Loaning money to friends can be a tricky situation. On one hand, you want to help someone you care about. On the other hand, mixing friendship with finances can sometimes lead to misunderstandings and strained relationships. That’s where a simple friend loan agreement template comes in handy. It’s a way to formalize the loan, protect both parties, and ensure everyone is on the same page.

Think of it as a safety net for your friendship. It doesn’t mean you don’t trust your friend, it simply means you’re both responsible adults who are taking the transaction seriously. This document outlines the amount of the loan, the repayment schedule, the interest rate (if any), and what happens if things don’t go according to plan. It’s a way to avoid awkward conversations and potential resentment down the road.

Using a simple friend loan agreement template demonstrates a commitment to transparency and clarity. It provides a written record of the agreement, which can be invaluable if disputes arise. In the end, using a template can actually strengthen your friendship by preventing misunderstandings and fostering open communication about money matters. It’s all about being proactive and ensuring a positive outcome for everyone involved.

Why You Need a Simple Friend Loan Agreement Template

Let’s be honest, nobody wants to think about things going wrong when lending money to a friend. But life happens, and sometimes unforeseen circumstances can affect someone’s ability to repay a loan. A written agreement provides a clear framework for handling such situations. It clarifies the terms of the loan, including the repayment schedule, interest rate (if any), and consequences of late or missed payments. This clarity can prevent misunderstandings and resentment, which are common pitfalls in informal lending arrangements.

A simple friend loan agreement template also protects you, the lender. It serves as legal documentation of the loan, which can be useful if you ever need to pursue legal action to recover the funds. While you probably don’t want to imagine suing your friend, having a written agreement in place provides a level of security and recourse if all other attempts at repayment fail. It demonstrates that the loan was a serious transaction, not just a casual gift.

Furthermore, a written agreement encourages both parties to think carefully about the loan terms. The borrower is forced to consider their ability to repay the loan according to the agreed-upon schedule. The lender, on the other hand, must assess the borrower’s financial situation and determine if lending the money is a prudent decision. This process can help both parties avoid entering into an agreement that is unrealistic or unsustainable.

Using a template ensures you don’t overlook important details. It prompts you to include essential provisions, such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. It might also address scenarios like prepayment options or what happens if the borrower defaults. By following a template, you can ensure that your agreement is comprehensive and covers all the necessary bases.

Finally, consider the peace of mind that comes with having a written agreement. Knowing that you have a clear and legally sound document outlining the terms of the loan can alleviate stress and anxiety. It allows you to focus on your friendship without constantly worrying about the financial implications of the loan. In the long run, a simple friend loan agreement template can protect your relationship and promote financial responsibility.

