Ever feel like you’re sitting on a goldmine, but that goldmine is, say, your office building, and you need cash flow now? Or maybe you’re looking to free up capital tied to valuable assets without losing the ability to use them. That’s where a sale and leaseback agreement comes into play. Think of it as a financial tool that lets you sell an asset you own (like real estate or equipment) to someone else, and then immediately lease it back from them. This way, you get a lump sum of cash upfront, and you still get to use the asset for your business operations. Sounds intriguing, right? Let’s dive in and explore how this works and what a sale and leaseback agreement template can do for you.

Now, you might be thinking, “Why would anyone do that?” Well, there are plenty of reasons! For businesses, it can be a fantastic way to unlock capital that’s tied up in fixed assets. This capital can then be reinvested into core business activities, like research and development, marketing, or expansion. It’s also a popular tactic for improving a company’s balance sheet ratios. By selling the asset, you reduce your debt and increase your cash on hand. The lease payments become operating expenses, which can sometimes be more tax-efficient than depreciation. It’s all about finding the best way to manage your assets and finances.

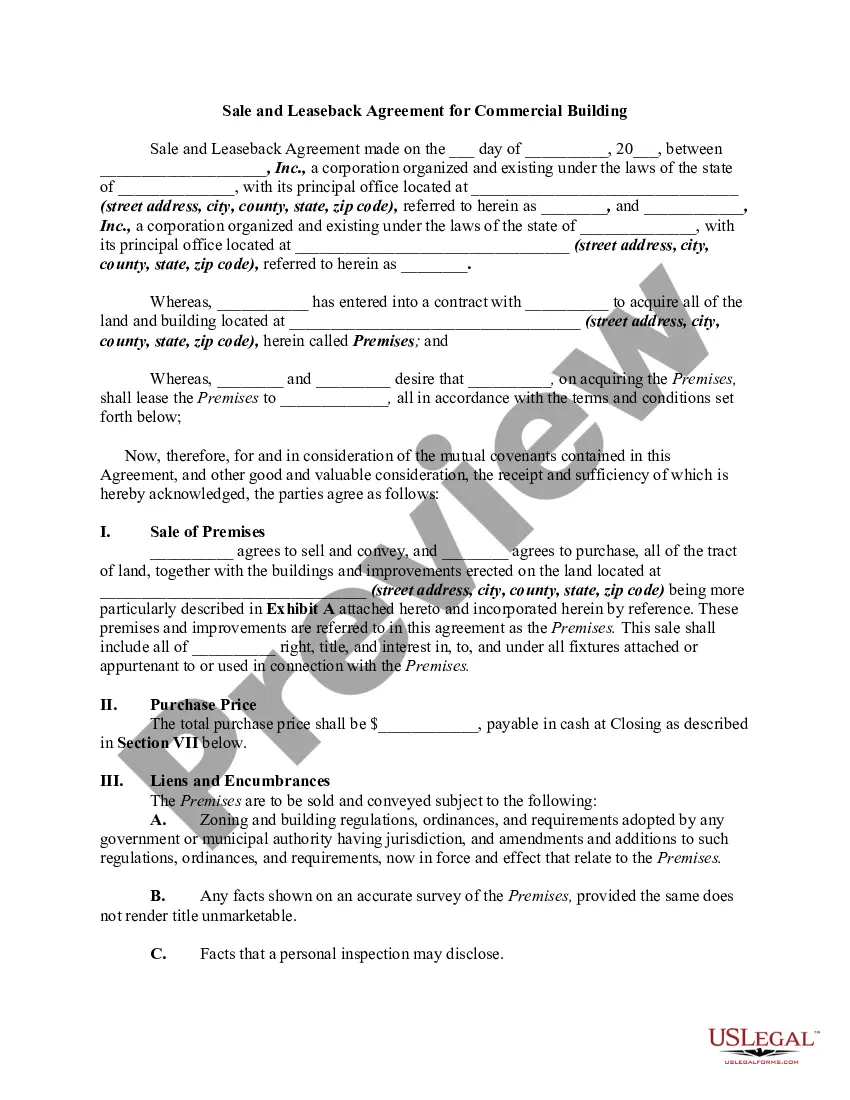

But before you jump in headfirst, it’s crucial to understand the intricacies of a sale and leaseback agreement. This isn’t just a simple transaction. It’s a legal contract that outlines the terms of the sale, the lease, and the responsibilities of both parties. That’s where a sale and leaseback agreement template comes in handy. It provides a structured framework to ensure all the essential elements are covered, and that both the seller and the buyer are protected. Let’s explore the key components and considerations that make this arrangement work.

