Buying a home is a major milestone, one filled with excitement and perhaps a little bit of trepidation. Amidst the open houses and mortgage applications, there’s a crucial document that seals the deal: the home purchase agreement. This legal contract outlines the terms and conditions of the sale, protecting both the buyer and the seller. Finding a straightforward and understandable agreement can seem daunting, but that’s where a simple home purchase agreement template comes in handy. It provides a solid foundation, helping you navigate the complexities of real estate transactions with greater confidence.

Think of a home purchase agreement as a roadmap, guiding you from initial offer to final closing. It covers everything from the purchase price and earnest money deposit to the closing date and contingencies. A well-drafted agreement ensures clarity and minimizes the risk of misunderstandings or disputes down the road. Using a template doesn’t mean you’re on your own; it’s a starting point that you can customize to fit your specific situation, with the guidance of real estate professionals.

The beauty of a simple home purchase agreement template lies in its accessibility. It demystifies the legal jargon, presenting the essential terms in a clear and concise manner. While it’s always wise to seek legal advice, especially for complex transactions, a template empowers you to understand the basics and participate actively in the negotiation process. In the end, having a solid grasp of the agreement ensures that everyone is on the same page, making the journey to homeownership a smoother and more satisfying experience.

Understanding the Key Components of a Simple Home Purchase Agreement

A home purchase agreement is more than just a formality; it’s the legal bedrock upon which the entire transaction rests. Each section serves a specific purpose, safeguarding your interests and outlining the obligations of all parties involved. Let’s break down some of the essential components you’ll typically find in a simple home purchase agreement template.

