Thinking about taking the plunge into homeownership, but not quite ready for a traditional mortgage? You might have stumbled upon the idea of a rent to own agreement. It sounds appealing, doesn’t it? Like a test drive for buying a house. Basically, you rent a property for a set period, with a portion of your rent going towards a future down payment. The key to making this work, though, is a solid, legally sound rent to own property agreement template.

These agreements outline everything from the rental period and monthly payments to the eventual purchase price and responsibilities of both the renter (future buyer) and the owner (seller). Think of it as the roadmap to your potential homeownership journey. Without a clear, comprehensive agreement, you could easily find yourself lost in a legal maze, potentially losing money and the chance to own the property.

So, where do you start? What exactly should be included in a rent to own property agreement template? How do you ensure you’re protected and getting a fair deal? We’re here to break it all down for you, making the process a little less daunting and a lot more understandable. Let’s dive in!

Understanding the Key Components of a Rent To Own Agreement

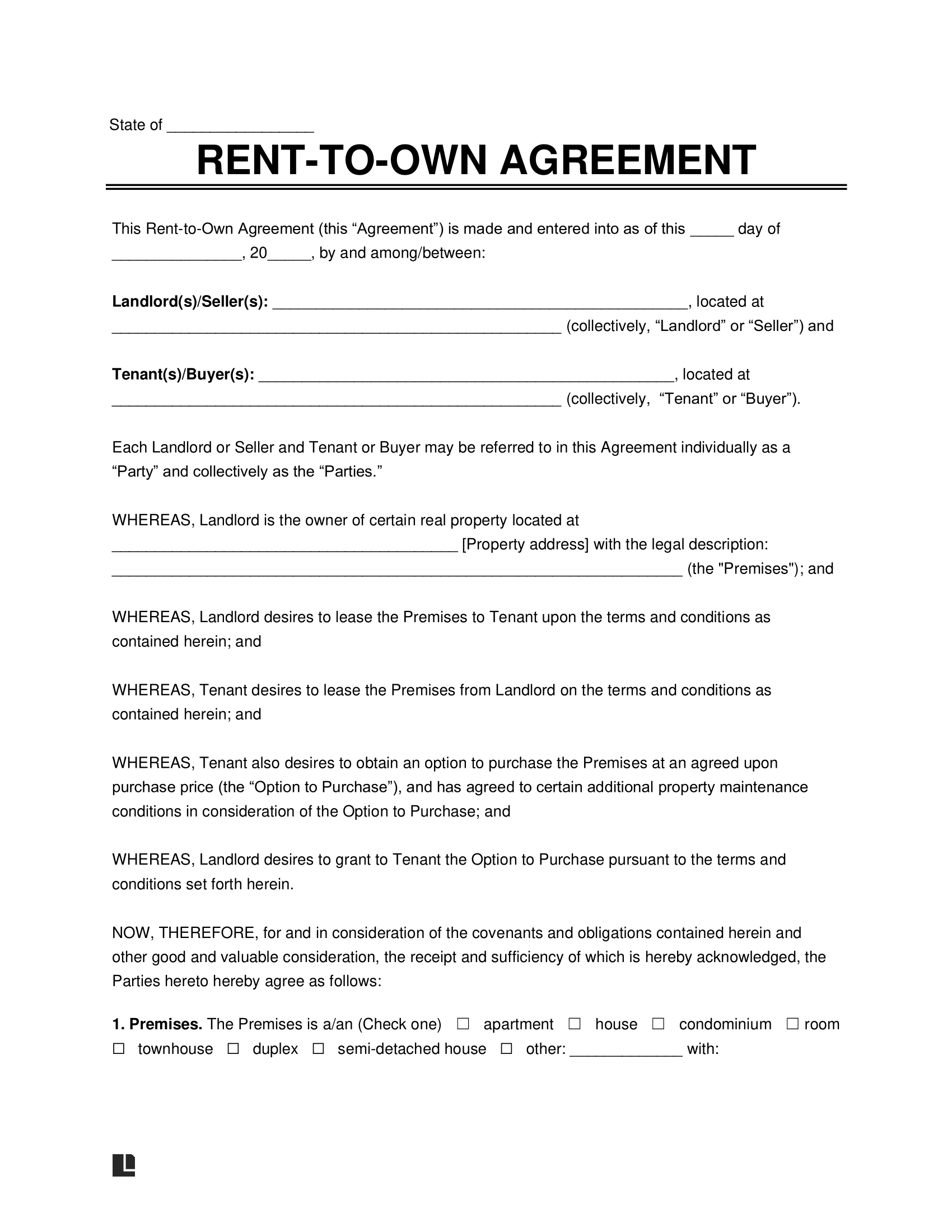

A rent to own agreement, also known as a lease-option or lease-purchase agreement, is a legally binding contract. Because of this, it’s vital to ensure that every aspect of the agreement is carefully considered and clearly defined. Failing to do so can lead to misunderstandings, disputes, and potentially, legal battles down the road. So, what are the crucial elements that need to be included in your rent to own property agreement template?