Key Elements of a Simple Friend Loan Agreement Template

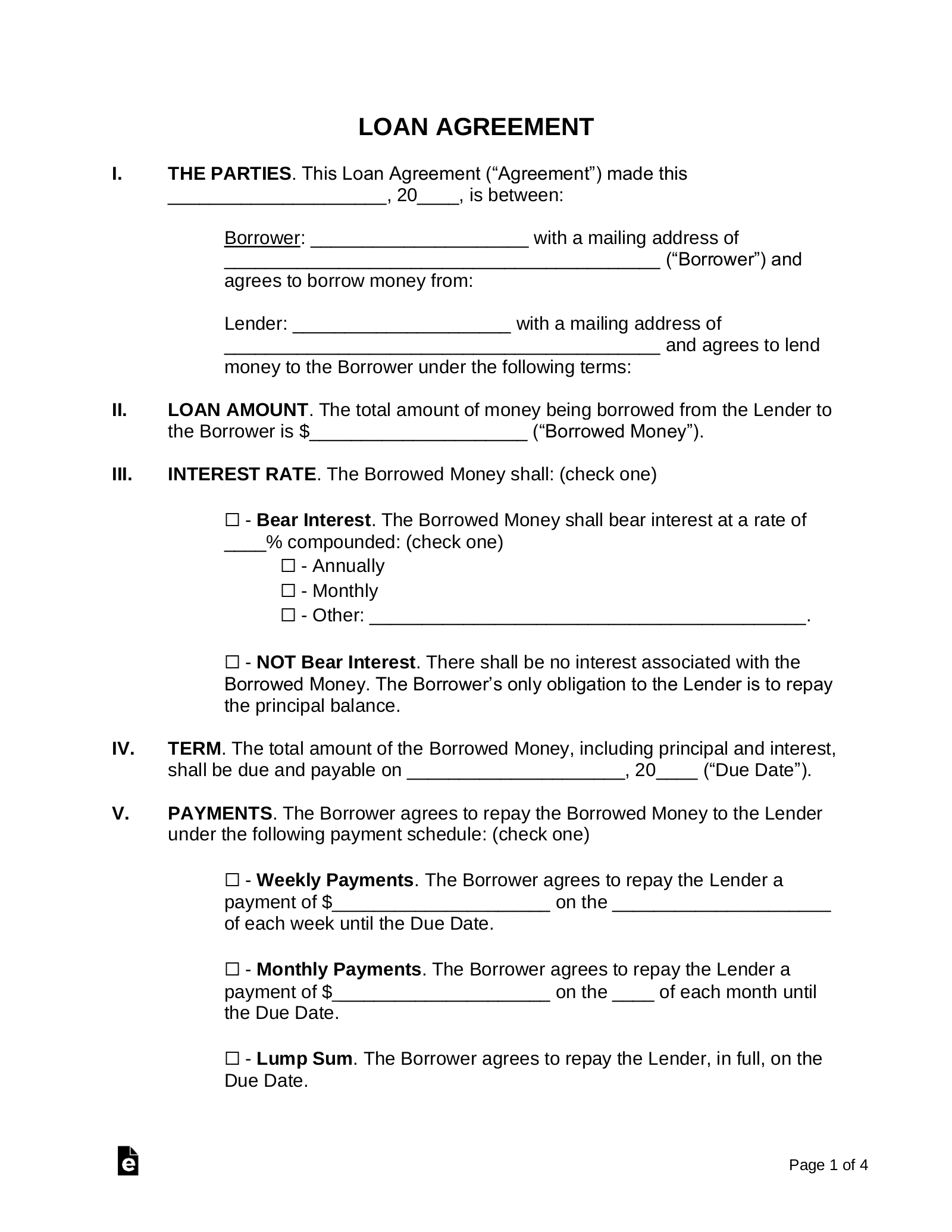

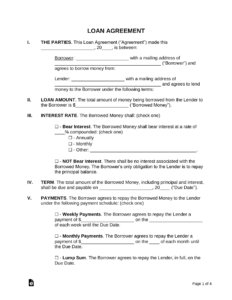

A comprehensive simple friend loan agreement template should contain several crucial elements. First and foremost, it must clearly state the names and addresses of both the lender and the borrower. This establishes the parties involved in the agreement and provides a point of contact for communication.

The agreement should also specify the exact loan amount being borrowed. This section should clearly state the principal amount of the loan, using both numerical and written forms (e.g., $1,000 – One Thousand Dollars). This avoids any ambiguity about the amount being lent and ensures that both parties are in agreement.

Another essential element is the repayment schedule. This section should detail the frequency of payments (e.g., weekly, monthly, quarterly), the amount of each payment, and the date on which the first payment is due. If there is an interest rate applied to the loan, this should be clearly stated, along with how the interest is calculated.

The agreement should also address what happens in the event of a default. This section should outline the consequences of late or missed payments, such as late fees or an acceleration of the loan balance. It should also specify the steps the lender can take to recover the funds if the borrower fails to repay the loan as agreed.

Finally, the agreement should include a section for signatures and dates. Both the lender and the borrower should sign and date the agreement in the presence of a witness. This confirms that both parties have read and understood the terms of the agreement and agree to be bound by them. Including a witness signature adds an extra layer of verification to the agreement.

Creating a simple friend loan agreement template doesn’t have to be difficult. In fact, there are many free templates available online that you can customize to fit your specific needs. By taking the time to create a written agreement, you can protect your friendship and ensure that the loan is repaid fairly and amicably. It’s a small investment that can pay dividends in the long run.

When lending to a friend, it’s not just about the money; it’s about preserving the relationship. A template helps ensure that financial matters don’t damage your bond. Taking a proactive approach and having a conversation about repayment expectations will do a long way.