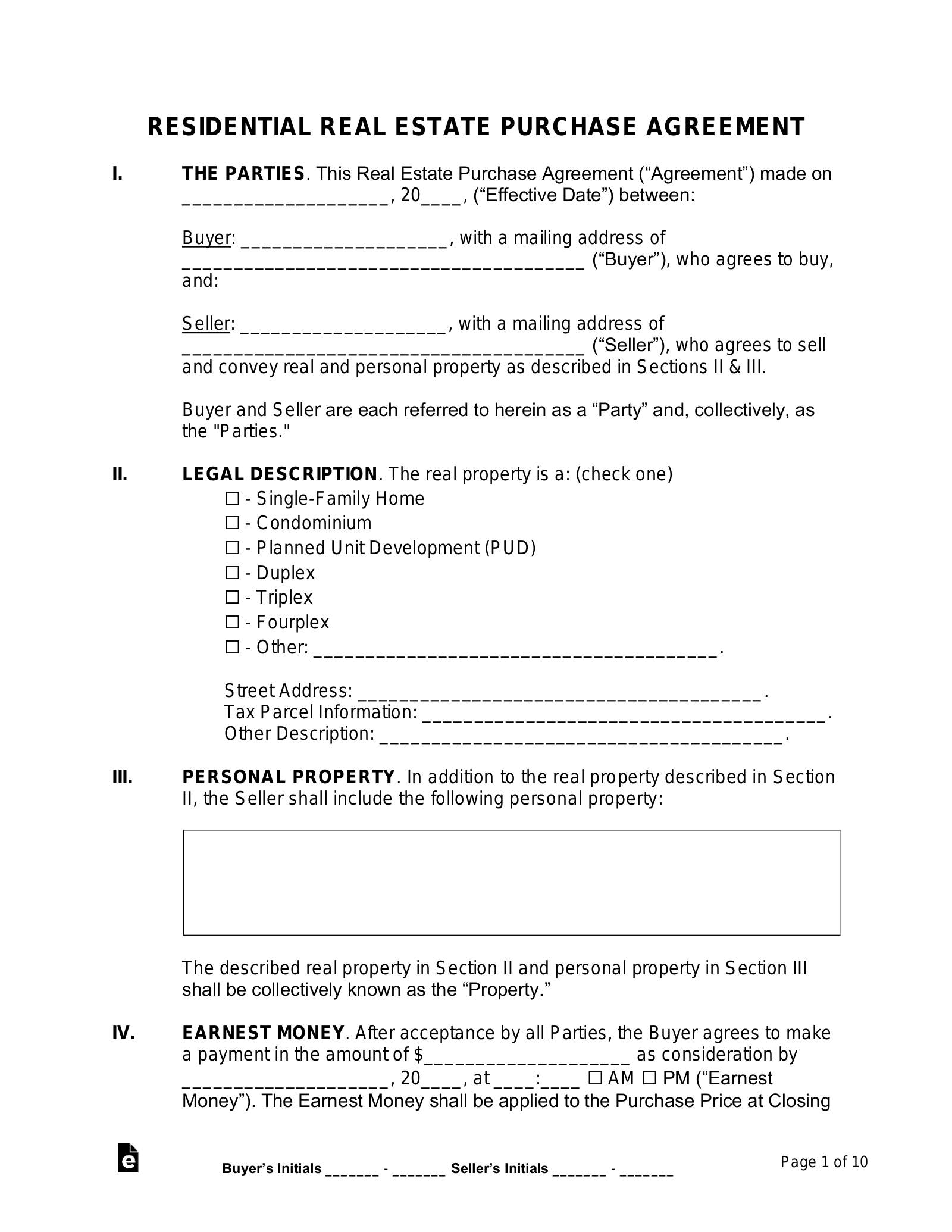

First and foremost, the agreement will clearly identify the parties involved: the buyer(s) and the seller(s). It will include their legal names and addresses. Then comes the property description, which should be as accurate and detailed as possible. This usually includes the street address, legal description, and any included fixtures or appliances. The purchase price, of course, is a crucial element. This specifies the agreed-upon amount the buyer will pay for the property.

The earnest money deposit is another key component. This is a good faith deposit made by the buyer to demonstrate their serious intent to purchase the property. The agreement will specify the amount of the deposit, how it will be held (usually in escrow), and under what circumstances it will be refunded to the buyer. Contingencies are conditions that must be met for the sale to proceed. Common contingencies include a satisfactory home inspection, appraisal, and financing approval. The agreement will outline the specific details of each contingency and the timeline for fulfilling them.

The closing date is the date on which the ownership of the property officially transfers from the seller to the buyer. The agreement will specify the agreed-upon closing date and any potential extensions. It also covers what happens if any party fails to meet their obligations under the agreement. This might include remedies such as specific performance (forcing the sale to go through) or monetary damages.

Finally, the agreement typically includes various disclosures required by law, such as information about lead-based paint, property defects, or environmental hazards. By carefully reviewing and understanding each of these components, you can ensure that your home purchase agreement accurately reflects your understanding of the transaction and protects your interests throughout the process.

Navigating the Purchase Process with Confidence

Using a simple home purchase agreement template is just the first step. Actively participating in the negotiation process and understanding your rights and responsibilities will make a huge difference. Remember, it’s a negotiation. Don’t be afraid to ask questions and voice your concerns. This is a significant investment, and you deserve to feel comfortable with every aspect of the agreement.

It’s advisable to work with qualified professionals. A real estate agent can provide valuable insights into the local market and help you negotiate favorable terms. A real estate attorney can review the agreement and advise you on your legal rights and obligations. Their expertise can help you avoid potential pitfalls and ensure that your interests are protected. Carefully review all documents before signing. Don’t rush the process. Take the time to read each clause carefully and make sure you understand its implications. If anything is unclear, seek clarification from your agent or attorney.

Be aware of deadlines. The home purchase agreement will specify deadlines for various actions, such as completing the home inspection, obtaining financing, and closing the sale. It’s crucial to adhere to these deadlines to avoid jeopardizing the transaction. Keep thorough records of all communication and documentation related to the purchase agreement. This includes emails, phone calls, and written correspondence. These records can be valuable in case of any disputes.

Don’t be afraid to walk away if necessary. If you encounter serious problems with the property or the agreement, don’t feel obligated to proceed. It’s better to lose the earnest money deposit than to invest in a property that is not right for you. Keep in mind that a simple home purchase agreement template is a starting point, you can customize it based on the specific nature of the deal.

By taking these steps, you can navigate the home purchase process with greater confidence and make informed decisions that are in your best interest. Ultimately, a well-executed purchase agreement sets the stage for a smooth and successful transaction, leading to the exciting moment when you finally receive the keys to your new home.

The process of buying a house requires patience, diligence, and a clear understanding of the paperwork involved. Whether you are a first-time homebuyer or an experienced investor, the knowledge and resources available will empower you to make sound decisions.

Remember, this is a journey, and every step taken contributes to securing a place you can call your own. So, embrace the process, seek guidance when needed, and look forward to the joys of homeownership that await.