So, you’re starting a business in Singapore, or maybe you’re already running one and need to inject some funds. Often, shareholders step up to the plate, offering loans to their own companies. It’s a common practice, but it’s crucial to do it right. This means having a solid shareholder loan agreement template singapore in place. Think of it as setting the ground rules for how the money will be repaid, what interest rate applies, and all the other important details that keep things clear and above board. Without it, you’re basically just lending money on a handshake – which, while nice in theory, can lead to misunderstandings and even legal issues down the road.

Why is a shareholder loan agreement so important? Well, imagine a scenario where the company starts doing really well. Other shareholders might question the terms of your loan if it wasn’t properly documented from the beginning. Or, if the company faces financial difficulties, having a clear agreement helps protect both the shareholder (as the lender) and the company. It outlines the repayment priority and ensures that everyone is on the same page. It really makes everything smoother and it’s a sign of good corporate governance.

In this article, we’ll explore the ins and outs of shareholder loan agreements in Singapore. We’ll cover what you need to include in your template, why it matters, and some of the potential pitfalls to avoid. Consider this your guide to navigating the world of shareholder loans and ensuring your company is on solid financial footing. Let’s get started!

Key Elements of a Robust Shareholder Loan Agreement

Creating a solid shareholder loan agreement template singapore involves more than just a few lines of text. It requires careful consideration of various factors to ensure that the interests of both the shareholder providing the loan and the company receiving it are adequately protected. Let’s break down some essential elements that should be included in your agreement.

