Ever dreamt of joining forces on a venture where everyone benefits directly from its success? That’s the beauty of a revenue sharing agreement. It’s a powerful tool for collaborations, partnerships, and even employee compensation plans. Instead of fixed salaries or upfront costs, parties agree to split the generated revenue based on a pre-determined percentage. This fosters a sense of shared ownership and motivates everyone to work towards maximizing the overall income.

Think about a small tech company collaborating with a marketing agency to launch a new product. Instead of paying hefty upfront fees, they could agree to share a percentage of the product’s sales with the agency. This aligns both parties’ interests – the tech company gets marketing expertise without breaking the bank, and the agency is incentivized to drive sales through effective campaigns. It’s a win-win! But, and this is a big but, all of that needs to be in a revenue sharing agreement.

Crafting a clear and comprehensive revenue sharing agreement is crucial for avoiding misunderstandings and disputes down the line. It’s not just about agreeing on a percentage; it’s about defining what constitutes “revenue,” outlining payment schedules, and establishing clear roles and responsibilities. That’s where a solid understanding of what goes into a good revenue sharing agreement template becomes invaluable. So, let’s dive into the key elements you need to consider.

Key Components of a Robust Revenue Sharing Agreement

A well-structured revenue sharing agreement needs to be more than just a handshake deal. It’s a legally binding document that outlines the obligations and rights of each party involved. Think of it as the roadmap for your collaborative journey. If everyone understands the roles, benefits and what’s expected, it drastically reduces the risk of disagreements and ensures a smoother, more profitable venture for everyone involved. Getting it right requires attention to detail and a clear understanding of each section’s importance. Each agreement should be tailored to the specific situation.

