So, you’re thinking about lending or borrowing money, huh? Whether it’s a helping hand to a friend, a family member needing some assistance, or a more formal arrangement, putting things in writing is always a smart move. That’s where a sample personal loan agreement template comes in handy. It’s all about clarity and protecting everyone involved. Think of it as the official roadmap for your loan transaction, ensuring everyone is on the same page right from the start.

A personal loan agreement is basically a legally binding contract that outlines the terms of a loan between two individuals. This includes things like the loan amount, the interest rate (if any), the repayment schedule, and what happens if someone defaults on the loan. It might seem a bit formal, especially if you’re dealing with someone you know well, but trust me, it can save a lot of potential headaches down the line. It’s better to have it and not need it, than need it and not have it!

Using a sample personal loan agreement template is a great way to get started. These templates provide a solid foundation, covering all the essential elements you need in your agreement. You can then customize it to fit your specific situation, adding or modifying clauses as necessary. No matter how well you know the person you’re dealing with, having a clear, written agreement is crucial for preventing misunderstandings and protecting your financial interests.

Why You Absolutely Need a Personal Loan Agreement

You might be thinking, “Do I really need a formal agreement for this?” Especially if you are lending money to a close friend or family member. The answer, almost always, is yes! While trust is important, a written agreement protects both the lender and the borrower. It provides a clear record of the loan terms, preventing disputes and misunderstandings that can strain relationships. Think of it as an insurance policy for your financial peace of mind and the preservation of your personal connections.

A comprehensive personal loan agreement spells out all the important details, leaving nothing to interpretation. This includes the exact amount of the loan, the interest rate (if applicable), how the loan will be repaid (weekly, monthly, lump sum), the due dates for payments, and what happens if the borrower fails to make payments on time (late fees, default terms, etc.). By having these details clearly defined in writing, everyone knows their responsibilities and obligations.

Without a written agreement, memories can fade, interpretations can differ, and disagreements can arise. Imagine lending a friend money without specifying an interest rate, and then later realizing you expected some return on your investment. Or, what if the repayment schedule is unclear, leading to confusion and frustration? A written agreement prevents these scenarios by providing a clear and unambiguous record of the loan terms.

Furthermore, a personal loan agreement can be crucial if you ever need to take legal action to recover the funds. If the borrower defaults and refuses to repay the loan, a written agreement serves as evidence of the debt and the agreed-upon terms. Without it, proving the existence of the loan and its conditions can be incredibly difficult, potentially leaving you without recourse.

So, while it might seem like overkill, creating a personal loan agreement is a responsible and prudent step to protect your financial interests and maintain healthy relationships. It’s a small investment of time and effort that can save you a lot of trouble in the long run. And remember, there are readily available resources, like a sample personal loan agreement template, to help you create a legally sound and comprehensive agreement.

Key Elements of a Solid Sample Personal Loan Agreement Template

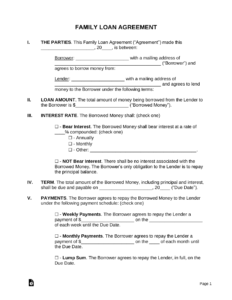

A good sample personal loan agreement template should include several key elements to ensure it’s comprehensive and legally sound. First and foremost, it needs to clearly identify the parties involved: the lender (the person lending the money) and the borrower (the person receiving the money). Include their full legal names and addresses to avoid any confusion.

Next, the agreement should specify the exact amount of the loan. This is the principal amount that the borrower is receiving. It should be stated clearly in both numerical and written form (e.g., $5,000.00 – Five Thousand Dollars). This leaves no room for ambiguity about the loan amount. The agreement should also include the date the loan is being issued.

The interest rate, if applicable, is another crucial element. If you’re charging interest on the loan, the agreement should clearly state the annual interest rate and how it’s calculated. Be sure to comply with any applicable state or federal laws regarding interest rates. If no interest is being charged, explicitly state that the loan is interest-free. This clarity is essential to prevent future disputes.

The repayment schedule is arguably one of the most important sections. This outlines how the borrower will repay the loan, including the frequency of payments (weekly, bi-weekly, monthly), the amount of each payment, and the due date for each payment. The agreement should also specify the method of payment (e.g., check, electronic transfer, cash). Furthermore, it should detail what happens if a payment is late, including any late fees or penalties.

Finally, the agreement should address default terms. This section outlines what constitutes a default on the loan (e.g., missing multiple payments, bankruptcy) and what actions the lender can take in the event of a default. This might include accelerating the loan (demanding immediate repayment of the entire balance) or pursuing legal action to recover the funds. By including these elements in your agreement, you create a strong and enforceable contract that protects both parties.

The act of lending or borrowing money, especially among acquaintances, carries considerable weight. A well-structured agreement does more than just outline the terms; it builds a foundation of mutual understanding and trust.

Ultimately, by crafting a clear and comprehensive personal loan agreement, you not only protect your financial interests but also foster a transparent and respectful relationship with the other party involved.