So, you’re lending money to a business, or maybe you’re the business borrowing the funds. Either way, congratulations! You’re taking a step towards growth and opportunity. But before any money changes hands, it’s absolutely crucial to get everything down in writing. That’s where a simple business loan agreement template comes in handy. Think of it as your roadmap for a smooth and transparent financial journey. It outlines the terms of the loan, protecting both the lender and the borrower and setting clear expectations from the start.

Why is a written agreement so important? Well, verbal agreements can get messy. Memories fade, interpretations differ, and suddenly you’re dealing with misunderstandings and potentially even disputes. A well-crafted loan agreement eliminates ambiguity, ensuring everyone is on the same page regarding repayment schedules, interest rates, and what happens if things don’t go according to plan. It’s about protecting your investment and maintaining a positive business relationship.

Using a simple business loan agreement template doesn’t mean you’re expecting the worst. It simply means you’re being responsible and proactive. It demonstrates professionalism and a commitment to clear communication, which are essential for any successful business transaction. It’s an investment in peace of mind, allowing you to focus on what really matters: growing your business and achieving your financial goals. No need to reinvent the wheel either. A template gives you a solid foundation to build upon, tailoring it to your specific needs.

Why Use a Simple Business Loan Agreement Template?

Let’s face it, legal jargon can be intimidating. Trying to draft a loan agreement from scratch without a legal background can feel like navigating a minefield. That’s where a simple business loan agreement template shines. It provides a pre-written framework, covering all the essential elements of a loan agreement in plain English, making it easier to understand and customize. You don’t need to be a lawyer to use one effectively. Most templates are designed to be user-friendly, with clear instructions and fill-in-the-blank sections.

Beyond simplicity, a template saves you time and money. Hiring a lawyer to draft a loan agreement can be expensive. While legal advice is always valuable, especially for complex situations, a template allows you to handle the basics yourself. This frees up your resources to focus on other critical aspects of your business. Plus, the time you save by not having to start from scratch can be significant. You can quickly adapt the template to your specific circumstances and have a legally sound agreement in place in no time.

Another key benefit is the peace of mind it offers. Knowing that you have a written agreement that clearly outlines the terms of the loan can alleviate a lot of stress and anxiety. It provides a sense of security for both the lender and the borrower, knowing that their rights and responsibilities are protected. This can foster a stronger, more trusting business relationship, built on transparency and mutual understanding.

Furthermore, a good simple business loan agreement template includes crucial clauses that you might not even think of on your own. These clauses address potential risks and contingencies, such as what happens if the borrower defaults on the loan or if there are changes in the business structure. By including these clauses, you’re proactively mitigating potential problems and ensuring that you’re prepared for unforeseen circumstances.

Finally, using a template ensures consistency and accuracy. Starting from a standardized format reduces the risk of errors or omissions that could later lead to disputes. It helps you ensure that all the necessary information is included, such as the loan amount, interest rate, repayment schedule, and collateral (if any). This meticulous attention to detail can make all the difference in ensuring a smooth and successful loan transaction.