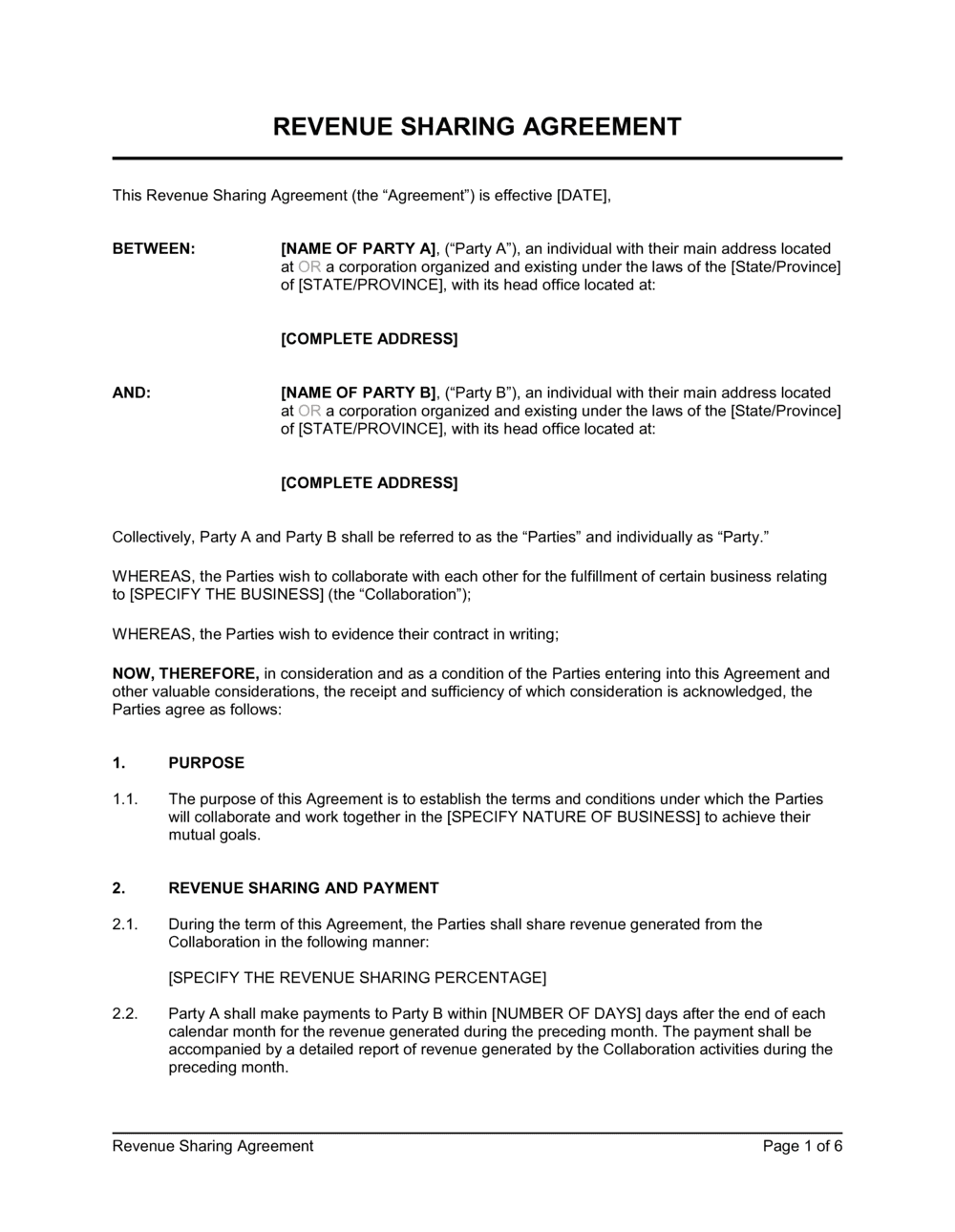

First, you absolutely have to clearly define the parties involved. Who are the individuals or entities entering into the agreement? Include their full legal names and addresses. Then, meticulously define the “revenue” that will be shared. Does it include gross sales, net profits after certain expenses, or something else entirely? Be specific and avoid ambiguity. For example, spell out whether returns, refunds, and taxes are deducted before calculating the shared revenue. Clarity here prevents major headaches later on.

Next, the agreement must explicitly state the revenue sharing percentage for each party. Is it a simple 50/50 split, or are there varying percentages based on milestones or other factors? Also detail the payment schedule. How often will revenue be calculated and distributed? Monthly, quarterly, or annually? Specify the method of payment – check, electronic transfer, etc. Include a clause addressing what happens if a payment is late or not received.

Furthermore, clearly outline the responsibilities of each party. Who is responsible for tracking revenue, generating reports, and handling finances? Define the access each party has to financial records for verification purposes. You might also consider including a clause about confidentiality, protecting sensitive business information shared during the collaboration. Don’t forget to detail how the agreement can be terminated, under what circumstances, and what happens to any ongoing revenue streams. Include a dispute resolution mechanism. If disagreements arise, how will they be resolved? Mediation or arbitration might be preferred over lengthy and costly litigation.

Finally, include any specific clauses relevant to your particular situation. Maybe there’s a clause about intellectual property ownership, or a non-compete agreement. Legal counsel is invaluable in reviewing the agreement to ensure it complies with local laws and regulations. They can also identify potential loopholes or ambiguities that could lead to future disputes. Remember, a well-drafted revenue sharing agreement is an investment in the success and longevity of your collaboration. Taking the time to get it right from the start can save you significant time, money, and stress in the long run. Having a sample revenue sharing agreement template on hand gives you a great starting point.

Benefits of Using a Sample Revenue Sharing Agreement Template

There are several compelling reasons to leverage a sample revenue sharing agreement template when embarking on a collaborative venture. First and foremost, it saves time and effort. Instead of starting from scratch, you have a pre-built framework that covers the essential elements of a comprehensive agreement. This allows you to focus on customizing the template to your specific needs rather than reinventing the wheel.

Using a template also ensures that you don’t overlook critical provisions. A well-designed template includes clauses addressing revenue definition, payment schedules, responsibilities, termination procedures, and dispute resolution mechanisms. These elements are often standardized in business contracts, and a template ensures consistency and completeness. This minimizes the risk of omissions that could lead to misunderstandings or legal challenges down the line. It’s like having a checklist to guide you through the agreement creation process.

Furthermore, a sample revenue sharing agreement template provides a valuable starting point for negotiations. It outlines the standard terms and conditions, giving both parties a clear understanding of what’s typically included in such agreements. This facilitates productive discussions and helps to identify areas where customization is needed. It can prevent either party from unknowingly accepting unfavorable terms or overlooking important considerations.

Additionally, templates often come with clear and concise language, making them easier to understand than complex legal documents drafted from scratch. This is particularly beneficial for parties who may not have extensive legal expertise. A plain-language template ensures that everyone understands their rights and obligations, fostering transparency and trust between the collaborators. This reduces the risk of misinterpretations and promotes a more collaborative and positive working relationship. Many are available to download, so you should review several before picking the one that best matches your needs.

Finally, using a template can ultimately save you money on legal fees. While it’s always recommended to have an attorney review any legal document, starting with a solid template reduces the amount of time they need to spend drafting and revising the agreement. This translates to lower legal costs and a more efficient process overall. It allows you to focus your legal budget on addressing specific concerns and ensuring the agreement fully protects your interests. In short, a sample revenue sharing agreement template is a valuable tool for creating a clear, comprehensive, and legally sound agreement that benefits all parties involved.

Understanding the dynamics of a revenue sharing model can unlock significant potential for collaborative success. It is a great option for aligning interests and fostering a sense of shared ownership.

By carefully crafting a revenue sharing agreement that addresses all key elements and using a sample revenue sharing agreement template, you can pave the way for a mutually beneficial and profitable partnership.