Need to borrow or lend some cash? Maybe you’re helping out a friend, or perhaps you’re running a small business and need a quick funding solution. Whatever the reason, it’s always a good idea to put everything in writing. That’s where a simple cash loan agreement template comes in handy. It’s basically a written promise outlining the terms of the loan, making sure everyone is on the same page and reducing the chances of misunderstandings or disputes down the road. Think of it as a friendship (or business relationship) saver!

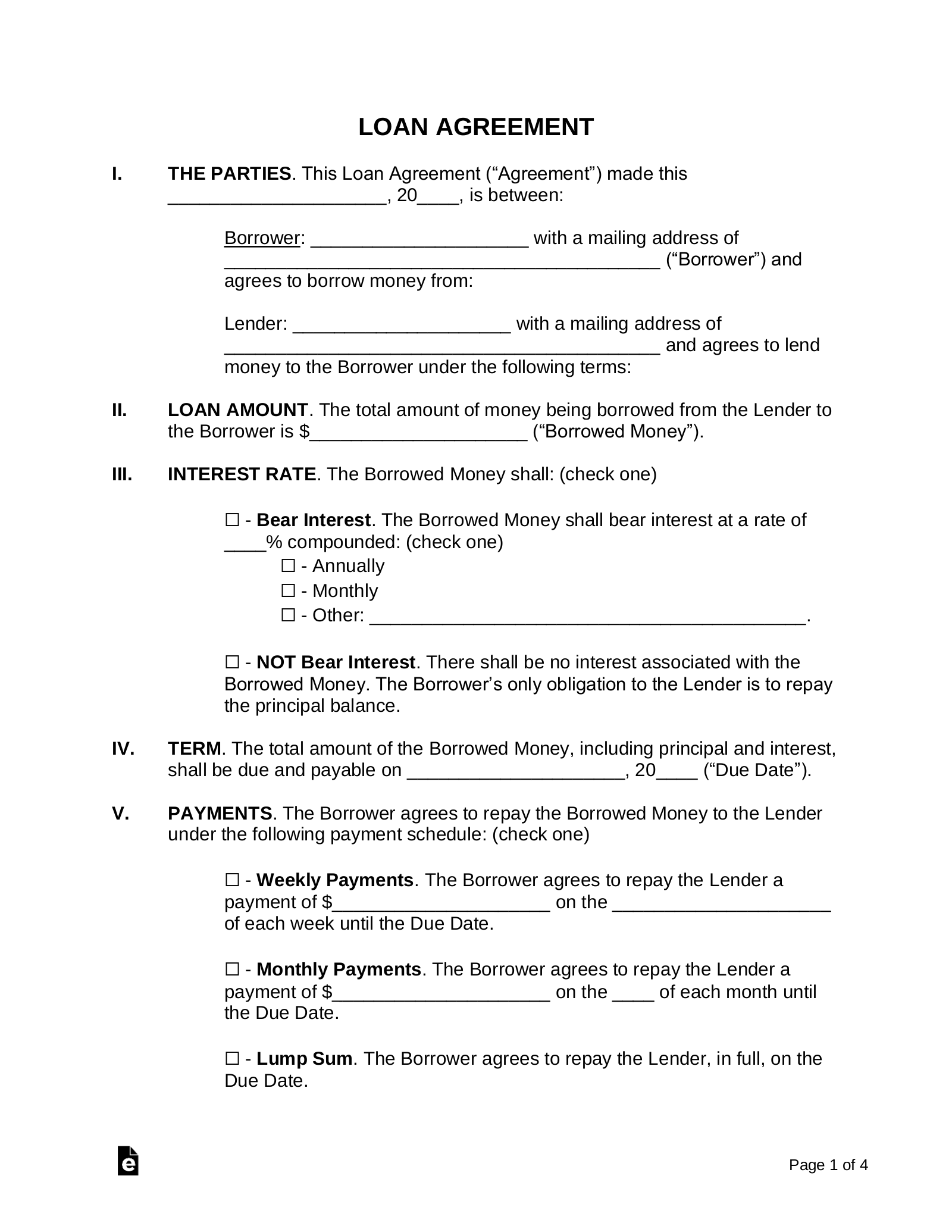

These templates aren’t some scary legal documents only lawyers can understand. A good simple cash loan agreement template is designed to be straightforward and easy to fill out. It covers the key details like how much money is being borrowed, the interest rate (if any), when and how the loan will be repaid, and what happens if someone doesn’t stick to the agreement. Using a template ensures you don’t forget any crucial information, providing a solid foundation for the loan agreement.