Key Elements of a Simple Business Loan Agreement

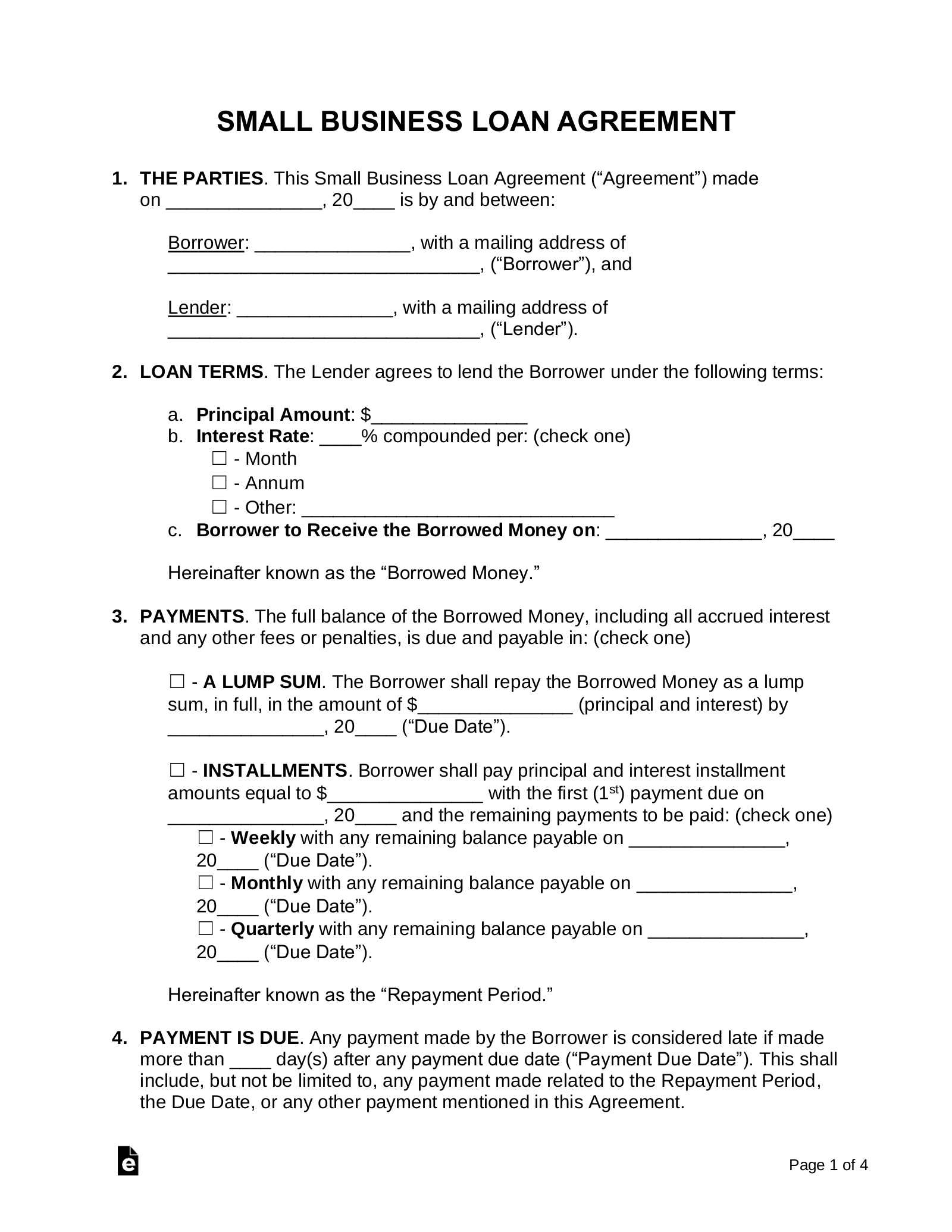

A well-structured simple business loan agreement template typically includes several key elements that define the loan terms and protect both parties. These elements include the identification of the parties involved (lender and borrower), the loan amount, the interest rate (fixed or variable), the repayment schedule (including the frequency and amount of payments), and any collateral being used to secure the loan. Make sure the details of each element are clearly defined to avoid future misunderstandings.

The agreement should also address the consequences of default. What happens if the borrower fails to make payments on time? What are the lender’s rights in such a situation? This section should clearly outline the steps the lender can take to recover the loan amount, such as seizing collateral or pursuing legal action. It’s a sensitive topic, but essential for protecting the lender’s investment.

Another crucial aspect is the inclusion of clauses related to governing law and dispute resolution. The governing law specifies which state’s laws will apply in the event of a dispute. The dispute resolution clause outlines the process for resolving disagreements, such as mediation or arbitration. These clauses help to ensure that any disputes are resolved fairly and efficiently, without resorting to costly and time-consuming litigation.

Furthermore, the agreement should include provisions for amendments or modifications. What happens if the parties agree to change the terms of the loan at a later date? The agreement should specify the process for making such changes, typically requiring a written amendment signed by both parties. This ensures that any changes are properly documented and legally binding.

Finally, don’t overlook the importance of signatures. Both the lender and the borrower should sign and date the agreement, preferably in the presence of a witness or notary public. This provides further evidence of the agreement’s validity and enforceability. A properly signed and witnessed loan agreement is a powerful document that can protect your interests in the event of a dispute.

Navigating the world of business finance can seem daunting, especially when lending or borrowing significant sums of money. However, with a little preparation and a reliable simple business loan agreement template, you can ensure that your financial transactions are conducted smoothly and securely. Remember, a clear and well-defined agreement is the foundation for a successful business relationship.

So, take the time to find a template that suits your specific needs and carefully review all the terms and conditions before signing. Don’t hesitate to seek legal advice if you have any questions or concerns. By being proactive and informed, you can protect your interests and pave the way for a brighter financial future.