Starting a business with partners is an exciting venture, full of possibilities and potential. But what happens if one partner decides to leave, retires, or something unexpected occurs? That’s where a buy sell agreement comes into play. Think of it as a prenuptial agreement for your business, outlining exactly what happens to ownership interests should certain events occur. It provides clarity, protects the remaining partners, and ensures a smooth transition, minimizing potential conflicts and legal battles down the road.

A well-crafted buy sell agreement is essential for any multi owner business, whether it’s a partnership, LLC, or corporation. It dictates the terms and conditions under which a partner’s share can be bought or sold, establishing a clear process for valuation, funding, and transfer of ownership. Without one, you could face significant challenges, including disputes over valuation, deadlock among owners, or even forced liquidation of the business. Imagine trying to navigate those complexities while also grieving the loss of a partner or dealing with a sudden departure. Not a fun scenario!

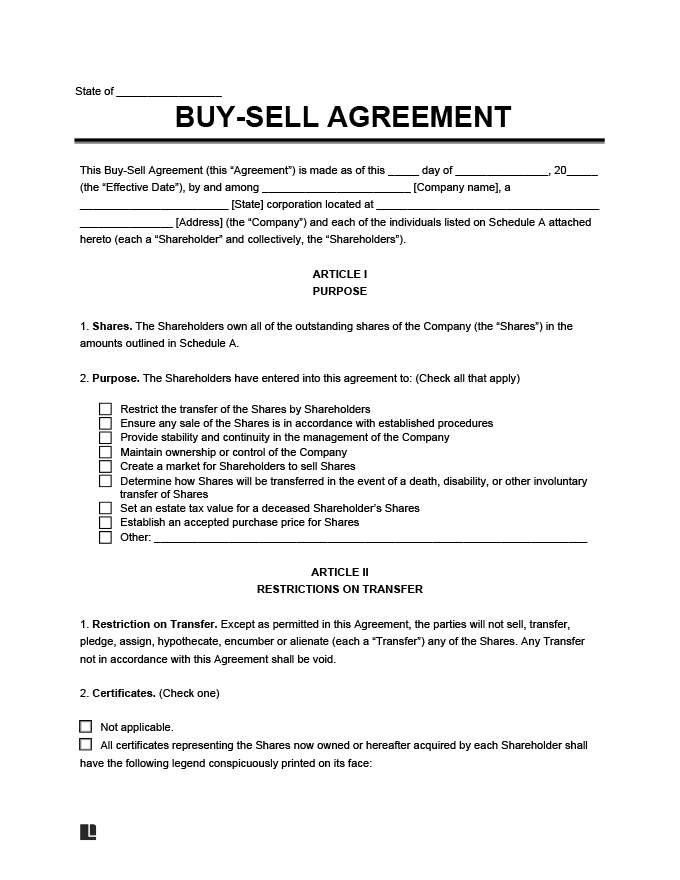

Fortunately, you don’t need to start from scratch. A simple buy sell agreement template can provide a solid foundation for creating a document that suits your specific business needs. These templates offer a framework for addressing key considerations, such as triggering events, valuation methods, and payment terms. Of course, it’s always recommended to consult with a legal professional to ensure your agreement complies with all applicable laws and adequately protects your interests, but a template can significantly streamline the process and save you time and money.

Understanding the Importance of a Buy Sell Agreement

A buy sell agreement is much more than just a piece of paper; it’s a vital component of your business’s long term stability and success. It ensures that the business can continue operating smoothly in the face of unforeseen circumstances, protecting the interests of all parties involved. Without a buy sell agreement in place, the departure of an owner can create significant disruption, leading to disputes, uncertainty, and potential financial hardship. The agreement acts as a roadmap, guiding the remaining owners through the process of acquiring the departing owner’s share and maintaining control of the business.

One of the most important aspects of a buy sell agreement is establishing a fair and objective valuation method for the departing owner’s share. This is crucial for avoiding disputes and ensuring that all parties are treated equitably. Common valuation methods include appraisals by independent experts, formula based calculations (such as multiples of earnings or revenue), and agreed upon values that are reviewed and updated periodically. The agreement should clearly specify the valuation method to be used, as well as the process for resolving any disagreements about the valuation.

Another critical element of a buy sell agreement is the funding mechanism for purchasing the departing owner’s share. This could involve life insurance policies on the owners, which provide the necessary funds in the event of death. Alternatively, the remaining owners could use their own personal funds, borrow from a bank, or arrange for an installment payment plan. The agreement should clearly outline the funding source and the terms of payment, ensuring that the remaining owners have the financial resources to acquire the departing owner’s share.

Furthermore, a buy sell agreement can address other important issues, such as restrictions on the transfer of ownership interests to outside parties. This prevents unwanted individuals or entities from becoming involved in the business and maintains control within the existing ownership group. The agreement can also specify the circumstances under which a partner can be forced to sell their shares, such as in cases of misconduct or disability. By addressing these potential scenarios upfront, the buy sell agreement provides clarity and certainty for all parties involved.

Finally, remember that a buy sell agreement is not a static document. It should be reviewed and updated periodically to reflect changes in the business, the ownership structure, and applicable laws. Major life events of the owners, such as marriage, divorce, or the birth of children, can also necessitate revisions to the agreement. Regular reviews will ensure that the buy sell agreement remains relevant and effective in protecting the interests of all parties involved.

Key Components of a Simple Buy Sell Agreement Template

When looking at a simple buy sell agreement template, you’ll find a few key sections that are crucial for defining the terms of the agreement. These sections cover the who, what, when, where, and how of transferring ownership interests. A well drafted template will provide clear and concise language, minimizing the potential for ambiguity and misinterpretation. Let’s break down some of these key components.

First, the agreement will clearly identify the parties involved. This includes the names and addresses of all the owners or shareholders, as well as the legal name and structure of the business (e.g., partnership, LLC, or corporation). It will also specify the type and amount of ownership interest held by each party, such as the number of shares of stock or the percentage of membership interest. This section establishes the foundation for the rest of the agreement.

Next, the template will define the “triggering events” that will activate the buy sell agreement. These are the specific circumstances that will require an owner to sell their shares. Common triggering events include death, disability, retirement, resignation, termination of employment, divorce, bankruptcy, and voluntary withdrawal from the business. The agreement should clearly define each of these triggering events to avoid any ambiguity. A simple buy sell agreement template will offer typical examples, but you may want to customize the definitions for your specific needs.

Another vital section outlines the valuation method for determining the fair market value of the departing owner’s share. As mentioned earlier, this could involve an independent appraisal, a formula based calculation, or an agreed upon value. The template should specify the details of the chosen valuation method, including the process for selecting an appraiser (if applicable), the formulas to be used, and the frequency of updating the agreed upon value. Clarity in this area is essential for preventing disputes.

Finally, the template will address the payment terms for purchasing the departing owner’s share. This includes the total purchase price, the method of payment (e.g., cash, installment payments, or a combination thereof), the interest rate (if any), and the schedule of payments. The agreement should also specify the security for the payments, such as a lien on the departing owner’s shares. A well defined payment plan ensures that the remaining owners can afford to purchase the shares without jeopardizing the financial stability of the business. Using a simple buy sell agreement template helps ensure you don’t miss any of these crucial elements, although professional legal advice is always recommended.

Starting a business involves many complexities, and planning for the future is always a smart move. Preparing for unexpected events is key.

Having a clear plan in place with a simple buy sell agreement template not only provides peace of mind but also safeguards the business’s future, ensuring continuity and stability regardless of what may come.