So, you’re thinking about buying or selling a business? Congratulations! That’s a big step, and it’s incredibly exciting. But before you pop the champagne, there’s some essential paperwork to take care of. One of the most important pieces of that puzzle is the business purchase agreement. Think of it as the roadmap for the entire transaction, outlining everything from the price to the closing date.

Navigating legal documents can feel daunting, especially when you’re already juggling so much. That’s where a simple business purchase agreement template comes in handy. It provides a starting point, a framework you can customize to fit the specific needs of your deal. It doesn’t replace the need for legal counsel, but it can certainly streamline the process and save you time and money.

This article will explore what a simple business purchase agreement template is, what it typically includes, and where you can find one. We’ll break down the key components in plain English, so you can confidently move forward with your business transaction. Remember, while a template is a great resource, it’s crucial to consult with legal and financial professionals to ensure your agreement is legally sound and protects your interests.

Understanding the Basics of a Business Purchase Agreement Template

A business purchase agreement is a legally binding contract that outlines the terms and conditions of a business sale. It details what’s being sold, for how much, and what each party’s responsibilities are. Think of it as the rule book for the transaction, ensuring everyone is on the same page and knows their obligations. A simple business purchase agreement template provides a pre-written structure you can adapt to your particular deal. It’s not a one-size-fits-all solution, but rather a starting point to build upon.

