Ever needed to lend a friend some cash or borrow from a family member? We’ve all been there. The awkwardness of money changing hands can be lessened with a clear and simple agreement. That’s where a short form loan agreement template comes in handy. It’s a straightforward way to outline the terms of the loan, ensuring everyone’s on the same page and avoiding potential misunderstandings down the road. Think of it as a financial handshake, putting everything in writing for peace of mind.

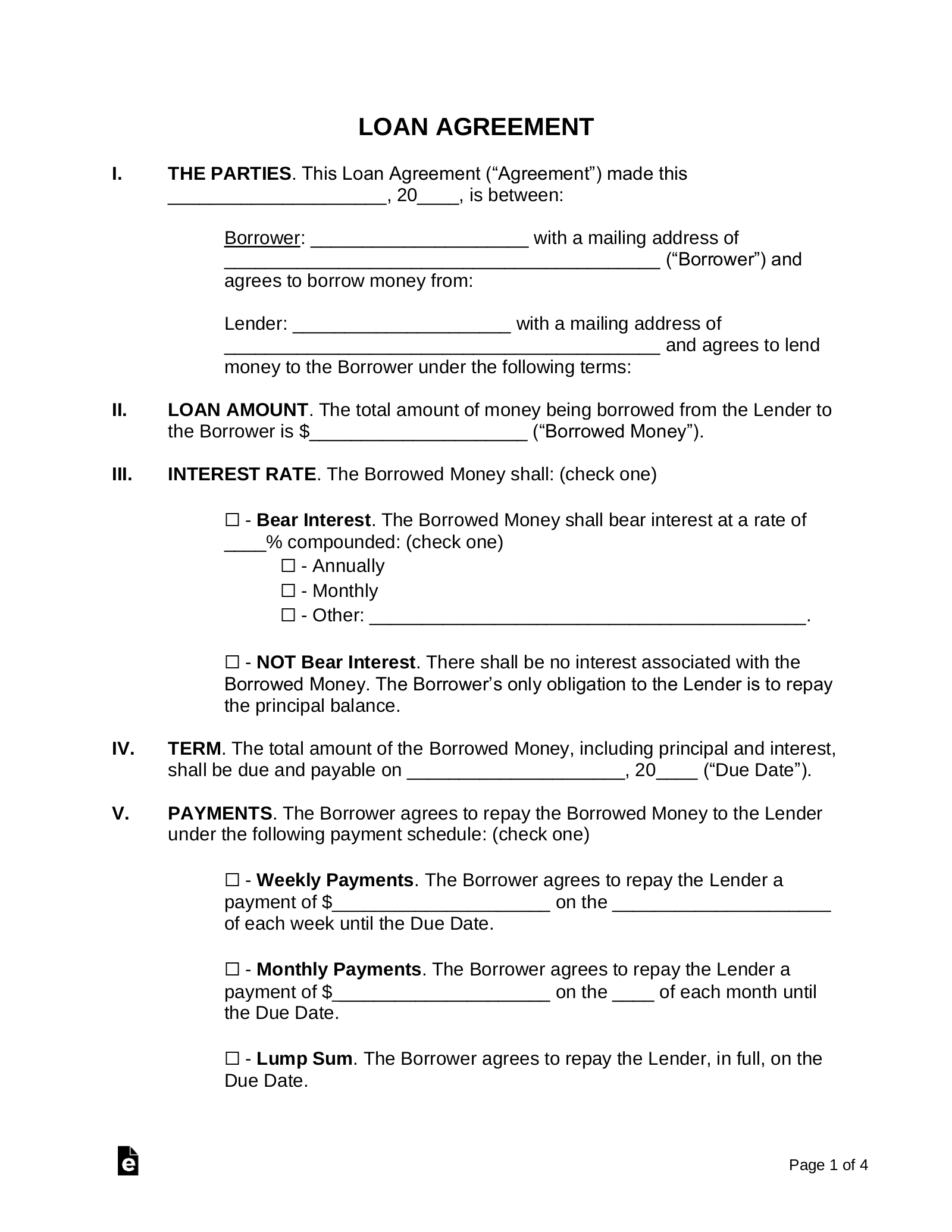

These templates are designed to be user friendly. You don’t need to be a lawyer to understand them. They typically include essential information like the loan amount, interest rate (if any), repayment schedule, and what happens if a payment is missed. Using a template saves you time and effort compared to drafting a loan agreement from scratch. It’s a practical solution for smaller loans between individuals or businesses.

