Thinking about taking control of your retirement savings and venturing into alternative investments? A Self Directed IRA LLC, often called a checkbook IRA, might be just what you’re looking for. It lets you invest in things like real estate, precious metals, and even private businesses. But before you dive in, there’s a crucial document you’ll need: the operating agreement. This agreement acts as the rulebook for your LLC, ensuring everything runs smoothly and stays compliant with IRS regulations.

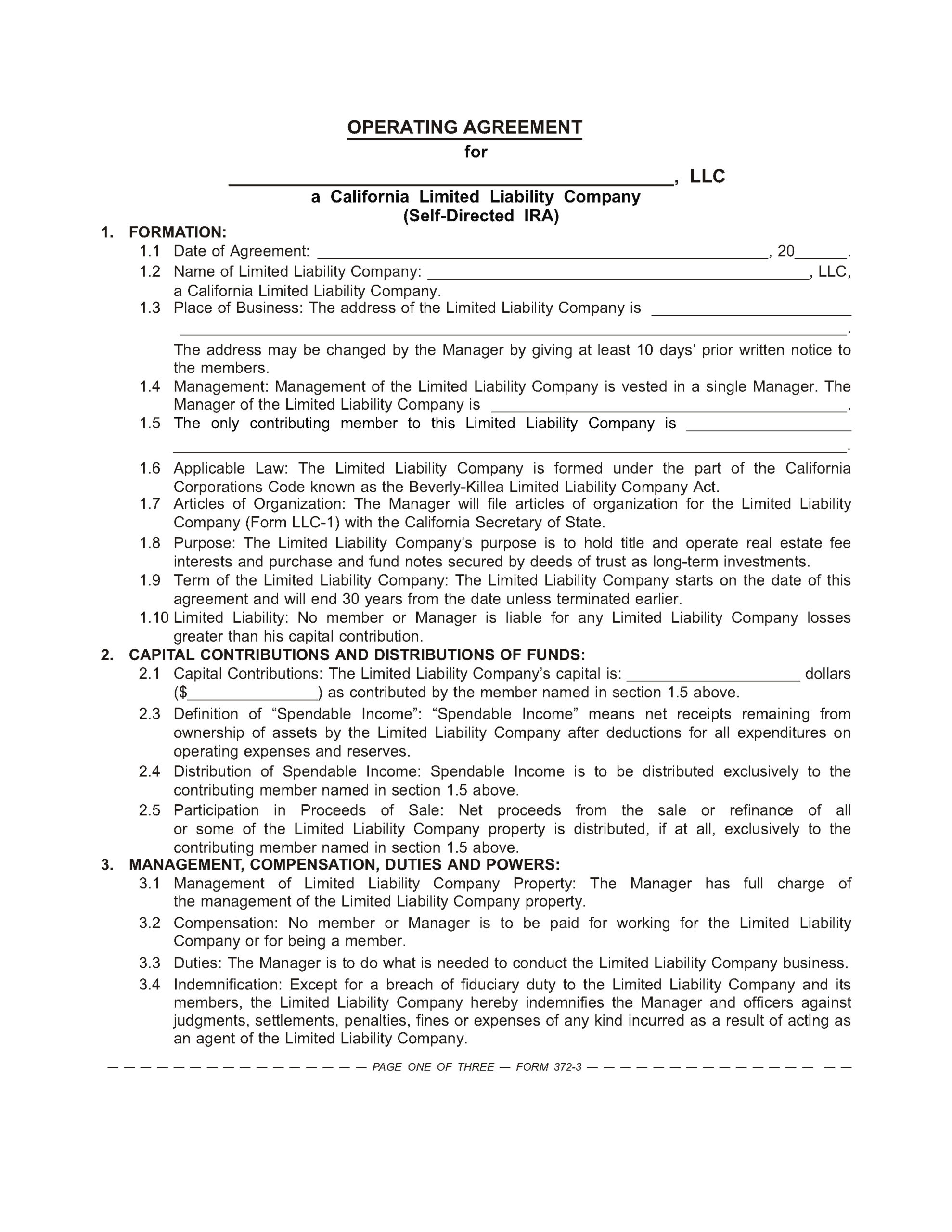

Creating an operating agreement from scratch can be daunting, especially if you’re not a legal expert. That’s where a self directed ira llc operating agreement template comes in handy. These templates provide a solid foundation, outlining key aspects like member responsibilities, profit distribution, and decision-making processes. However, it’s important to remember that a template is just a starting point. You’ll need to customize it to fit your specific situation and investment goals.