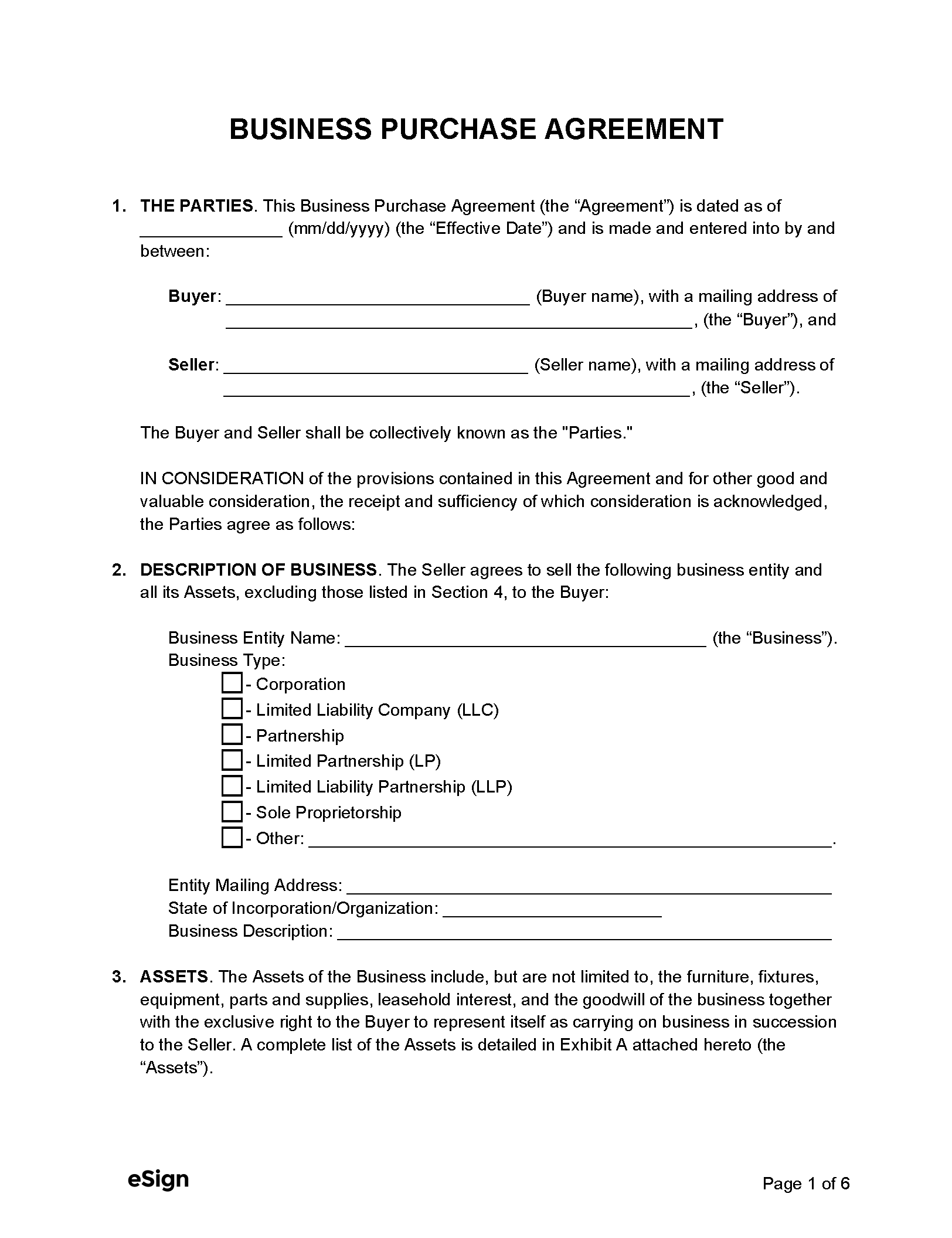

These templates often cover essential elements such as the identification of the buyer and seller, a clear description of the assets being sold (which might include inventory, equipment, intellectual property, and goodwill), the purchase price and payment terms, the closing date, and any warranties or representations made by the seller. They may also include clauses addressing confidentiality, non-compete agreements, and dispute resolution mechanisms. Using a template can help you avoid overlooking critical aspects of the agreement, ensuring a more comprehensive and secure transaction.

However, it’s crucial to remember that every business sale is unique. A simple business purchase agreement template can’t possibly address every scenario. For example, if the business has significant debt or complex intellectual property, you’ll need to tailor the agreement to address those specific issues. Similarly, if the deal involves stock options or earn-out provisions, the template will need to be modified accordingly. This is where consulting with legal counsel becomes essential.

While finding a free simple business purchase agreement template online might be tempting, exercise caution. Free templates may not be up-to-date, legally sound in your jurisdiction, or comprehensive enough to protect your interests. Investing in a professionally drafted or reviewed template, or seeking legal advice, can save you significant headaches and potential legal complications down the road.

In summary, a business purchase agreement template is a valuable tool for outlining the terms of a business sale. It provides a structured framework that can be customized to fit your specific needs. However, it’s not a substitute for professional legal advice. Always consult with an attorney to ensure your agreement is legally sound, comprehensive, and protects your interests.

Key Sections Typically Included in a Simple Business Purchase Agreement

When you’re looking at a simple business purchase agreement template, you’ll notice several recurring sections. These sections are designed to cover the most important aspects of the sale and ensure both parties understand their rights and responsibilities. Let’s break down some of the most common sections you’ll find:

First, there’s the “Identification of Parties” section. This clearly identifies the buyer and seller, including their legal names and addresses. It might also specify their roles in the transaction (e.g., “Seller” and “Buyer”). This section is crucial for establishing who is bound by the agreement.

Next, you’ll find the “Description of Assets” section. This is where you list exactly what’s being sold. Is it just the physical assets, like equipment and inventory? Or does it also include intangible assets like customer lists, trademarks, and goodwill? Being specific here is essential to avoid any misunderstandings later on.

The “Purchase Price and Payment Terms” section outlines the agreed-upon price for the business and how that price will be paid. Will it be a lump sum payment, or will there be installment payments? What are the deadlines for each payment? Are there any escrow arrangements in place? This section needs to be clear and unambiguous.

Another important section is the “Closing Date.” This specifies the date on which the ownership of the business will transfer from the seller to the buyer. This date is often tied to the completion of certain conditions, such as obtaining financing or completing due diligence. It’s a crucial deadline that sets the timeline for the entire transaction.

Finally, you’ll likely find sections on “Representations and Warranties” and “Governing Law.” Representations and warranties are statements made by the seller about the business’s condition and financial health. The “Governing Law” section specifies which state’s laws will govern the interpretation and enforcement of the agreement. While these sections might seem less exciting, they’re essential for protecting your interests in case of a dispute.

Understanding these key sections will help you navigate a simple business purchase agreement template with greater confidence. Remember to review each section carefully and seek legal advice if you have any questions or concerns.

Negotiating the terms of a business purchase agreement is like a dance. Both parties are trying to achieve their objectives, but it requires collaboration and understanding. It’s important to approach the negotiations with a clear understanding of your priorities and a willingness to compromise.

Ultimately, the goal of a business purchase agreement is to create a clear and legally binding document that protects both the buyer and the seller. By understanding the key components and seeking professional advice, you can navigate the process with confidence and ensure a smooth and successful transaction.