Need to lend an employee some money? It’s a common practice, especially in smaller businesses where you might have a closer relationship with your team. But even with the best intentions, lending money without clear terms can lead to misunderstandings and strained relationships. That’s where a simple employee loan agreement template comes in handy. It’s a straightforward document that outlines the loan amount, repayment schedule, interest (if any), and what happens if things don’t go according to plan. Think of it as a safety net for both you and your employee.

Creating a loan agreement might sound intimidating, but it doesn’t have to be. A well-drafted template makes the process much easier, providing a framework to build on. These templates help ensure you cover all the essential details, protecting your business and maintaining a professional relationship with your employee. It also ensures that both parties understand their responsibilities. No surprises, just clear expectations.

This article will walk you through the essentials of a simple employee loan agreement template. We’ll cover what to include, why it’s important, and offer some tips for creating a document that works for your specific situation. By the end, you’ll have a better understanding of how to manage employee loans responsibly and avoid potential pitfalls.

Why Use a Simple Employee Loan Agreement Template?

Let’s face it, lending money to an employee, even with the best intentions, can get messy. Without a formal agreement, you’re relying on verbal promises and good faith, which can be easily misinterpreted or forgotten. A simple employee loan agreement template removes ambiguity and ensures that everyone is on the same page. It’s a written record of the loan terms, protecting both the employer and the employee.

Imagine a scenario where an employee leaves the company before the loan is fully repaid. Without a clear agreement, recovering the outstanding balance could be challenging and potentially require legal action. A template outlines the consequences of termination of employment, providing a mechanism for repayment, such as deducting the remaining balance from the employee’s final paycheck (where legally permissible). It also spells out what happens if the employee defaults on the loan. This can involve setting up a payment plan or other solutions for the loan.

Beyond legal protection, a loan agreement also fosters transparency and trust. By clearly outlining the terms of the loan, you demonstrate professionalism and respect for your employee. This can help maintain a positive working relationship, even in potentially sensitive financial matters. It shows you’re taking the loan seriously and treating your employee fairly. Remember that a well written simple employee loan agreement template ensures that all parties are in agreement.

Furthermore, using a template ensures consistency in your lending practices. If you’ve lent money to employees in the past, or plan to do so in the future, a template ensures that all loans are subject to the same terms and conditions. This avoids any perception of favoritism or unfair treatment and streamlines the process for your HR department. It also keeps your business in legal compliance, ensuring that the loan structure fits the local laws.

Finally, a good template can save you time and money. Instead of hiring a lawyer to draft a loan agreement from scratch, you can customize a template to fit your specific needs. This is a more cost-effective solution for small businesses and entrepreneurs. There are numerous online resources where you can download a simple employee loan agreement template, allowing you to get your agreement started right away.

Key Elements of a Simple Employee Loan Agreement Template

So, what exactly goes into a simple employee loan agreement template? Several key elements need to be included to ensure the agreement is comprehensive and legally sound. Let’s break down some of the most important components.

