Need a quick infusion of cash? Whether you’re lending money to a friend, family member, or running a small business that needs a fast turnaround, a short term loan can be a lifesaver. But before you hand over the funds or sign on the dotted line, it’s crucial to have a solid agreement in place. That’s where a short term loan agreement template comes in handy. Think of it as your financial safety net, clearly outlining the terms and conditions of the loan to protect both the lender and the borrower.

Imagine lending a significant amount of money based on a handshake. Things can get messy if misunderstandings arise about repayment schedules, interest rates, or even the principal amount itself. A well-drafted agreement acts as a reference point, ensuring everyone is on the same page and minimizing the risk of disputes. It’s not just about distrust; it’s about clarity and protecting your financial interests.

This article will explore the ins and outs of using a short term loan agreement template, highlighting its key components and providing guidance on how to customize it to fit your specific needs. We’ll discuss why having a written agreement is essential, what to include, and where to find reliable templates. Let’s dive in and equip you with the knowledge to create a secure and professional lending arrangement.

Why You Need a Short Term Loan Agreement Template

In the world of lending, regardless of the sum of money, a formal agreement is essential. A short term loan agreement template is more than just a piece of paper; it’s a legal document that protects all parties involved. It clearly defines the responsibilities and expectations, reducing the chances of disagreements or misunderstandings down the road. Think of it like this: would you hire someone to renovate your home without a written contract? Probably not, and lending money should be treated with the same level of seriousness.

One of the most significant advantages of using a template is the clarity it provides. The document spells out the principal amount of the loan, the interest rate (if any), the repayment schedule, and any late payment penalties. This eliminates any ambiguity and ensures that both the lender and the borrower have a clear understanding of their obligations. It’s about creating a transparent environment where everyone knows what to expect.

Beyond clarity, a short term loan agreement template offers legal protection. Should a dispute arise, the agreement serves as evidence of the agreed-upon terms. This can be invaluable if you need to pursue legal action to recover the funds. Without a written agreement, it can be difficult to prove the existence of the loan or the specific terms that were agreed upon. This legal protection gives both the lender and the borrower peace of mind.

Furthermore, using a template saves time and effort. Creating a loan agreement from scratch can be daunting, especially if you’re not familiar with legal terminology. A template provides a pre-written framework that you can easily customize to your specific situation. This saves you the time and expense of hiring a lawyer to draft an agreement from the ground up. You can find a suitable short term loan agreement template online and adapt it as necessary.

Finally, having a formal agreement fosters a more professional and trustworthy relationship. It demonstrates that you are serious about the loan and committed to protecting your financial interests. This can strengthen the relationship between the lender and the borrower, even if they are friends or family members. It helps to keep the lending process transparent and avoids any potential for hard feelings due to miscommunication. Using a short term loan agreement template is simply a smart and responsible way to manage your finances and protect your relationships.