In this article, we’ll explore the benefits of using a short form loan agreement template, what key elements to include, and where to find reliable templates. We will help you navigate the world of lending agreements, ensuring a smooth and transparent transaction. Whether you’re lending or borrowing, having a documented agreement protects everyone involved.

Why Use a Short Form Loan Agreement Template?

A short form loan agreement template is a simplified version of a standard loan agreement, designed for less complex lending situations. Imagine lending your sibling money for a new laptop. Do you really need a lengthy, legally dense document? Probably not. That’s where the beauty of a short form template shines. It provides a clear and concise framework for the loan without unnecessary jargon.

One of the biggest advantages is its simplicity. These templates are typically easy to understand and fill out, even for individuals without legal expertise. They focus on the essential terms of the loan, such as the principal amount, interest rate (if any), repayment schedule, and consequences of default. This streamlined approach saves time and reduces the potential for confusion.

Using a short form loan agreement template helps to formalize the lending process. Even if you’re lending money to someone you trust, putting the agreement in writing creates a clear record of the terms. This can be incredibly helpful in resolving any disputes that may arise later. For instance, if the borrower forgets the agreed-upon repayment date, you can refer back to the written agreement.

Another benefit is the protection it offers to both the lender and the borrower. The lender is assured that the terms of the loan are clearly defined and legally binding. The borrower knows exactly what is expected of them in terms of repayment. This mutual understanding fosters trust and reduces the risk of misunderstandings that could damage the relationship.

Where can you find these templates? Many websites offer free or low-cost short form loan agreement templates that can be downloaded and customized to your specific needs. Look for templates that are compliant with the laws in your jurisdiction to ensure their enforceability. Always review the template carefully and make any necessary modifications to reflect the specific terms of your loan.

Key Elements to Include

While a short form loan agreement template is designed to be simple, there are certain essential elements that should always be included. These include the names and addresses of the lender and borrower, the principal amount of the loan, the interest rate (if applicable), the repayment schedule (including the amount and frequency of payments), the date of the agreement, and the consequences of default.

What Happens If the Borrower Defaults?

Nobody wants to think about the possibility of a loan going sour, but it’s important to plan for the unexpected. A well-drafted short form loan agreement template should clearly outline the consequences of default. Default typically refers to a borrower’s failure to meet the agreed-upon repayment terms, such as missing a payment or failing to repay the loan in full by the due date.

The consequences of default can vary depending on the terms of the agreement. Common consequences include late payment fees, increased interest rates, and the lender’s right to demand immediate repayment of the entire outstanding loan balance. In more serious cases, the lender may pursue legal action to recover the debt.

A clear default clause in the agreement helps to protect the lender’s interests and provides a framework for resolving the situation if the borrower fails to meet their obligations. It also serves as a deterrent to the borrower, encouraging them to prioritize repayment. It’s crucial to ensure that the default clause is fair and reasonable, and that it complies with applicable laws and regulations.

In addition to outlining the consequences of default, the agreement should also address the process for resolving disputes. This may involve mediation, arbitration, or legal action. Having a clear dispute resolution process in place can help to avoid costly and time-consuming litigation. A short form loan agreement template can be a lifesaver when borrowing or lending money.

Remember, a short form loan agreement template is a tool to help facilitate a financial transaction between two parties. By using this kind of template, you can save both parties time and effort. This promotes transparency and mutual understanding, reducing the risk of future conflicts. Make sure to tailor the template to your specific situation.

Loans don’t need to create headaches! With a solid agreement in place, both the lender and borrower can proceed with confidence. By having a document to refer back to, you have something concrete if any questions arise down the line.

By choosing to use a short form loan agreement template, you’re taking a proactive step in managing your financial relationships. You’re setting the stage for a positive outcome and protecting your interests.