Lending money to family can be tricky. You want to help out, but you also want to protect yourself and your finances. It’s a balancing act between familial love and financial responsibility. That’s where a simple family loan agreement template comes in handy. Think of it as a way to formalize the loan, ensuring everyone is on the same page regarding the terms, repayment schedule, and potential consequences of default. It doesn’t have to be complicated or feel impersonal; it can actually strengthen your relationship by establishing clear expectations and preventing misunderstandings down the road.

This kind of agreement isn’t just about the money; it’s about maintaining healthy relationships. Without a written agreement, assumptions can lead to resentment and friction. What if your sibling expects a longer repayment period than you’re comfortable with? What if they think the loan is more of a gift? A written agreement avoids these pitfalls and provides a clear reference point for both parties. It’s a sign of respect and consideration, demonstrating that you value the relationship and want to ensure the loan doesn’t damage it.

Using a simple family loan agreement template allows you to document the loan specifics in a straightforward and understandable way. It’s not about distrust; it’s about clarity and good communication. It helps manage expectations and offers a safety net should any disagreements arise in the future. Plus, in the unfortunate event of a serious dispute, having a documented agreement can be invaluable. So, before you transfer any funds, consider taking the time to create a formal agreement – it’s an investment in both your financial well-being and your family relationships.

Why You Need a Formal Loan Agreement Even with Family

It might seem strange or even cold to create a formal loan agreement with your family members. After all, aren’t you supposed to trust them? But trust isn’t always enough when money is involved. Think of it this way: a written agreement isn’t a sign of distrust; it’s a sign of respect. It acknowledges that even the best of relationships can be strained by financial misunderstandings. By clearly outlining the terms of the loan, you’re protecting both yourself and your loved one from potential conflict.

One of the most significant benefits of a formal loan agreement is that it clarifies expectations. How much is being loaned? What is the interest rate, if any? What is the repayment schedule? What happens if a payment is missed? These are all crucial questions that need to be answered before the loan is made. Without a written agreement, these details can be easily forgotten or misinterpreted, leading to disagreements and resentment. A simple family loan agreement template helps you cover all the bases and ensures everyone is on the same page.

Consider the perspective of the person receiving the loan. They might feel pressured to agree to terms they aren’t comfortable with if the agreement isn’t formalized. A written agreement gives them the opportunity to review the terms carefully and ask questions before committing. This process promotes transparency and fairness, strengthening the bond between family members rather than weakening it.

Another important reason to have a formal agreement is for tax purposes. The IRS can view large, undocumented loans to family members as gifts, which can have significant tax implications. By creating a formal loan agreement with a reasonable interest rate and repayment schedule, you can demonstrate to the IRS that the transaction is indeed a loan, not a gift. This can save you and your family members a lot of money and hassle down the road. You can utilize a simple family loan agreement template for this reason.

Finally, life is unpredictable. Circumstances can change unexpectedly, making it difficult for the borrower to repay the loan as agreed. A formal loan agreement provides a framework for handling these situations. It can outline options for modifying the repayment schedule or even forgiving a portion of the loan if necessary. This flexibility can prevent a temporary financial setback from damaging your relationship permanently. Having a formal agreement can provide some peace of mind knowing there’s a documented plan in place.

