Ever dreamed of owning a car, but your credit score has other plans? A rent to own car agreement might be the bridge you need to finally get behind the wheel. It’s essentially a lease agreement with an option to buy the vehicle at the end of the rental period. Sounds simple, right? Well, like any legal agreement, there are important details you need to understand before signing on the dotted line. We’re here to break it down for you.

Think of it this way: you’re renting the car, and a portion of your rental payments goes toward the eventual purchase price. It’s a chance to drive now, build credit (in some cases), and become the official owner later. However, it’s not a standard car loan, and that’s where understanding the fine print, and especially having a solid rent to own car agreement template, becomes crucial. You want to protect yourself and ensure a fair deal.

This article will walk you through the ins and outs of rent to own car agreements. We’ll explore what these agreements typically include, the potential benefits and drawbacks, and why using a reliable rent to own car agreement template is so important. By the end, you’ll have a better understanding of whether this option is right for you and how to navigate the process with confidence. Let’s dive in!

Understanding the Essentials of a Rent To Own Car Agreement

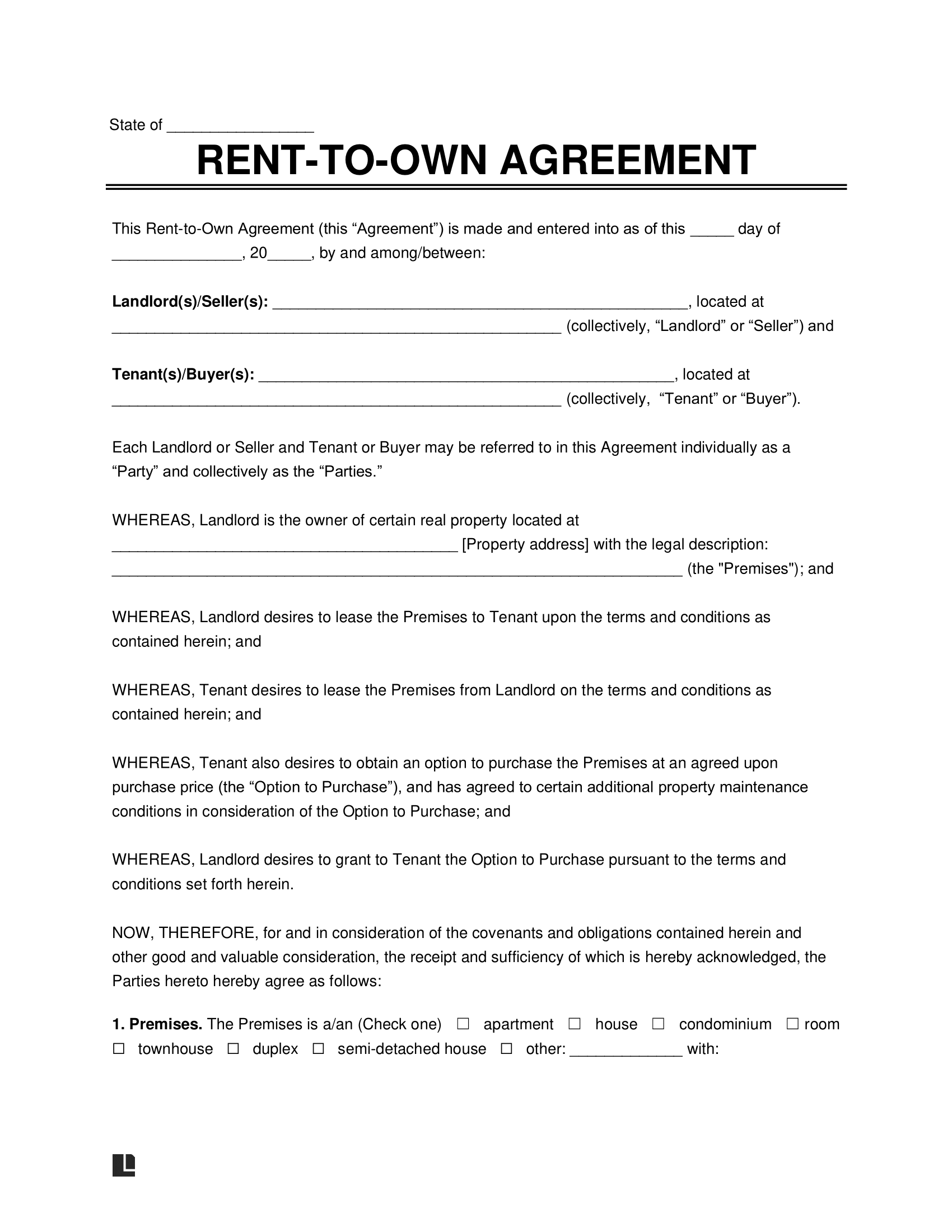

A rent to own car agreement is a legal document that outlines the terms and conditions of renting a vehicle with the option to purchase it at a later date. Unlike a traditional car loan, you don’t technically own the car until you’ve made all the required payments and exercised your option to buy. This unique structure has implications that are important to understand.

At its core, the agreement specifies the rental period, the amount of each rental payment, and how much of that payment goes towards the final purchase price. It should also clearly state the purchase price of the vehicle at the end of the rental term. Look for details about mileage limitations, insurance requirements, and who is responsible for maintenance and repairs. A solid rent to own car agreement template will cover all of these points.

Another crucial aspect is the consequences of defaulting on the agreement. What happens if you miss a payment? What are the fees involved? Can the car be repossessed? These are all questions that should be clearly addressed in the agreement. Pay close attention to the terms regarding early termination. What are the penalties for ending the agreement before the end of the rental period? Getting familiar with these details will help you avoid unpleasant surprises down the road.

Many people explore rent to own options because they have poor credit or difficulty obtaining traditional financing. While it can be a helpful solution, it’s important to be aware that the overall cost of the vehicle might be higher than with a conventional loan. This is due to the interest rates and fees that are typically associated with rent to own agreements. Make sure to compare the total cost of ownership with other financing options before making a decision.