First and foremost, the agreement needs to clearly identify all parties involved: the lessor (property owner) and the lessee (potential buyer). It should include their full legal names and addresses. This seems basic, but it’s a foundational element for any valid contract. Beyond that, the agreement must contain a detailed description of the property. This isn’t just the street address. It should include details like the number of bedrooms and bathrooms, lot size, any included appliances, and even the property’s legal description as it appears in official records. The more specific you are, the better.

Next, let’s talk money. The agreement needs to clearly state the initial rent amount, the due date for rent payments, and the acceptable methods of payment. It’s also critical to define how much of each rent payment will be credited toward the eventual purchase price of the property – this is often referred to as the rent credit or option fee. Additionally, the agreement should specify whether the option fee is refundable if the tenant decides not to purchase the property at the end of the lease term. A potential tenant must carefully evaluate if the option fee works for their circumstance or not.

Beyond the financial aspects, a comprehensive agreement will also address maintenance and repairs. Who is responsible for what? Typically, the tenant is responsible for routine maintenance, like lawn care and minor repairs, while the owner remains responsible for major repairs, such as structural issues or appliance replacements. However, these responsibilities can be negotiated and should be clearly outlined in the agreement. Failing to do so can create tension and disagreements throughout the rental period.

Finally, the agreement must specify the purchase price of the property and the timeframe within which the tenant has the option to buy. This option period is crucial, as it gives the tenant the exclusive right to purchase the property at the agreed-upon price during that time. It should also outline the process for exercising the option to purchase, including any required notices or documentation. Having all these details ironed out in a rent to own property agreement template helps both parties to have a mutual and shared understanding.

Key Clauses and Considerations in a Rent To Own Agreement

Beyond the fundamental components, there are several key clauses and considerations that can significantly impact the outcome of a rent to own agreement. These often involve more nuanced aspects of the arrangement and require careful attention from both parties. Overlooking these details can lead to unexpected consequences and potentially jeopardize the entire agreement.

One important clause is the default clause. This outlines what happens if either party fails to meet their obligations under the agreement. For example, what happens if the tenant fails to make rent payments on time? Or what happens if the owner fails to maintain the property as agreed? The default clause should clearly define the consequences of such breaches, including potential penalties or termination of the agreement. This protects both parties and provides a clear path forward in case of a problem.

Another important consideration is the potential for property appreciation or depreciation. What happens if the value of the property increases significantly during the rental period? Or, conversely, what happens if the value decreases? The agreement should address this issue, ideally by setting a fixed purchase price at the beginning of the term. This protects both the tenant from paying more than they bargained for and the owner from selling the property for less than its market value at the time of the sale. This is especially important during times of economic change.

Furthermore, the agreement should address the issue of property taxes and insurance. Who is responsible for paying these expenses during the rental period? Typically, the owner remains responsible for paying property taxes and homeowner’s insurance, but this can be negotiated. The agreement should clearly state who is responsible for these costs to avoid any confusion or disputes. Consider having an attorney review the agreement and its clauses to make sure there are no conflicts and that it is legally binding.

Finally, consider the importance of obtaining independent legal and financial advice. A rent to own agreement is a complex legal document, and it’s always a good idea to have it reviewed by an attorney before signing. An attorney can help you understand your rights and obligations under the agreement and ensure that you are getting a fair deal. Similarly, a financial advisor can help you assess your financial readiness for homeownership and determine whether a rent to own agreement is the right option for you.

Crafting a rent to own agreement template needs careful consideration. If done correctly, this can be a win-win for both the potential home buyer and seller. Be sure to consider all aspects that could impact the contract.

A thoughtfully structured rent to own property agreement template is a safeguard, a clarity provider, and the foundation for a successful transition into homeownership. This document becomes a mutual understanding that allows a smoother process for all parties involved.