Key Elements of a Simple Family Loan Agreement

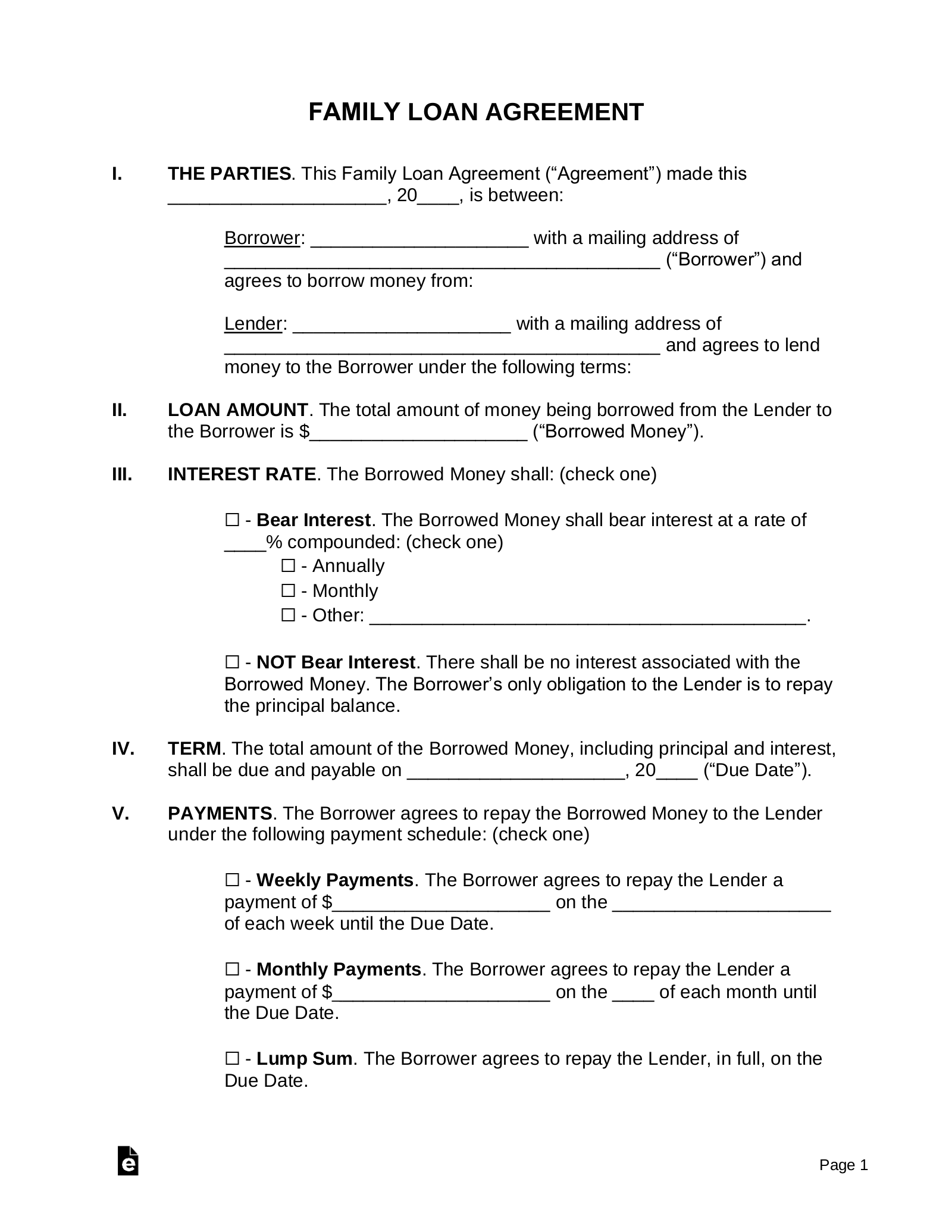

When drafting your simple family loan agreement template, certain key elements should be included to ensure clarity and enforceability. The first, and perhaps most obvious, is the identification of the parties involved. Clearly state the full legal names and addresses of both the lender and the borrower. This might seem basic, but it’s essential for legal identification should any disputes arise.

Next, you must clearly define the loan amount. Specify the exact amount of money being loaned, using both numerical and written forms (e.g., $5,000, five thousand dollars). This eliminates any ambiguity about the principal amount. Additionally, indicate the purpose of the loan. While not always necessary, stating the intended use of the funds can provide context and further clarify the nature of the agreement.

Interest rate is another critical element. Decide whether or not you will charge interest. If so, specify the annual interest rate. Keep in mind that the IRS may scrutinize loans with unusually low or no interest, potentially classifying them as gifts. Research the applicable federal rates (AFR) to determine a reasonable interest rate for your loan. This will ensure the agreement complies with tax regulations. A simple family loan agreement template usually includes this information.

Repayment terms are arguably the most important part. Outline the repayment schedule in detail. Specify the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date. Clearly state how the payments should be made (e.g., check, electronic transfer). Also, include provisions for late payments, such as late fees or penalties. Be realistic and fair when setting these terms, considering the borrower’s ability to repay.

Finally, include a default clause. This section outlines the consequences of the borrower failing to make payments as agreed. It should specify what constitutes a default (e.g., missing a certain number of payments) and what actions the lender can take in the event of a default. This might include demanding immediate repayment of the entire loan balance, pursuing legal action, or other remedies. While you might hope to never use this clause, it’s essential to have it in place to protect your interests. Ensure both parties sign and date the agreement, preferably in the presence of a notary public. This provides added legal weight and helps to establish the authenticity of the document.

Making these agreements with those closest to us may bring about thoughts of the worst case scenario, it can actually create a path of open communication that ultimately strengthens your relationship.

Ultimately, the goal is to support each other through life’s ups and downs while protecting your own financial security. A simple family loan agreement template allows you to do just that.