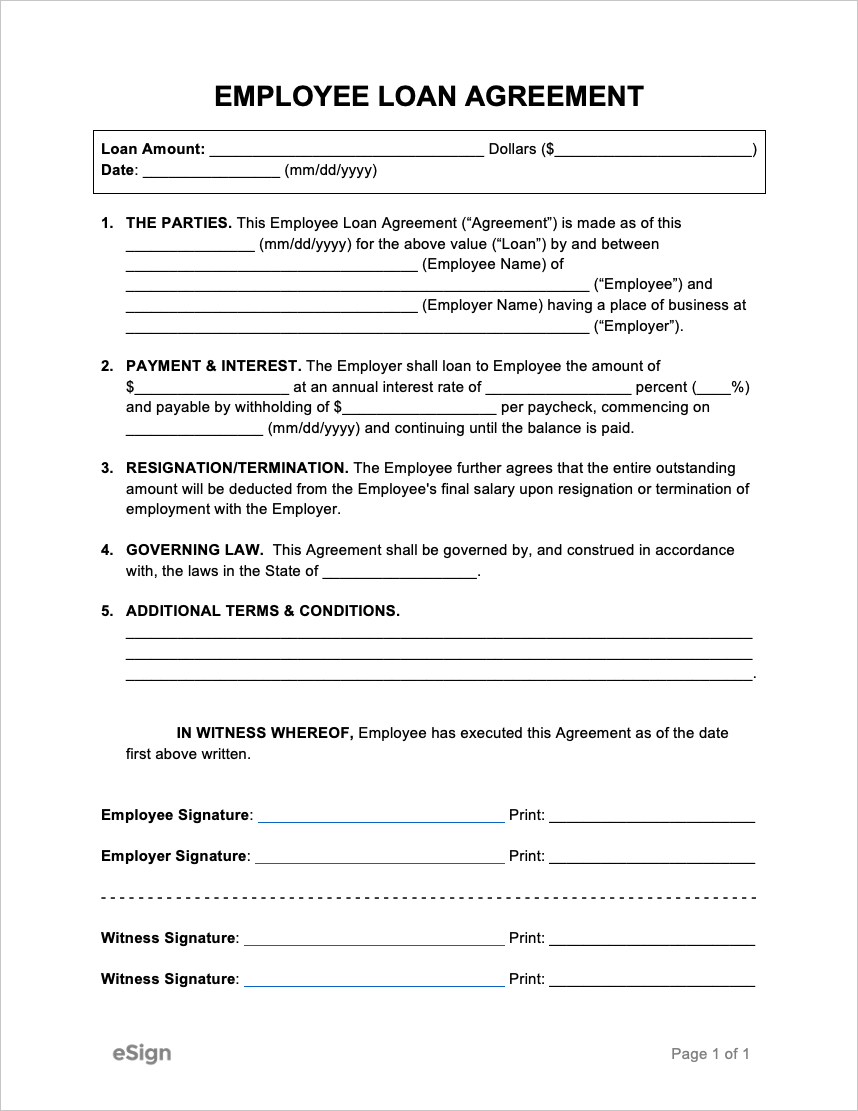

First and foremost, you need to clearly state the parties involved: the employer (lender) and the employee (borrower). Include their full legal names and addresses. This establishes the identity of the parties bound by the agreement. You also need to define the loan amount. Specify the exact amount of money being loaned to the employee. Use numerals and spell out the amount in words to avoid any confusion. For example, “$5,000 (Five Thousand US Dollars)”.

Next, outline the repayment schedule. This is crucial for clarity and avoiding misunderstandings. Specify the frequency of payments (e.g., weekly, bi-weekly, monthly), the amount of each payment, and the due date. Also, address whether the payments will be deducted directly from the employee’s paycheck or if the employee will make separate payments. Another important thing is to define the interest rate, if any. If you’re charging interest, clearly state the annual interest rate (APR). Be sure to comply with any applicable usury laws, which limit the amount of interest you can charge.

The template should also include a section on default. Define what constitutes a default on the loan (e.g., missing a payment, termination of employment). Specify the consequences of default, such as acceleration of the loan (requiring the employee to pay the entire outstanding balance immediately). Also include late payment fees. Specify if there will be any fees charged for late payments and the amount of the fee. Make sure your late fee aligns with the standards for similar types of business loans.

Finally, the template should address the termination of employment. Explain what happens to the loan if the employee leaves the company, either voluntarily or involuntarily. Specify how the remaining balance will be repaid (e.g., deducted from the final paycheck, paid in a lump sum, or through continued monthly payments). It’s also a good idea to include a clause on governing law. Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This provides clarity in case of any legal disputes.

Creating a simple employee loan agreement template doesn’t have to be difficult. By including these key elements, you can create a document that protects your business, maintains a positive relationship with your employees, and avoids potential legal issues.

While employee loans can be helpful, it is important to remember that offering them can be a significant undertaking for a business of any size.

A clear written agreement is essential for ensuring everyone is protected in the event of any dispute related to the loan. It is important for employee relations to have fairness across the company and any agreement will help to make sure everyone has equal opportunities.