Need to borrow some money but want to keep things professional and above board? A secured personal loan agreement template might be just what you’re looking for. It’s essentially a legally binding document that outlines the terms of a loan between two individuals, where the borrower offers some asset as collateral to guarantee repayment. Think of it as lending money to a friend or family member, but with a safety net for both parties.

Using a secured personal loan agreement template helps protect both the lender and the borrower. It clearly defines the loan amount, interest rate, repayment schedule, and what happens if the borrower defaults. This can prevent misunderstandings and maintain good relationships, especially when dealing with loved ones. Instead of relying on verbal agreements, which are difficult to prove and often forgotten, a written agreement sets clear expectations.

Creating a formal agreement doesn’t have to be complicated or expensive. With a good secured personal loan agreement template, you can easily customize it to fit your specific needs. This template provides a structured framework, ensuring you cover all essential aspects of the loan, from the identification of the parties involved to the detailed description of the collateral. It takes the guesswork out of lending and borrowing, making the whole process much smoother and more transparent.

Why Use a Secured Personal Loan Agreement Template?

Let’s face it, lending money, even to people we trust, can be tricky. A handshake and a promise are nice, but they don’t offer much protection if things go south. That’s where a secured personal loan agreement template comes in handy. It transforms a potentially awkward situation into a clear, documented agreement, protecting both the lender’s investment and the borrower’s interests. The template removes ambiguity and reduces the risk of future disputes. It clearly sets out all the conditions and what happens if those conditions are not met.

One of the biggest benefits of using a template is clarity. The agreement spells out everything: the loan amount, the interest rate (if any), how often payments are due, and what happens if a payment is missed. This is crucial because memories fade, and verbal agreements can be easily misinterpreted. A written agreement serves as a reference point, ensuring everyone is on the same page. In addition, the very process of filling out the agreement can initiate a conversation about money and the potential consequences.

Furthermore, the “secured” aspect adds another layer of protection for the lender. By requiring the borrower to pledge an asset as collateral, the lender has recourse if the borrower defaults. This could be anything from a car to a piece of jewelry to a valuable collectible. The template will guide you in defining the collateral, assessing its value, and outlining the process for seizing and selling it if necessary. Think of it as an insurance policy for the loan.

Another significant advantage is its legal enforceability. While a simple IOU might hold some weight, a properly drafted secured personal loan agreement template is much more likely to stand up in court if a dispute arises. It demonstrates that both parties understood and agreed to the terms of the loan, making it easier to resolve any issues through legal channels. Having that legal foundation can provide significant peace of mind to both parties.

Using a template also saves time and effort. Instead of drafting an agreement from scratch, which could be daunting and require legal expertise, you can simply fill in the blanks and customize the template to your specific situation. Most templates are designed to be user-friendly, with clear instructions and explanations, making the process straightforward even for those with no legal background. This allows you to focus on the important aspects of the loan, such as the relationship with the borrower and the borrower’s ability to repay.

Key Elements of a Secured Personal Loan Agreement Template

Understanding what goes into a secured personal loan agreement template is crucial for ensuring it accurately reflects your agreement and provides adequate protection. These templates typically cover several essential aspects, and being familiar with them will help you customize the template effectively. It’s more than just filling in the blanks; it’s understanding the implications of each section.

