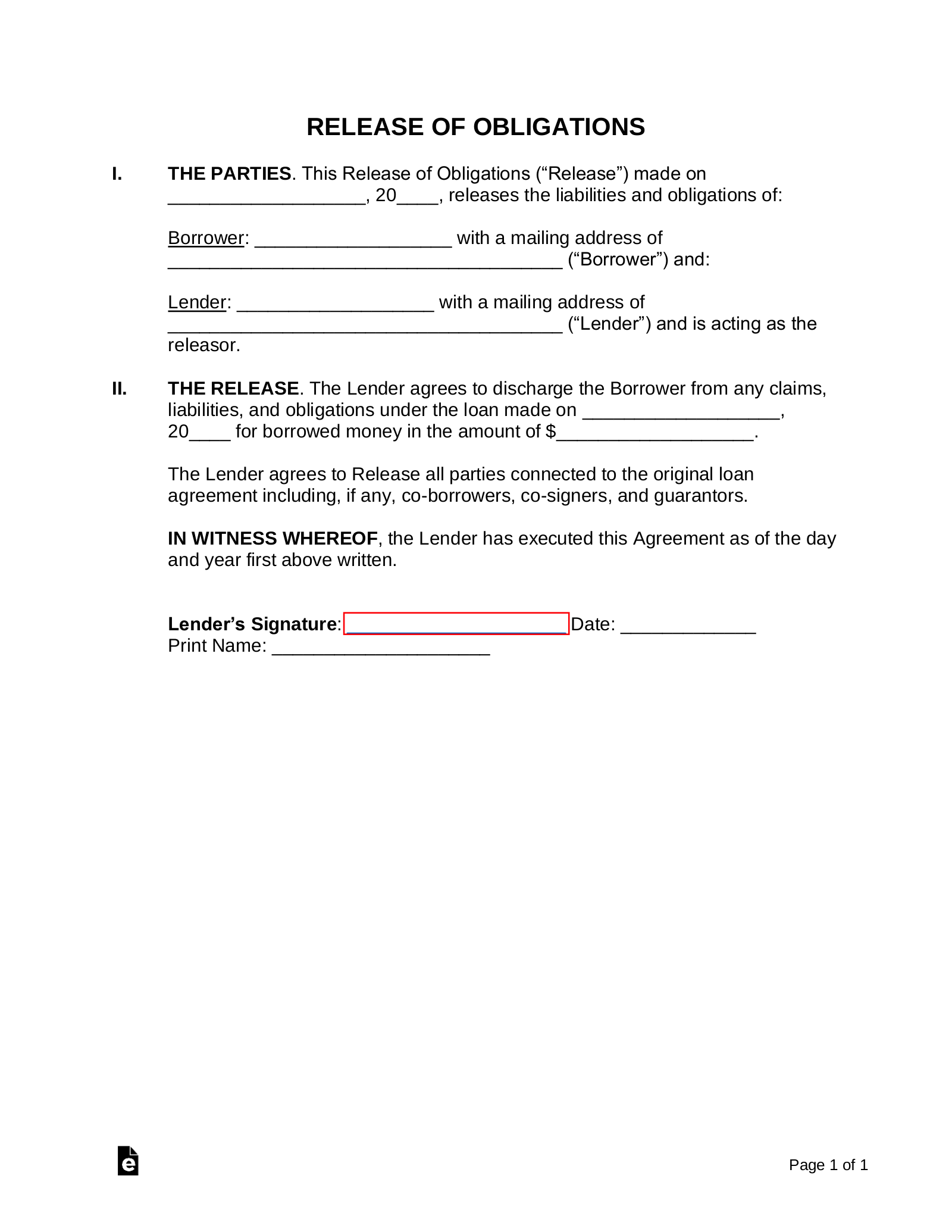

The release of loan agreement template typically includes key information such as the names of the borrower and lender, the date of the original loan agreement, the loan amount, and a clear statement that the loan has been fully repaid and the borrower is released from all further obligations. It should also be signed and dated by both the borrower and the lender, confirming their agreement to the terms of the release.

Furthermore, having a properly executed release can be especially important when dealing with secured loans, such as mortgages or auto loans. In these cases, the lender holds a lien on the property until the loan is fully repaid. The release not only confirms the satisfaction of the debt but also paves the way for the removal of the lien from the property title. This is a critical step in ensuring clear ownership of the asset.

In essence, a release of loan agreement template offers protection, clarity, and peace of mind. It’s a simple yet essential step in finalizing the loan process and safeguarding your financial future.

Key Elements of a Good Release of Loan Agreement Template

A comprehensive release of loan agreement template should cover several essential elements to ensure its effectiveness and legal validity. First and foremost, it needs to clearly identify the parties involved: the borrower and the lender. This includes their full legal names and addresses. Accuracy in this section is paramount to avoid any ambiguity or confusion down the line.

Next, the template must explicitly reference the original loan agreement being released. This involves stating the date of the original agreement, the loan amount, and any identifying loan numbers or reference codes. This detailed information ensures there’s no room for misinterpretation about which specific loan is being released.

The core of the template is the release clause itself. This clause should state, in clear and unambiguous language, that the lender acknowledges the full repayment of the loan, including both principal and accrued interest. It should also explicitly state that the borrower is released from any and all further obligations or liabilities under the original loan agreement.

Furthermore, the template should address any collateral or security interests related to the loan. If the loan was secured by an asset, such as a property or vehicle, the release should state that the lender releases its claim on that asset and will take the necessary steps to remove any liens or encumbrances. This is particularly important for secured loans to ensure the borrower regains full ownership of the asset.

Finally, the release of loan agreement template should include signature lines for both the borrower and the lender, along with spaces for the date. Both parties should sign and date the release in the presence of a notary public for added legal validity. This notarization adds an extra layer of authentication to the document.

It’s also a good idea to keep a copy of the signed release document with your important financial records. This will provide you with easy access to the document if needed in the future.

Taking that final step of securing your release of loan agreement template and ensuring its proper completion is a proactive way to protect yourself and your finances. Consider it a small investment in long-term peace of mind.

Having this documentation on hand is about feeling confident that you’ve taken all the necessary steps to protect your financial interests and that you’re prepared for any future inquiries or potential discrepancies.