Understanding the Nuances of a Sale and Leaseback Agreement

A sale and leaseback agreement isn’t just about selling an asset and then renting it back. It’s a strategic financial maneuver that requires careful planning and a clear understanding of the terms involved. The agreement effectively converts a fixed asset into working capital, which can provide a significant boost to a company’s liquidity. But it’s not without its complexities. The devil, as they say, is in the details. A well-crafted sale and leaseback agreement template will address these details, ensuring a smooth and beneficial transaction for both parties involved.

One of the most critical aspects of the agreement is the lease term. How long will the seller lease the asset back from the buyer? This term needs to be carefully considered, as it will impact the monthly lease payments and the overall cost of the arrangement. Generally, longer lease terms result in lower monthly payments but potentially higher total costs over the life of the lease. Shorter lease terms, on the other hand, may lead to higher monthly payments but could save money in the long run. Factors such as the asset’s lifespan, the company’s financial projections, and market conditions should all be taken into account when determining the optimal lease term.

Another key element is the purchase price of the asset. This should be a fair market value, determined through an independent appraisal or other reliable valuation method. The purchase price directly impacts the amount of cash the seller receives upfront, so it’s essential to ensure that it accurately reflects the asset’s worth. A sale below market value could raise red flags with tax authorities or other stakeholders.

The lease payments are, of course, a crucial consideration. These payments will typically be structured as either fixed or variable. Fixed payments provide predictability, while variable payments may be tied to an index or benchmark, such as the Consumer Price Index (CPI). The lease agreement should also specify who is responsible for maintenance, repairs, insurance, and property taxes. These responsibilities can be negotiated between the parties, but it’s essential to clearly define them in the agreement to avoid any misunderstandings or disputes down the line.

Finally, the agreement should address the possibility of renewal options. Does the seller have the option to renew the lease at the end of the initial term? If so, what are the terms of the renewal? Renewal options provide the seller with continued access to the asset, which can be particularly important if the asset is essential to their business operations. The sale and leaseback agreement template will guide you in outlining all of these provisions clearly and concisely.

Key Benefits and Considerations When Using a Sale and Leaseback

The strategic advantages of a sale and leaseback agreement are multifaceted. Primarily, it immediately injects capital into the seller’s business, which can be used for various purposes such as expansion, debt reduction, or investment in new technologies. This infusion of cash can significantly improve a company’s financial flexibility and enable it to pursue growth opportunities that might otherwise be out of reach. Furthermore, it’s a method to remove an asset from the balance sheet, impacting key financial ratios positively, which could be crucial for attracting investors or securing loans. Many growing companies leverage sale and leaseback programs to sustain capital and maintain momentum.

However, it’s not all sunshine and roses. One important consideration is the loss of ownership. While the seller retains the right to use the asset, they no longer own it. This means they forfeit any potential appreciation in the asset’s value over time. Also, the lease payments represent an ongoing expense, which could potentially be higher than the costs of owning the asset outright. It’s important to conduct a thorough cost-benefit analysis before entering into such an arrangement.

Another critical aspect to consider is the tax implications. While lease payments are typically tax-deductible, the sale of the asset may trigger capital gains taxes. It’s essential to consult with a tax advisor to understand the specific tax consequences of the transaction and to ensure compliance with all applicable tax laws. Proper structuring of the transaction can often minimize the tax burden and maximize the financial benefits.

The choice of the buyer is also important. Ideally, the buyer should be a reputable and financially stable entity with experience in sale and leaseback transactions. This will ensure that the transaction is handled professionally and that the lease terms are fair and reasonable. Before finalizing the agreement, due diligence on the buyer is a must, including reviewing their financial statements and checking their references.

Ultimately, the success of a sale and leaseback agreement hinges on careful planning, clear communication, and a thorough understanding of the risks and rewards involved. Using a solid sale and leaseback agreement template ensures that all the important details are considered and that the interests of both parties are protected.

So, is a sale and leaseback right for your situation? Like any major financial decision, weigh the pros and cons carefully. Consider your long-term goals, your financial needs, and the impact on your business. Do your homework and seek professional advice. Because when it’s done right, a sale and leaseback can be a powerful tool for unlocking capital and driving growth.

The beauty of a sale and leaseback lies in its adaptability. It’s not a one-size-fits-all solution, but rather a flexible strategy that can be tailored to meet the specific needs of a business. Whether you’re looking to free up cash, improve your balance sheet, or streamline your operations, a sale and leaseback might just be the answer you’ve been searching for.