So, you’re thinking about transferring stock in your S corporation? That’s fantastic! Whether you’re welcoming a new shareholder, a current shareholder is exiting, or you’re simply restructuring things, a stock transfer agreement is your best friend. It’s a legally binding document that outlines all the nitty-gritty details of the stock transfer, ensuring everyone is on the same page and minimizing potential headaches down the road. Think of it as the instruction manual for handing off those valuable pieces of your company pie.

Navigating the world of S corp stock transfers can feel a little daunting, especially with all the legal jargon involved. But don’t worry, it doesn’t have to be! The key is to approach it methodically and to ensure you have all the necessary documentation in place. A well-drafted agreement protects the interests of both the transferor (the one selling the stock) and the transferee (the one buying the stock), and it safeguards the overall health of your S corporation.

That’s where the magic of an S corp stock transfer agreement template comes in! It’s like having a pre-written framework that you can customize to fit your specific situation. Instead of starting from scratch with a blank page, you have a solid foundation that addresses the key elements of the transfer. It’s a huge time-saver and can significantly reduce the risk of overlooking important details. In this article, we’ll explore everything you need to know about using an S corp stock transfer agreement template, empowering you to handle this process with confidence and clarity.

Why You Absolutely Need a Solid S Corp Stock Transfer Agreement

Imagine handing someone a stack of cash without counting it or writing anything down. Sounds risky, right? Transferring stock in your S corporation without a proper agreement is similar. It opens the door to misunderstandings, disputes, and even legal battles down the line. A well-defined agreement provides clarity and certainty for all parties involved, safeguarding your company’s interests and preventing potential chaos. Think of it as your company’s prenuptial agreement – hopefully, you won’t need it, but it’s crucial to have in place.

