Rent To Own House Agreement Template

Thinking about owning a home but not quite ready for a traditional mortgage? A rent-to-own agreement might be the perfect stepping stone. It’s like test-driving homeownership, allowing you to live in the house while building towards buying it. But before you jump in, it’s crucial to understand the agreement that governs this unique arrangement.

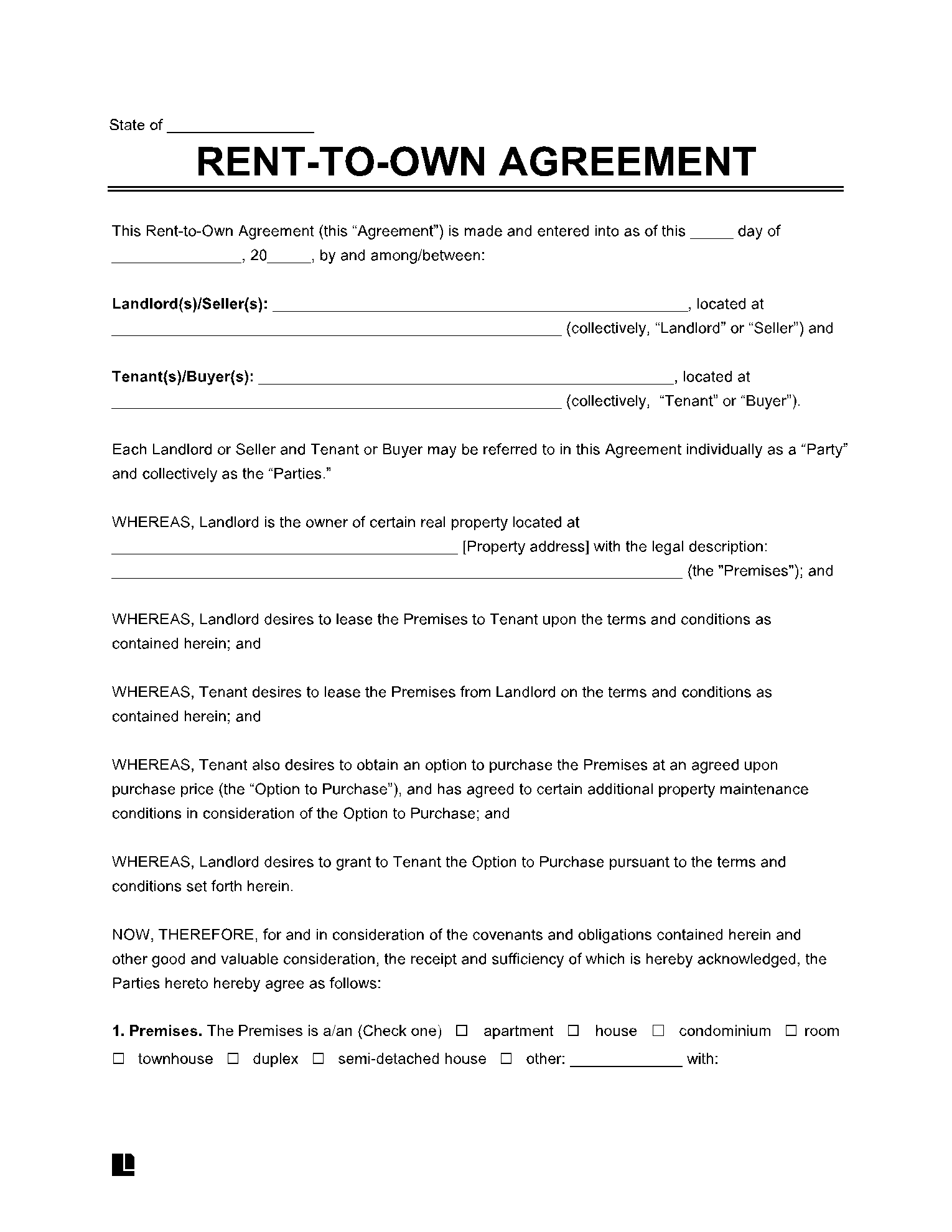

That’s where a rent to own house agreement template comes in handy. Think of it as your roadmap to potential homeownership. It outlines all the essential terms, conditions, and responsibilities for both you (the renter/buyer) and the seller. Having a well-drafted template ensures everyone’s on the same page and reduces the risk of misunderstandings or disputes down the line.