In this article, we’ll explore what a self directed ira llc operating agreement template is, why it’s so important, and what key elements it should include. We’ll also discuss how to find a reliable template and how to customize it to ensure it perfectly suits your individual needs and helps you navigate the world of self-directed investing with confidence.

Why You Absolutely Need a Rock-Solid Operating Agreement

The operating agreement is the backbone of your Self Directed IRA LLC. Think of it as the constitution for your company. It’s a legally binding document that outlines the rights, responsibilities, and obligations of each member, ensuring everyone is on the same page and preventing potential conflicts down the road. Without a clear and comprehensive operating agreement, you’re essentially navigating uncharted waters, which can lead to costly mistakes and even jeopardize the tax-advantaged status of your IRA.

One of the primary reasons an operating agreement is crucial is to maintain the separation between you and your IRA assets. The IRS requires a clear distinction between your personal finances and your retirement funds. The operating agreement helps establish this separation by defining the LLC as a separate legal entity, preventing you from using IRA funds for personal expenses or engaging in prohibited transactions. This is incredibly important for staying compliant and avoiding penalties.

Furthermore, the operating agreement outlines the management structure of your LLC. It specifies who has the authority to make decisions, how those decisions are made (e.g., majority vote, unanimous consent), and what happens if there’s a disagreement among members. This clarity is essential for smooth day-to-day operations and ensures that all actions taken on behalf of the LLC are aligned with the best interests of the IRA.

Beyond management and compliance, the operating agreement also addresses important financial aspects. It defines how profits and losses are allocated among members, how contributions and distributions are handled, and what happens if a member wants to withdraw or transfer their interest. Having these details clearly documented prevents misunderstandings and ensures that everyone is treated fairly. It also helps with record keeping for tax purposes.

Finally, the operating agreement provides a framework for resolving disputes. Even in the best of circumstances, disagreements can arise. The operating agreement should outline a process for resolving conflicts, such as mediation or arbitration, to avoid costly and time-consuming litigation. This proactive approach can save you significant headaches and preserve the integrity of your Self Directed IRA LLC.

Key Elements of a Self Directed IRA LLC Operating Agreement Template

When selecting a self directed ira llc operating agreement template, it’s essential to ensure it includes certain key elements. The template should clearly state the name and purpose of the LLC. This seems simple, but it’s crucial for identification and establishing the LLC’s legal standing. The purpose should be broad enough to encompass your anticipated investment activities but specific enough to avoid ambiguity.

The membership section should clearly identify all members of the LLC, including the IRA custodian acting on behalf of the IRA. It should also specify the percentage ownership interest of each member and their respective rights and responsibilities. This section is vital for determining how profits and losses are allocated and how decisions are made.

The management section details how the LLC will be managed. Will it be member-managed, where all members participate in day-to-day operations, or manager-managed, where a designated manager is responsible for the LLC’s affairs? The operating agreement should clearly define the roles and responsibilities of each member or manager, as well as the decision-making process. It should also outline procedures for removing or replacing managers.

The capital contributions section outlines the initial contributions of each member to the LLC. These contributions can be in the form of cash, property, or other assets. The operating agreement should specify the amount of each member’s contribution and how those contributions will be used to fund the LLC’s operations. It should also address the possibility of future capital contributions and how they will be handled.

Finally, the distribution section describes how profits and losses will be allocated among members. Typically, profits and losses are allocated in proportion to each member’s ownership interest. However, the operating agreement can specify a different allocation method if desired. The distribution section should also outline the procedures for making distributions to members, including the frequency and method of payment. Ensure that all distributions are handled in a way that complies with IRS rules for Self Directed IRAs to avoid penalties.

Navigating the world of Self Directed IRA LLCs can seem complicated, but with a clear understanding and a well-drafted operating agreement, you can confidently take control of your retirement investments. Remember, a template is just a starting point; customize it to fit your unique needs and consult with legal and financial professionals to ensure compliance.

Ultimately, investing with a self directed ira llc operating agreement template provides the flexibility and control many investors seek. With the right planning and guidance, you can unlock new opportunities for growth and build a more secure financial future.