In this article, we’ll break down the importance of using a simple cash loan agreement template, what essential elements it should include, and how to use it effectively. We’ll also touch on some common pitfalls to avoid, ensuring that your loan agreement is clear, fair, and legally sound. Let’s get started!

Why Use a Simple Cash Loan Agreement Template?

Life gets complicated, and money matters can be especially tricky. Verbal agreements are often unreliable, especially when significant sums are involved. Memories fade, interpretations differ, and what seemed clear at the outset can become incredibly murky over time. A simple cash loan agreement template provides clarity and certainty, acting as a reference point for both the lender and the borrower.

Think about it: you loan a friend some money, and you both vaguely remember agreeing on a repayment schedule. Months later, you’re both arguing about the exact terms. A written agreement eliminates this ambiguity. It spells out the exact amount of the loan, the agreed-upon interest rate (if any), the repayment schedule, and any penalties for late payments or default. This level of detail minimizes misunderstandings and disagreements.

Beyond preventing arguments, a simple cash loan agreement template also offers legal protection. While a friendly loan might seem informal, having a written agreement makes the loan legally enforceable. If the borrower fails to repay the loan as agreed, the lender can pursue legal action to recover the funds. Without a written agreement, it can be very difficult to prove the existence of the loan and its terms in court.

A well-drafted template also helps to professionalize the transaction. Even if it’s a loan between friends or family, using a formal agreement shows that you’re taking the matter seriously and that you value the relationship enough to protect it with clear terms. This can build trust and demonstrate a commitment to fairness.

Furthermore, having a simple cash loan agreement template in place encourages responsible borrowing and lending. It forces both parties to think carefully about the terms of the loan, the borrower’s ability to repay, and the lender’s risk tolerance. This can lead to more responsible financial decisions and prevent either party from getting into a situation they can’t handle. Remember that you can also customize the simple cash loan agreement template to better suit your needs.

Key Elements of a Simple Cash Loan Agreement Template

A comprehensive simple cash loan agreement template should cover several essential aspects of the loan. Omitting any of these elements can create ambiguity and potentially lead to disputes later on. Let’s break down the key components:

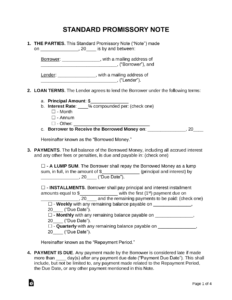

First and foremost, the agreement must clearly identify the parties involved: the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Include their full legal names and addresses.

Next, the agreement must state the principal amount of the loan – the exact amount of money being borrowed. This should be expressed both numerically (e.g., $5,000) and in words (e.g., Five Thousand Dollars). Also, the simple cash loan agreement template should also specify how the money will be delivered, for example, by check, cash, or electronic transfer.

If interest is being charged on the loan, the agreement must clearly state the interest rate (expressed as a percentage per year) and how the interest will be calculated (e.g., simple interest, compound interest). It should also specify when and how interest payments are due. Ensure that the interest rate complies with applicable usury laws in your jurisdiction.

Perhaps the most important part of the agreement is the repayment schedule. This should detail the amount of each payment, the frequency of payments (e.g., weekly, monthly, quarterly), and the due date of each payment. It should also specify the method of payment (e.g., check, online transfer). Consider including a provision for prepayment, allowing the borrower to repay the loan early without penalty.

Finally, the agreement should address what happens in the event of default – when the borrower fails to make payments as agreed. This section should outline the lender’s remedies, such as charging late fees, accelerating the loan (demanding immediate repayment of the entire balance), or pursuing legal action. It’s also a good idea to include a section on governing law, specifying which jurisdiction’s laws will govern the interpretation and enforcement of the agreement. And, of course, make sure both the lender and borrower sign and date the agreement, preferably in the presence of a witness.

Using a template provides a solid foundation. Remember to always review it carefully and tailor it to your specific circumstances, it’s not about just finding a simple cash loan agreement template and using it right away.

Creating a simple cash loan agreement template might seem daunting, but the peace of mind and legal protection it provides are well worth the effort. It’s about establishing a clear understanding and protecting your interests. Think of it as an investment in a healthy financial relationship, whether it’s with a friend, a family member, or a business associate.

So, next time you’re lending or borrowing money, remember the importance of a written agreement. It’s a simple step that can save you a lot of headaches down the road, and the right simple cash loan agreement template can make the process straightforward and stress-free.