Finally, remember that a well-drafted agreement protects both the renter and the dealer. It ensures transparency and clarifies each party’s responsibilities. Before signing anything, take the time to carefully review every clause and consider seeking legal advice to ensure that your rights are protected. Using a reliable rent to own car agreement template is a great first step, but professional guidance can provide an extra layer of security.

Key Considerations Before Entering a Rent To Own Car Agreement

Before you jump into a rent to own car agreement, it’s crucial to take a step back and evaluate whether it’s the right fit for your specific situation. This option comes with both benefits and potential pitfalls, so a thorough assessment is essential. One of the primary advantages is the ability to obtain transportation even with a less-than-stellar credit history. It can also be a chance to improve your credit score if the rental payments are reported to credit bureaus.

However, you need to be mindful of the potential downsides. Rent to own agreements often come with higher interest rates and fees compared to traditional car loans. This means that you could end up paying significantly more for the vehicle over the long term. Furthermore, you don’t own the car until you’ve made all the required payments and exercised your option to buy. If you miss a payment, the car could be repossessed, and you might lose any money you’ve already put towards it.

Always shop around and compare different rent to own options before making a decision. Don’t settle for the first offer you receive. Check the reputation of the dealer and read online reviews to see what other customers have to say. Be wary of dealers who pressure you into signing an agreement without giving you enough time to review the terms. A trustworthy dealer will be transparent about all the costs and conditions involved.

Thoroughly inspect the vehicle before agreeing to rent it. Take it for a test drive and have a trusted mechanic check it out. You want to make sure that it’s in good condition and that you’re not going to be stuck with expensive repairs down the road. Understand who is responsible for maintenance and repairs under the agreement. Some agreements require you to pay for all repairs, while others place that responsibility on the dealer.

Ultimately, the decision of whether or not to enter a rent to own car agreement is a personal one. Carefully weigh the potential benefits and risks, and make sure that you fully understand all the terms and conditions before signing anything. Having a good rent to own car agreement template can help you get started, but don’t hesitate to seek professional advice if you have any doubts or concerns. It’s better to be safe than sorry when it comes to your finances and transportation.

Navigating the world of car ownership doesn’t have to be complicated. By understanding the ins and outs of rent to own agreements, you can make an informed decision that aligns with your financial goals and transportation needs.

Take your time, do your research, and protect yourself with a comprehensive agreement. Drive safely and enjoy the ride!