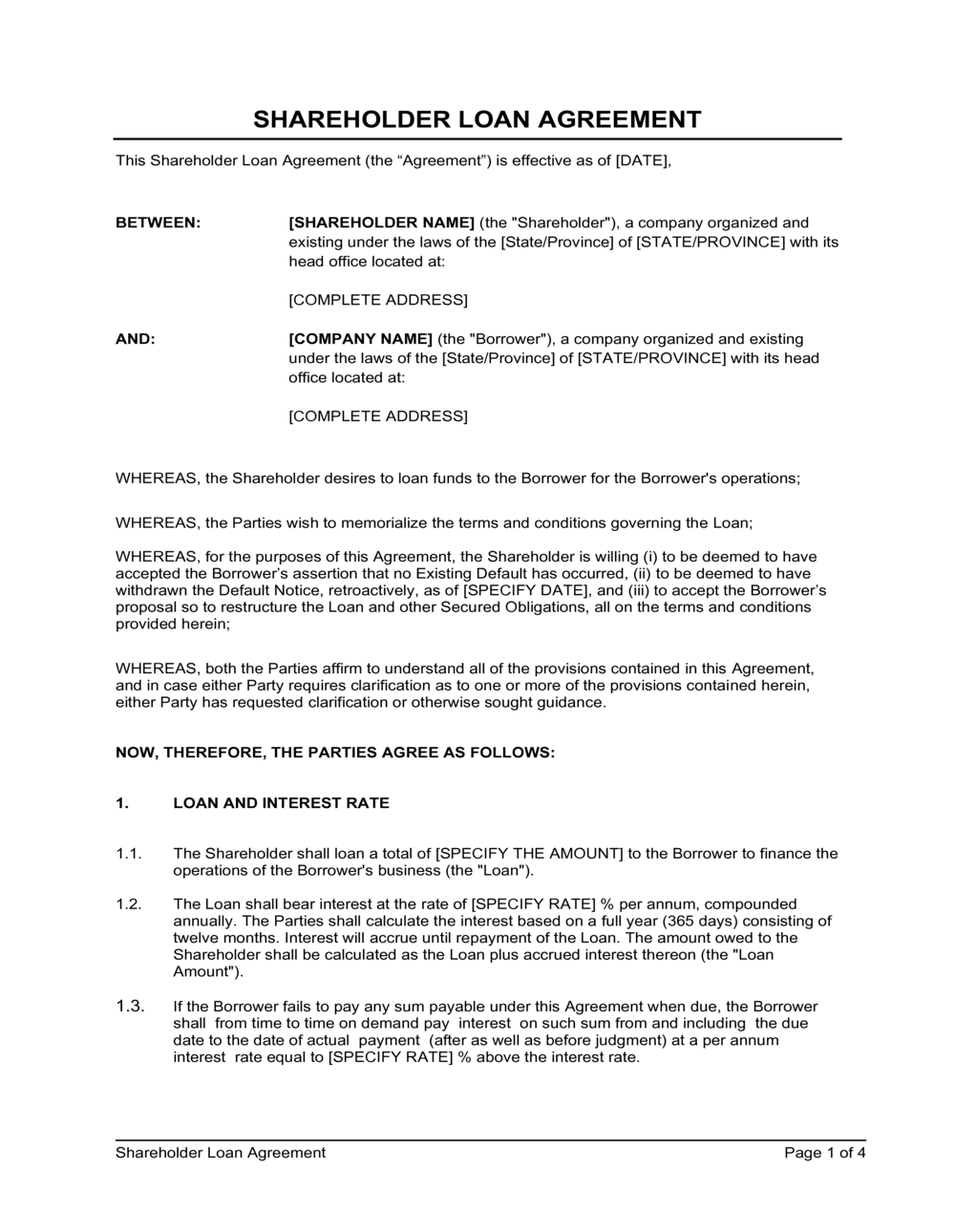

First and foremost, the agreement needs to clearly identify the parties involved. This means specifying the full legal names and addresses of both the shareholder (as the lender) and the company (as the borrower). Don’t skimp on the details; accuracy is key here. Then, the document must state the principal amount of the loan. This is the exact sum of money being lent to the company. Make sure the amount is written out in both numerical and written form to avoid any ambiguity. For example, “$100,000 (One Hundred Thousand Singapore Dollars)”.

Next up, specify the interest rate applicable to the loan. Singapore law allows parties to agree on an interest rate, but it should be fair and reasonable. Include details such as how the interest rate is calculated (e.g., fixed or floating) and when it is payable (e.g., monthly, quarterly, or annually). The agreement should also outline the repayment schedule. This section details how and when the loan principal and interest will be repaid. Will it be a lump-sum payment at the end of the term, or will it be paid in installments? Be specific about the dates and amounts of each payment.

You’ll also want to include clauses that cover events of default. What happens if the company fails to make a payment on time? What are the consequences? This section should clearly define what constitutes a default and what remedies the shareholder has in such cases. These remedies might include demanding immediate repayment of the entire loan, seizing assets, or taking legal action. Furthermore, you should address governing law and jurisdiction. Specify that the agreement is governed by the laws of Singapore and that any disputes will be resolved in the Singapore courts. This ensures clarity in case of disagreements.

Finally, it is wise to include clauses on prepayment. Does the company have the option to repay the loan early, without penalty? If so, specify the terms and conditions of prepayment. Also include clauses on assignment. Can the shareholder transfer their rights under the agreement to another party? If so, what are the procedures for doing so? By addressing all these key elements, you can create a comprehensive and legally sound shareholder loan agreement template singapore that protects the interests of both parties.

Why Having a Solid Agreement Matters in Singapore

In the vibrant business environment of Singapore, having a meticulously drafted shareholder loan agreement is not just good practice; it’s essential for maintaining financial clarity and preventing future disputes. Think of it as a roadmap that guides both the company and the lending shareholder through the loan’s lifecycle, ensuring everyone stays on the same page.

One of the key benefits of a well-structured agreement is its role in providing clarity and transparency. By clearly outlining the terms and conditions of the loan, including the interest rate, repayment schedule, and default provisions, the agreement minimizes the risk of misunderstandings and disagreements down the road. This is particularly important in closely held companies where personal relationships and business interests can sometimes become intertwined. A clearly defined agreement acts as an objective reference point, helping to resolve potential conflicts fairly and efficiently.

Beyond clarity, a shareholder loan agreement can also have significant tax implications in Singapore. Properly documenting the loan helps ensure that the interest payments are tax-deductible for the company, reducing its overall tax burden. Conversely, it clarifies the shareholder’s tax obligations concerning the interest income received. Without a formal agreement, the tax authorities may scrutinize the transaction more closely, potentially leading to unfavorable tax treatment. Also, it plays a crucial role in corporate governance. It demonstrates that the company is operating in a professional and transparent manner, adhering to best practices. This can enhance the company’s credibility with investors, creditors, and other stakeholders.

Moreover, a shareholder loan agreement can provide a level of protection for the shareholder in the event of the company’s insolvency. While the shareholder may not have the same priority as secured creditors, having a documented loan agreement can improve their chances of recovering at least a portion of their investment. The agreement establishes the shareholder’s status as a creditor, providing a legal basis for their claim against the company’s assets. It also ensures that the loan is treated as a legitimate debt obligation, rather than being reclassified as equity, which would significantly reduce the shareholder’s recovery prospects.

In conclusion, a meticulously drafted shareholder loan agreement template singapore is a vital tool for businesses and shareholders alike. It promotes clarity, transparency, and good corporate governance, while also offering tax benefits and protecting the interests of the shareholder. By investing the time and effort to create a comprehensive agreement, you can lay a solid foundation for a successful and sustainable business relationship.

Regardless of how confident you are in your relationship with your fellow shareholders, a clear and comprehensive shareholder loan agreement will always be valuable. It may seem like unnecessary paperwork at first, but you’ll be thankful you have it if any disputes arise in the future.

Ultimately, seeking professional legal advice when drafting these agreements is always recommended. A lawyer specializing in corporate law in Singapore can ensure that your agreement complies with all applicable laws and regulations, and that it adequately protects your interests.