Ever feel like you’re wading through legal jargon just to move something simple from one place to another? Transferring ownership of an asset, whether it’s a car, a piece of equipment, or even intellectual property, shouldn’t feel like climbing Mount Everest. That’s where a simple asset transfer agreement template comes in handy. It’s your go-to tool for ensuring the process is smooth, clear, and legally sound, without needing a law degree to understand it. Think of it as a roadmap for a hassle-free transaction.

This template is designed to cut through the complexity. It’s about clarity and making sure everyone involved knows exactly what’s being transferred, what the terms are, and what happens if things don’t go exactly as planned. Using a template minimizes the risk of misunderstandings down the line, potentially saving you time, money, and a whole lot of headaches. It allows you to handle asset transfers with confidence.

In this article, we’ll break down why having a simple asset transfer agreement template is essential, what it typically includes, and how to use it effectively. We’ll explore the key elements that make it legally sound and user-friendly, so you can approach your next asset transfer with peace of mind. You’ll be equipped with the knowledge to customize the template to fit your specific needs, ensuring a smooth and transparent transaction.

Why You Need a Simple Asset Transfer Agreement Template

Imagine trying to sell your used car without any paperwork. You shake hands, exchange money, and then… what? Who’s responsible if something breaks down the next day? Who proves ownership? A simple asset transfer agreement template prevents these kinds of ambiguities. It formally documents the transfer, outlining the specifics of the asset, the terms of the transfer, and the responsibilities of both the seller and the buyer. This written record is invaluable should any disputes arise later on.

Beyond preventing disputes, a well-drafted template provides clarity for everyone involved. It clearly states the asset being transferred – down to the serial number if necessary. It details the agreed-upon price or consideration. And it spells out any warranties or disclaimers that apply. This transparency builds trust between parties, leading to a smoother and more professional transaction. No one wants to feel like they’re getting the short end of the stick, and a clear agreement ensures fairness.

Another key advantage is that it saves time and money. Instead of hiring a lawyer to draft a custom agreement for every single asset transfer, you can use a pre-designed template and customize it to your specific situation. This is particularly useful for businesses that frequently transfer assets, or for individuals dealing with straightforward transactions. Think of it as a cost-effective way to protect your interests and streamline your operations.

Furthermore, utilizing a simple asset transfer agreement template helps ensure legal compliance. While templates aren’t a substitute for legal advice, they are typically designed to incorporate standard legal clauses and provisions. This helps reduce the risk of overlooking critical legal requirements that could invalidate the agreement. By using a template, you’re taking a proactive step towards ensuring the transfer is legally sound and enforceable.

Finally, consider the psychological benefit. Having a written agreement in place provides peace of mind. You know that you have a legally binding document that protects your interests and outlines the terms of the transfer. This reduces stress and uncertainty, allowing you to focus on other aspects of the transaction. It’s a proactive approach that empowers you to manage your assets with confidence.

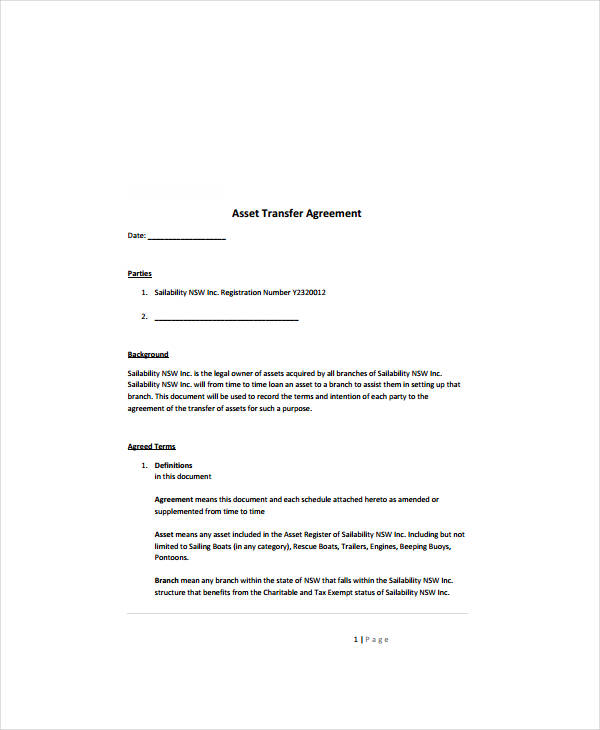

Essential Elements of a Simple Asset Transfer Agreement Template

Every good simple asset transfer agreement template should include certain core components to ensure its validity and effectiveness. The first, and perhaps most obvious, is the identification of the parties involved. This includes the full legal names and addresses of both the transferor (the seller) and the transferee (the buyer). This information clearly establishes who is making the transfer and who is receiving it.

Next, the agreement needs a thorough description of the asset being transferred. This isn’t just a vague description like “a car.” It should include the make, model, year, vehicle identification number (VIN), and any other relevant details that uniquely identify the asset. For equipment, it might include serial numbers, specifications, and condition. The more detailed the description, the less room there is for misunderstanding or dispute. This detail ensures that both parties are on the same page regarding exactly what is being transferred in the agreement.

Consideration is another crucial element. This refers to what the transferee is providing in exchange for the asset. Typically, this is a monetary amount, but it could also be other goods, services, or even another asset. The agreement should clearly state the amount of the consideration and how it will be paid (e.g., cash, check, wire transfer, installment payments). If the consideration is something other than money, it should be described in detail and its value should be clearly stated.

The agreement must also specify the date of the transfer. This is the date on which ownership of the asset officially passes from the transferor to the transferee. This date is important for determining when the transferee assumes responsibility for the asset, as well as for tax and accounting purposes. The agreement should also outline any conditions that must be met before the transfer can take place, such as inspection or payment of funds.

Finally, warranties and disclaimers are essential. A warranty is a guarantee that the asset is in a certain condition or meets certain standards. A disclaimer, on the other hand, is a statement that the asset is being transferred “as is,” without any warranties. The agreement should clearly state whether any warranties are being provided, and if so, what they cover. If no warranties are being provided, the agreement should include a clear disclaimer. This protects both the transferor and the transferee from future disputes related to the condition of the asset. All parties must agree with the conditions stated to ensure a transparent agreement.

Using a simple asset transfer agreement template doesn’t need to be complicated. These templates offer a solid framework, but remember to tailor them to your specific circumstances. By understanding their importance and key elements, you’ll be well-equipped to navigate asset transfers with confidence and peace of mind.

Ultimately, it’s about ensuring everyone is on the same page and that the transfer happens smoothly. Utilizing a template provides a foundation for a transparent and legally sound process, saving you time, money, and potential headaches down the road.