So, you’re thinking about setting up a Series LLC in Illinois? Smart move! It’s a fantastic way to protect your assets and streamline your business operations, especially if you’re juggling multiple ventures. One of the most crucial documents you’ll need is a solid Series LLC Operating Agreement. Think of it as the rulebook for your business – it outlines how things will be run, who’s responsible for what, and how decisions will be made. Finding the right series llc operating agreement template illinois can seem daunting, but don’t worry, we’re here to break it down for you.

Why is an operating agreement so important, especially for a Series LLC? Well, in Illinois, while not strictly mandatory, it’s highly recommended. It clearly defines the structure of each series within your LLC, ensuring that each series has its own distinct assets and liabilities. This separation is key to the asset protection benefits of a Series LLC. Without a comprehensive operating agreement, you could jeopardize the legal separation between series, potentially exposing your assets to unnecessary risk. So, let’s dive into what makes a great operating agreement for your Illinois Series LLC.

In this article, we will guide you through the essential aspects of a Series LLC operating agreement in Illinois. We’ll cover what it should include, why each section is important, and where you can find a reliable series llc operating agreement template illinois. By the end, you’ll have a solid understanding of how to create a document that protects your business and sets you up for success.

Understanding the Core Components of a Series LLC Operating Agreement in Illinois

Creating a Series LLC Operating Agreement for your business in Illinois can seem like a complex task, but it doesn’t have to be. The key is to break it down into manageable sections and understand the purpose of each one. This document acts as the constitution for your Series LLC, detailing the rights, responsibilities, and operational procedures of each series and the overarching LLC. Let’s delve into the essential components:

