Starting a small business is exciting, right? You’ve got your vision, your team, and hopefully, a solid business plan. But before you dive headfirst into chasing your entrepreneurial dreams, there’s a crucial document you need to consider: a shareholders agreement. Think of it as a prenuptial agreement for your business relationships. It’s not the most glamorous part of launching a company, but trust us, it’s one of the most important, especially when it comes to protecting your interests and preventing potential conflicts down the road.

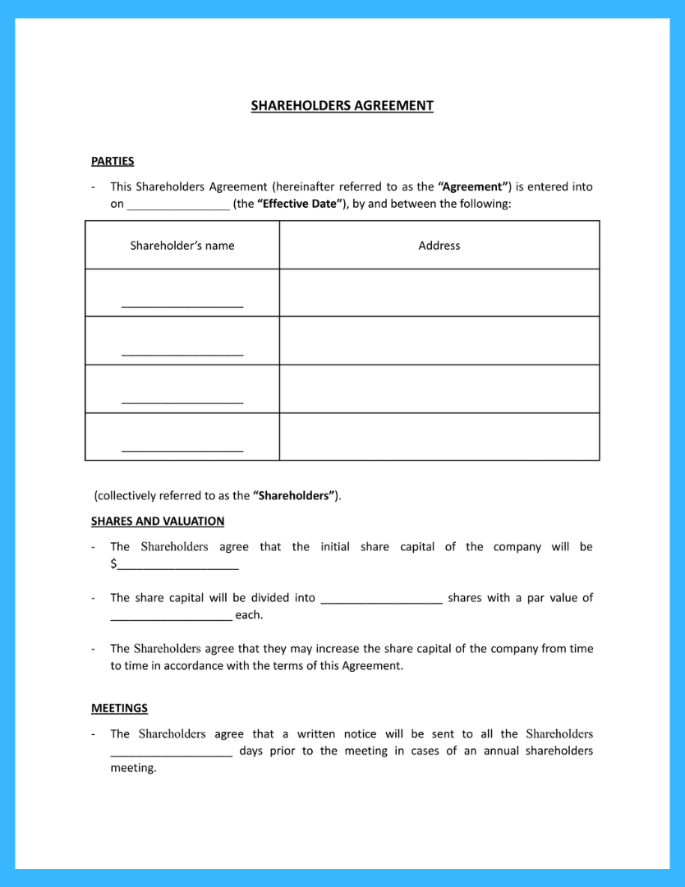

So, what exactly *is* a shareholders agreement? Simply put, it’s a legally binding contract between the shareholders of a company. It outlines the rights, responsibilities, and obligations of each shareholder, and sets the ground rules for how the company will be governed. It’s particularly vital for small businesses where the shareholders are often closely involved in the day to day operations.

Without a shareholders agreement, you’re essentially leaving the fate of your company to chance. Disputes between shareholders can arise over anything from dividend payments to management decisions, and without a clear agreement in place, resolving these conflicts can be costly, time consuming, and even lead to the downfall of the business. Using a shareholders agreement template for small business is a great starting point in making sure you are prepared for a successful future.

Why You Absolutely Need a Shareholders Agreement

Imagine this: You and your best friend start a coffee shop together. Initially, everything is amazing. You both work hard, the business is thriving, and you’re making money. But then, your friend decides they want to start another business on the side, and suddenly their commitment to the coffee shop dwindles. Or, maybe you disagree on how to expand the business or how to handle finances. Without a shareholders agreement, these disagreements can quickly escalate into full blown disputes, potentially ruining your friendship and your business.

A well-drafted shareholders agreement acts as a roadmap for navigating these types of scenarios. It clarifies each shareholder’s role and responsibilities, establishes procedures for decision making, and outlines what happens if a shareholder wants to leave the company or sell their shares. It essentially creates a safety net, protecting all shareholders from potential risks and uncertainties.

Here are some key aspects typically covered in a shareholders agreement:

Share Transfer Restrictions

This section outlines the rules for selling or transferring shares. It might include provisions like right of first refusal, which gives existing shareholders the opportunity to purchase shares before they are offered to an outside party. This helps maintain control over who becomes a shareholder in the company.

Voting Rights and Decision Making

This section specifies how decisions will be made and how voting rights are allocated. It could outline specific matters that require unanimous shareholder approval or establish a process for resolving deadlocks.

Dividend Policy

This section addresses how profits will be distributed among shareholders. It could outline a specific dividend policy or leave the decision to the board of directors.

Dispute Resolution

This section outlines the process for resolving disputes between shareholders, such as mediation or arbitration. This can save significant time and money compared to going to court.

Key Clauses to Include in Your Agreement

While every business is unique, there are some essential clauses that should be included in almost every shareholders agreement. These clauses provide a framework for managing various aspects of the company and ensuring fairness among the shareholders.

First, you’ll want a comprehensive clause detailing the capital contributions of each shareholder. This section clearly outlines the amount of money or assets each shareholder invested in the company. It also specifies the percentage of ownership each shareholder holds, which directly correlates to their voting rights and share of the profits.

Another critical element is a clause covering the management of the company. This outlines the roles and responsibilities of each shareholder involved in managing the business. It also specifies how key decisions will be made, whether through a majority vote or unanimous agreement. This section helps prevent power struggles and ensures that important decisions are made in a transparent and efficient manner. In addition, you will need to determine if a Board of Directors will be created.

Exit strategies are another crucial component. What happens if a shareholder wants to leave the company, either voluntarily or involuntarily? A well drafted exit strategy outlines the process for selling shares, determining the fair market value of those shares, and ensuring a smooth transition. Common provisions include buy sell agreements, which require the remaining shareholders to purchase the departing shareholder’s shares, and tag along rights, which allow minority shareholders to sell their shares on the same terms as the majority shareholder.

Finally, including a confidentiality clause is important. This clause requires all shareholders to keep confidential any sensitive information about the company, such as financial data, trade secrets, and customer lists. This helps protect the company’s competitive advantage and prevents confidential information from falling into the wrong hands.

Using a shareholders agreement template for small business is a great starting point to protect your interests. However, it is always best to consult with a legal professional to ensure that the document is tailored to your specific business needs and is legally enforceable in your jurisdiction.

Think of a shareholders agreement as an investment in the long term health and stability of your small business. It’s a proactive measure that can save you significant headaches and heartaches down the road. While it might seem like an unnecessary expense at the outset, the peace of mind and protection it provides are well worth the investment. By taking the time to carefully consider and draft a comprehensive shareholders agreement, you can set your business up for success and build a strong foundation for long term growth.

Don’t wait until disagreements arise to think about these issues. The best time to create a shareholders agreement is at the beginning of your business venture, when everyone is still on good terms and motivated to work together. By addressing potential conflicts proactively, you can create a more collaborative and productive environment for your business to thrive. So, take the time to protect your interests and invest in the future of your small business with a well drafted shareholders agreement.