Key Elements of a Short Term Loan Agreement

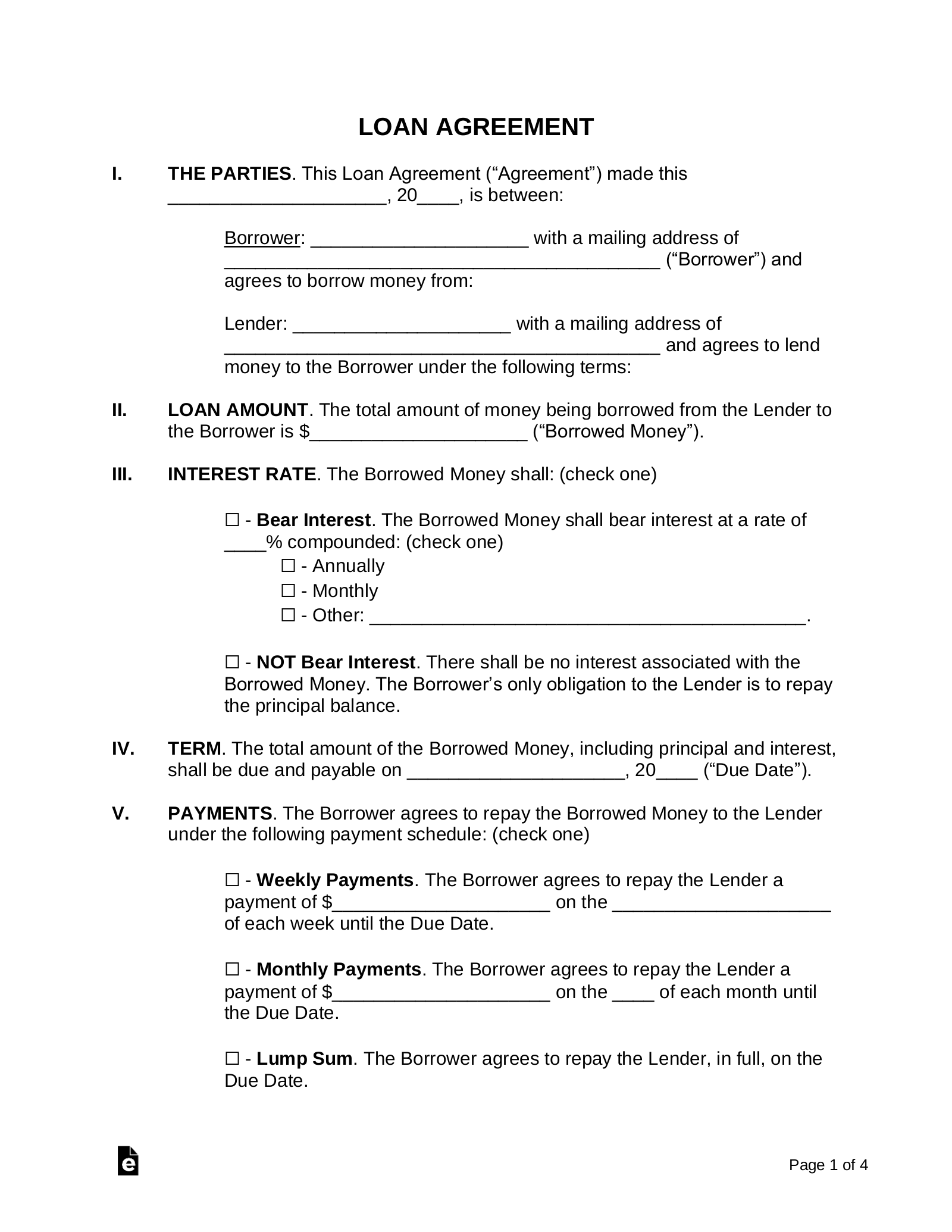

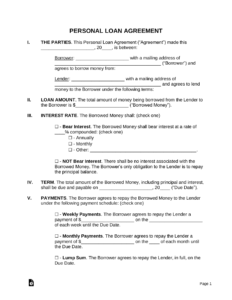

When crafting a short term loan agreement, several key elements should be included to ensure its completeness and enforceability. These elements provide a clear and comprehensive overview of the loan terms, protecting both the lender and the borrower. The first and foremost component is the identification of the parties involved: the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Be sure to include their full legal names and addresses for accurate record-keeping and potential legal recourse.

Next, the agreement must clearly state the principal loan amount. This is the exact sum of money being lent to the borrower. It’s crucial to specify this amount in both numerical and written form (e.g., $5,000, written as Five Thousand Dollars). This helps to avoid any ambiguity or disputes regarding the loan amount. Furthermore, the agreement should outline the interest rate, if applicable. While some short term loans may be interest-free, many do accrue interest. Clearly state the percentage rate and how the interest is calculated (e.g., annually, monthly).

The repayment schedule is another critical component. This section details how the borrower will repay the loan, including the frequency of payments (e.g., weekly, monthly), the amount of each payment, and the due dates. It’s helpful to include a table or chart outlining the payment schedule for easy reference. The agreement should also address what happens in the event of late payments. Specify any penalties for late payments, such as late fees or increased interest rates. It’s also wise to include a clause about default – what constitutes a default on the loan and what actions the lender can take in such a situation.

Finally, the agreement should include sections for governing law and dispute resolution. The governing law clause specifies which state or jurisdiction’s laws will govern the agreement. The dispute resolution clause outlines the process for resolving any disagreements that may arise. This might include mediation, arbitration, or litigation. Including these clauses ensures that there’s a clear path forward if any conflicts arise.

Including all these key elements in your short term loan agreement template creates a legally sound and comprehensive document. Remember to review the agreement carefully with all parties involved before signing to ensure everyone understands the terms and obligations. With a well-drafted agreement in place, you can protect your financial interests and foster a transparent and trustworthy lending relationship.

Using a suitable template can really streamline the whole process and make sure you have all the necessary clauses covered!

Creating these documents may seem tedious but can provide peace of mind and legal security. Don’t underestimate the importance of clarity and preparation in any financial agreement.