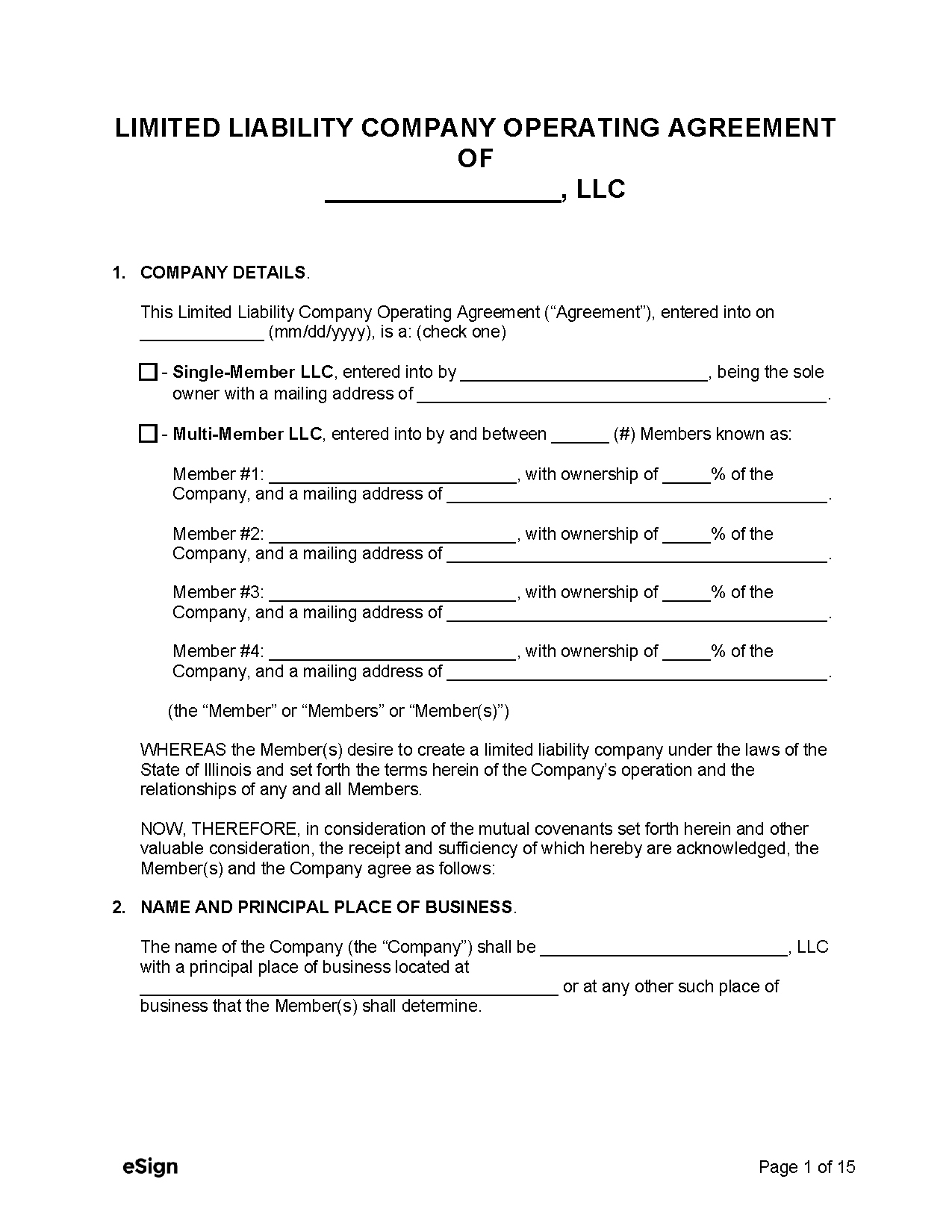

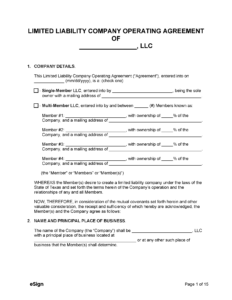

Formation Details: This section lays the groundwork for your LLC. It includes the name of your LLC, its registered agent’s information, and the principal place of business. Crucially, it states the purpose of the LLC and explicitly designates it as a Series LLC. This is where you’ll also specify the term of the LLC – whether it’s perpetual or for a specific period. Make sure this information aligns perfectly with your Articles of Organization filed with the Illinois Secretary of State.

Series Creation and Management: This section is unique to Series LLCs and is absolutely vital. It outlines the procedure for creating new series within the LLC. It defines the powers, rights, and limitations of each series. It also specifies how each series will be managed – whether by members, managers, or a combination of both. This section should clearly state that each series has its own distinct assets and liabilities, legally separated from other series and the overarching LLC. A well-defined series creation and management section is the cornerstone of the asset protection benefits of a Series LLC.

Membership and Ownership: This part details the members (owners) of the LLC and their respective ownership percentages. It outlines the rights and responsibilities of each member, including their voting rights, rights to profits and losses, and rights to distributions. It also addresses the process for adding new members, transferring membership interests, and the consequences of a member’s withdrawal or death. Clear definitions here are critical for preventing future disputes among members.

Financial Matters: This section covers all aspects of the LLC’s finances, including how profits and losses will be allocated among the members, how distributions will be made, and how capital contributions will be handled. It should also address accounting methods, banking arrangements, and the process for maintaining financial records. Having a clear financial section helps ensure transparency and accountability within the LLC.

Dissolution: This section outlines the process for dissolving the LLC or individual series within the LLC. It specifies the events that would trigger dissolution, the procedures for winding up the LLC’s affairs, and how assets will be distributed upon dissolution. A well-defined dissolution section provides a roadmap for closing the business in an orderly and legally compliant manner.

Finding and Customizing Your Illinois Series LLC Operating Agreement Template

Now that you understand the key components of a Series LLC Operating Agreement, let’s talk about finding a suitable template and customizing it for your specific needs. While there are numerous templates available online, it’s crucial to choose one that is specifically designed for Illinois Series LLCs. Generic templates might not adequately address the unique requirements and nuances of Illinois law. Remember, this document is the foundation of your business structure, so taking the time to find the right template and customize it properly is a worthwhile investment.

Where to Find Templates: Start by checking reputable online legal resource websites. Many of these sites offer free or low-cost templates that are drafted by attorneys. Look for templates that specifically mention Illinois Series LLCs. You can also consult with a business attorney who specializes in LLC formation. While this option may be more expensive upfront, it ensures that your operating agreement is tailored to your specific circumstances and complies with all applicable laws. Local bar associations often have referral services that can connect you with qualified attorneys.

Customizing the Template: Once you have a template, don’t just fill in the blanks and assume it’s ready to go. Carefully review each section and make sure it accurately reflects your business structure, ownership arrangement, and operational procedures. Pay particular attention to the sections on series creation and management, as these are the heart of a Series LLC. Consider the specific assets and liabilities that will be held by each series, and make sure the operating agreement clearly defines the separation between them. Also, think about the decision-making process within each series and how disputes will be resolved.

Legal Review: After you’ve customized the template, it’s highly recommended to have it reviewed by an attorney. An attorney can identify any potential legal issues or inconsistencies and ensure that your operating agreement is legally sound and enforceable. They can also advise you on any specific considerations related to your industry or business model. A small investment in legal review can save you significant headaches and legal costs down the road.

Remember, a Series LLC Operating Agreement is not a static document. As your business evolves, you may need to amend the operating agreement to reflect changes in ownership, management, or operations. It’s a good idea to review your operating agreement periodically to ensure it’s still relevant and accurate. Treat your Series LLC Operating Agreement as a living document that reflects the current state of your business. Utilizing a series llc operating agreement template illinois is the first step to building a solid foundation.

Don’t underestimate the importance of having a well-drafted and customized operating agreement for your Illinois Series LLC. It’s a critical document that protects your assets, defines your business structure, and provides a framework for future operations. By taking the time to find the right template, customize it carefully, and seek legal review, you can create an operating agreement that sets your Series LLC up for success.

Creating an LLC, particularly a Series LLC, involves careful planning and execution. Remember, this document is the backbone of your company, providing clarity and protection. Seek professional guidance when needed, and always ensure your agreement reflects the unique aspects of your business.

With a solid operating agreement in place, you can focus on growing your business with confidence, knowing that you have a strong legal foundation to support your ventures.