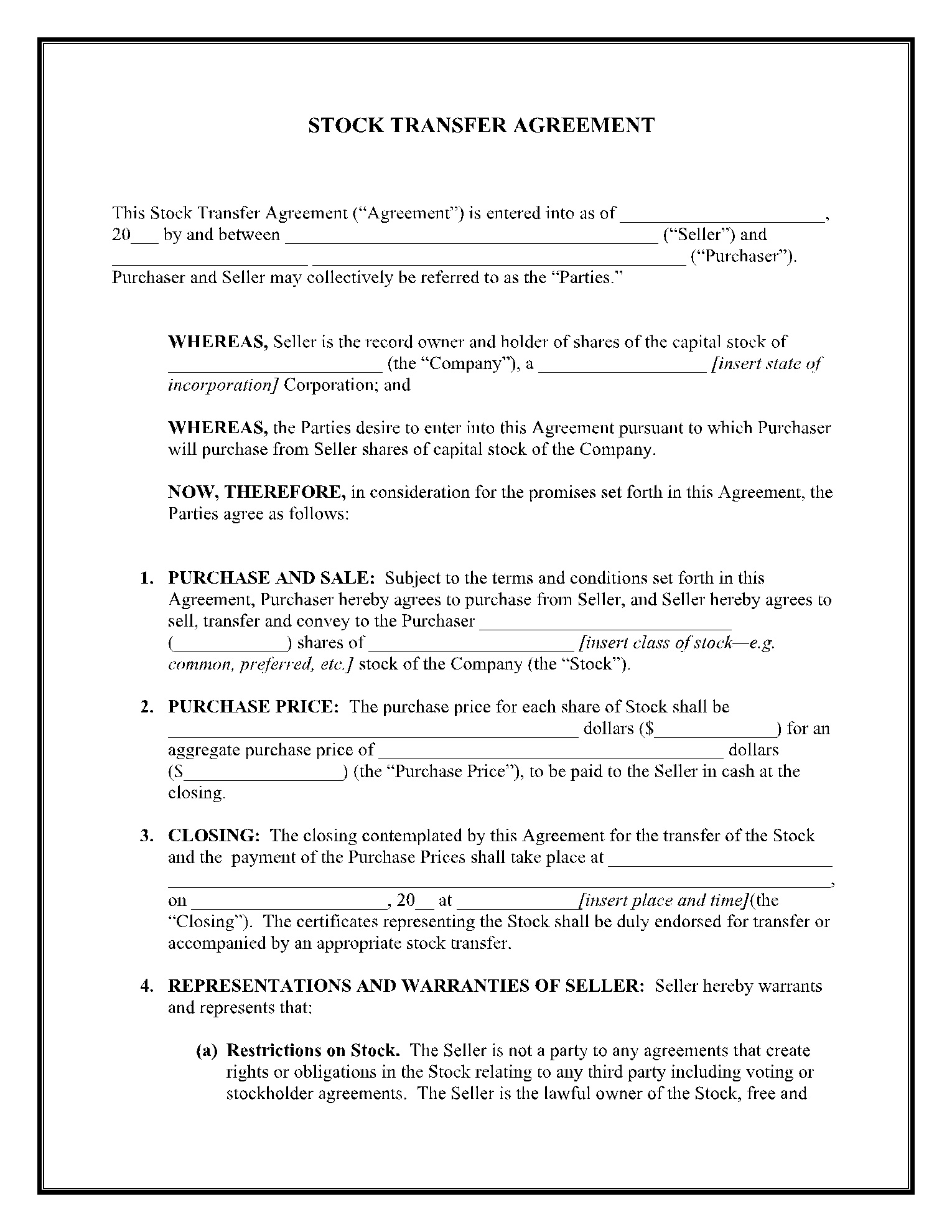

One of the most important reasons to use a stock transfer agreement is to clearly define the terms of the transfer. This includes the number of shares being transferred, the price per share, the payment terms, and the date of the transfer. By explicitly outlining these details, you minimize the potential for confusion or disagreement later on. For example, if the payment is structured as installments, the agreement should specify the amount of each installment, the due dates, and any applicable interest rates. A template helps ensure you cover these critical aspects.

Beyond the basic terms, a stock transfer agreement can also address other important considerations. This might include representations and warranties from the transferor (assurances about the validity of the stock and their right to sell it), indemnification clauses (protection against potential liabilities arising from the transfer), and provisions for dispute resolution (how disagreements will be handled). A template acts as a checklist, prompting you to think about these less obvious but equally important elements.

Furthermore, the agreement provides a record of the transfer for your company’s records. This documentation is crucial for maintaining accurate shareholder information and complying with legal and regulatory requirements. It’s proof that the transfer occurred legally and with the consent of all necessary parties. This is especially important for S corporations, which have specific rules about who can be a shareholder and how many shareholders are allowed.

Using an S corp stock transfer agreement template is not just a formality; it’s a fundamental step in protecting your company, your shareholders, and yourself. It establishes a clear understanding of the terms of the transfer, minimizes the risk of disputes, and ensures compliance with legal requirements. It’s an investment in the long-term health and stability of your S corporation.

Key Components of a Solid S Corp Stock Transfer Agreement Template

So, what exactly should be included in a robust S corp stock transfer agreement template? While the specific provisions will vary depending on your situation, there are several key components that should be addressed in every agreement. Think of these as the essential ingredients that make up a complete and legally sound document. Neglecting any of these components could leave you vulnerable to future problems.

First and foremost, the agreement should clearly identify the parties involved: the transferor (the seller) and the transferee (the buyer). Include their full legal names and addresses. Then, the agreement must specify the number of shares being transferred and the class of stock (e.g., common stock, preferred stock). Be precise and avoid any ambiguity. If there are any restrictions on the transfer of the stock (such as a right of first refusal held by the corporation or other shareholders), these restrictions must be clearly outlined in the agreement.

The purchase price of the stock and the payment terms are crucial elements. Specify the total purchase price, the method of payment (e.g., cash, check, wire transfer), and the payment schedule. If the payment is to be made in installments, clearly state the amount of each installment, the due dates, and any applicable interest rates. The agreement should also address what happens if the buyer defaults on the payment obligations.

Representations and warranties are also vital. The transferor should represent and warrant that they have the legal right to transfer the stock, that the stock is free and clear of any liens or encumbrances, and that the company’s financial statements are accurate. These representations provide the buyer with assurance about the validity of the stock and the financial health of the company. From the transferee, a representation that they are buying the stock for investment purposes and not with the intent to redistribute, is often required for securities law purposes.

Finally, the agreement should include provisions for governing law (which state’s laws will govern the agreement), dispute resolution (how disagreements will be handled, such as through arbitration or mediation), and severability (if one provision of the agreement is found to be invalid, the remaining provisions will still be in effect). It should also have an integration clause stating that the agreement constitutes the entire agreement between the parties. An S corp stock transfer agreement template that incorporates all these elements will provide a solid foundation for a smooth and legally sound stock transfer.

It is very essential to seek legal counsel while doing so. Although templates exist, legal advice from a qualified attorney can ensure the protection of one’s interests. There are several legal and tax implications involved in the transfer of shares for an S corp, therefore, speaking with an expert is recommended.

The world of S corporations and stock transfers can seem overwhelming at first glance. However, by understanding the importance of a solid S corp stock transfer agreement template and the key components it should contain, you can navigate this process with confidence and protect the interests of your company and its shareholders.

Remember, a well-drafted agreement is an investment in the long-term health and stability of your S corporation. So, take the time to research your options, choose a template that meets your specific needs, and don’t hesitate to seek professional advice when needed.