This article will delve into the ins and outs of rent-to-own agreements, highlighting what to look for in a solid template and offering insights into how to navigate this path to homeownership successfully. So, let’s get started and explore how a rent to own house agreement template can pave your way to owning your dream home.

Understanding the Rent To Own House Agreement Template

A rent to own house agreement template is a legally binding document that outlines the terms and conditions of a rent-to-own arrangement. It’s designed to protect both the renter/buyer and the seller, ensuring clarity and accountability throughout the agreement period. These agreements can seem daunting, but breaking them down into their core components makes them much easier to understand.

The most crucial elements typically found within a rent to own house agreement template include the identification of the parties involved (the renter/buyer and the seller), a detailed description of the property, the duration of the rental period, the monthly rent amount, and the option fee (if applicable). The option fee is a non-refundable upfront payment that gives the renter/buyer the exclusive right to purchase the property at a predetermined price within a specific timeframe.

Another critical aspect covered in the template is the purchase price and how it’s determined. The agreement should clearly state the agreed-upon purchase price of the property at the end of the rental period. It should also outline how any rent credits will be applied toward the purchase price. Rent credits are a portion of the monthly rent that goes towards the down payment or purchase price of the home.

The template also details responsibilities for property maintenance and repairs. Typically, the renter/buyer is responsible for routine maintenance, while the seller remains responsible for major repairs. However, the specific responsibilities should be clearly defined in the agreement to avoid confusion. It should also cover what happens if the renter/buyer fails to make timely rent payments or decides not to exercise the option to purchase.

Finally, a robust rent to own house agreement template will include clauses addressing default, termination, and dispute resolution. It will outline the consequences of breaching the agreement and the procedures for resolving any disagreements that may arise. Before signing anything, both parties should carefully review the entire document and seek legal counsel to ensure they understand their rights and obligations.

Key Considerations Before Using a Rent To Own House Agreement Template

Before diving headfirst into a rent-to-own agreement, it’s essential to take a step back and carefully consider whether this arrangement aligns with your financial situation and long-term goals. Rent-to-own is not a one-size-fits-all solution, and it’s crucial to weigh the pros and cons before committing.

One of the primary benefits of rent-to-own is the opportunity to build equity while living in the home. If you consistently make rent payments and exercise your option to purchase, you can accumulate a down payment over time. This can be particularly helpful if you have difficulty saving for a down payment through traditional methods.

However, there are also potential downsides to consider. Rent-to-own agreements often come with higher monthly rent payments than traditional rental agreements. This is because a portion of the rent is typically allocated towards the purchase price. Additionally, the option fee, which is a non-refundable upfront payment, can be a significant expense.

Furthermore, if you fail to exercise your option to purchase at the end of the rental period, you may lose all the rent credits you’ve accumulated. This can be a significant financial setback, especially if you’ve invested a substantial amount of money in the property. It’s also crucial to ensure that the agreed-upon purchase price is fair and reflects the current market value of the property. An independent appraisal can help determine the true value of the home.

Finally, always have a lawyer review the rent to own house agreement template before you sign it. An attorney can help you understand the legal implications of the agreement and ensure that your interests are protected. They can also identify any potential red flags or unfair terms in the contract. By carefully considering these factors and seeking professional advice, you can make an informed decision about whether rent-to-own is the right path to homeownership for you.

Navigating the real estate landscape can be complex, and rent-to-own agreements are no exception. A well-defined rent to own house agreement template provides a strong foundation, but understanding your rights and responsibilities is paramount.

Ultimately, successful rent-to-own ventures require thorough research, careful planning, and open communication between all parties involved. With the right approach, this alternative path to homeownership can be a rewarding experience.