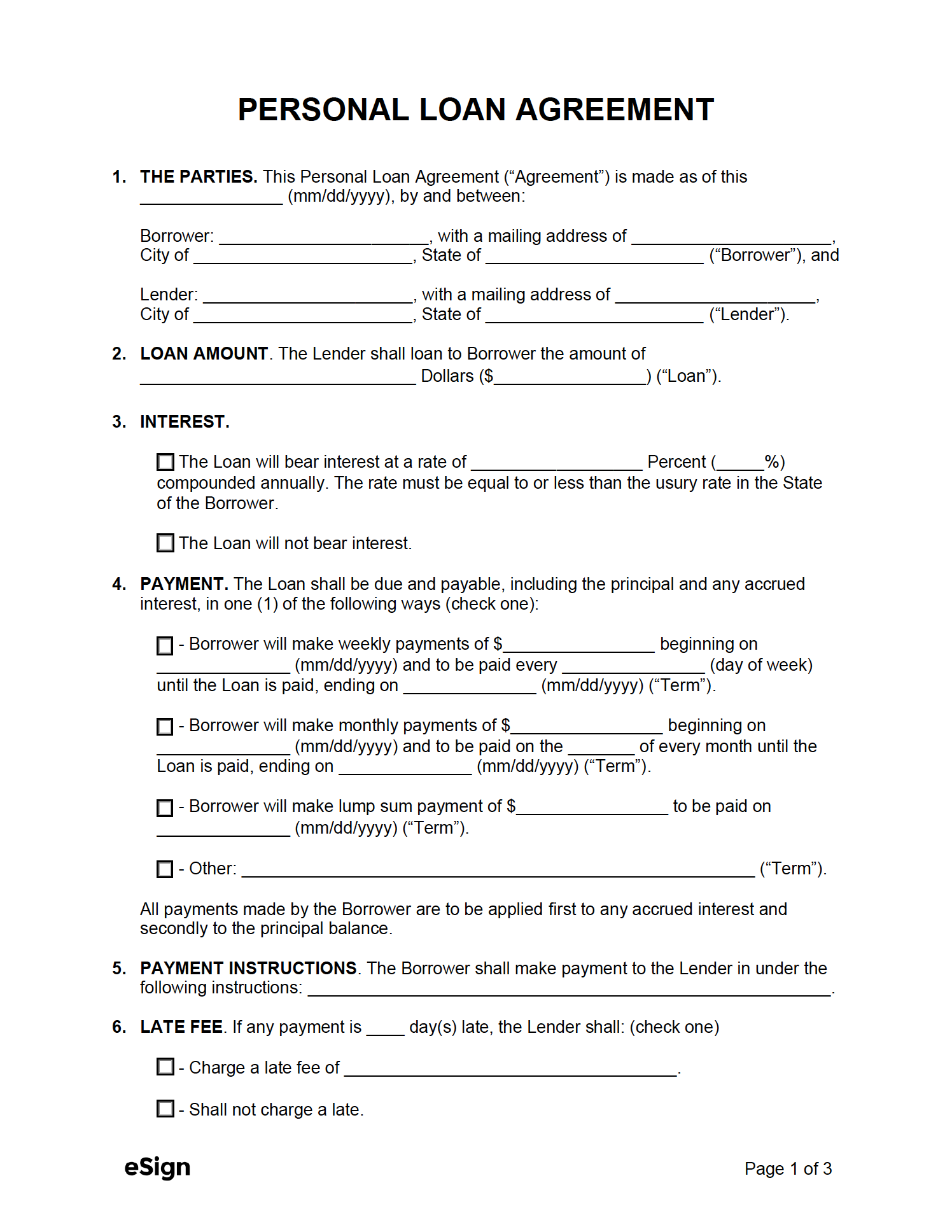

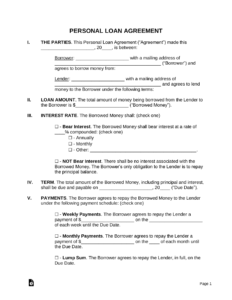

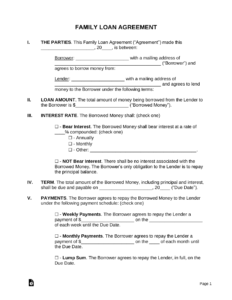

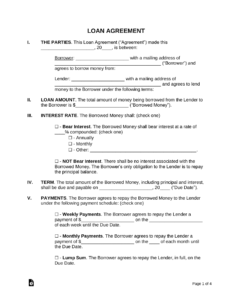

First and foremost, the agreement needs to clearly identify the parties involved: the lender and the borrower. This includes their full legal names, addresses, and contact information. Accurate identification is essential for legal enforceability and prevents any confusion about who is responsible for what. Consider also adding clauses regarding the potential change of address of each party during the term of the loan.

Next comes the loan details. This section specifies the principal loan amount, the interest rate (if any), the repayment schedule (including the frequency and amount of payments), and the total repayment period. Being precise about these details is crucial to avoid misunderstandings and ensure both parties are clear about their obligations. It’s also important to consider how the payments will be made (e.g., direct transfer, check, etc.).

The “secured” part of the agreement centers around the collateral. The template will require a detailed description of the asset being pledged as security, including its make, model, serial number, or any other identifying information. It should also specify the condition of the collateral and its estimated value. The agreement must clearly state that the lender has a lien on the collateral until the loan is fully repaid, meaning they have the right to seize and sell it if the borrower defaults. An independent appraisal may be needed to justify the stated value of the asset.

Default provisions are another critical element. This section outlines what constitutes a default (e.g., missing payments, failing to maintain insurance on the collateral) and what actions the lender can take in the event of a default. This might include accelerating the loan (demanding immediate repayment of the entire balance), seizing the collateral, and pursuing legal action to recover any outstanding debt. Clear and comprehensive default provisions are essential for protecting the lender’s interests.

Finally, the template should include standard legal clauses, such as governing law (which state’s laws will govern the agreement), dispute resolution (how disputes will be resolved, e.g., through mediation or arbitration), and severability (if one part of the agreement is found to be unenforceable, the rest remains valid). It’s always a good idea to have a legal professional review the agreement to ensure it complies with all applicable laws and regulations.

Ultimately, this simple tool can provide clarity. A secured personal loan agreement template makes it possible to loan money more easily.

When navigating financial agreements, remember that preparation and clarity are key. A secured personal loan agreement template gives you a starting point for a successful transaction.