Lending money to friends can be tricky. On one hand, you want to help someone you care about, especially when they are in a bind. On the other hand, mixing friendships with finances can sometimes lead to awkwardness, misunderstandings, and even strained relationships. The key is to approach the situation with open communication and a clear understanding of expectations from both parties. That’s where a simple loan agreement template between friends can be a lifesaver.

Think of it this way: it’s not about distrust; it’s about clarity. A written agreement, even a basic one, helps ensure everyone is on the same page regarding the loan amount, repayment schedule, interest (if any), and what happens if things don’t go as planned. This is especially important when the loan amount is significant. It provides a reference point for both the lender and the borrower, reducing the chance of misinterpretations or disagreements down the road. It also protects the friendship by adding a layer of professionalism to the transaction.

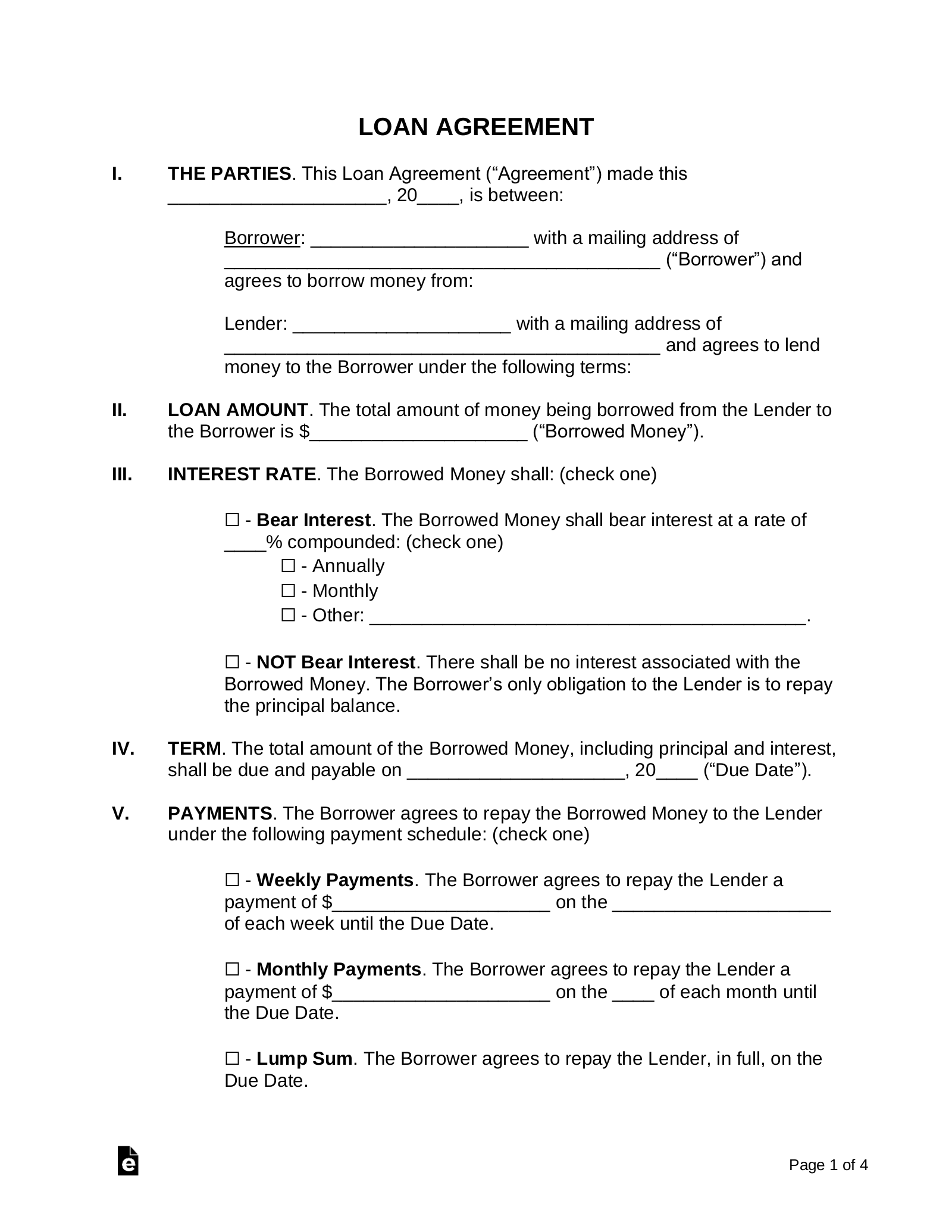

Creating a simple loan agreement doesn’t have to be complicated or involve lawyers and hefty fees. Many free or low-cost templates are available online that you can easily adapt to your specific needs. This article will guide you through the process of creating your own, ensuring a smooth and transparent lending experience with your friends. Remember, a little planning can go a long way in preserving both your friendship and your finances.

Why You Should Use a Simple Loan Agreement with Friends

When dealing with money and friendships, it’s always better to err on the side of caution. While a verbal agreement might seem sufficient, memories can fade, and interpretations can differ. A written agreement, even a simple one, provides a clear record of the terms agreed upon by both parties. This clarity can prevent misunderstandings and protect the friendship from potential conflicts arising from financial matters.

Imagine lending a friend a substantial amount of money without specifying a repayment schedule. Over time, you might become hesitant to bring it up, fearing it could damage the relationship. Your friend might also feel awkward about initiating the conversation. A written agreement outlines a clear repayment schedule, reducing the awkwardness and providing a framework for both parties to follow. It’s a respectful way to manage the loan and keep the friendship intact.

Moreover, a simple loan agreement template between friends helps address potential contingencies. What happens if your friend loses their job and can’t make payments? What if you unexpectedly need the money back sooner than anticipated? By including clauses that address such scenarios, you can proactively manage potential challenges and avoid strained relationships. It’s about having an honest conversation upfront and preparing for various possibilities.

Furthermore, think about the emotional aspect. When money is involved, emotions often run high. A written agreement can serve as a neutral reference point, preventing impulsive reactions and fostering rational decision-making. It’s a way to depersonalize the transaction and focus on the facts, reducing the likelihood of hurt feelings or misunderstandings. It shows you both value the relationship and want to handle the financial aspect responsibly.

Essentially, using a written agreement showcases maturity and respect within the friendship. It demonstrates that you value the relationship enough to handle the financial aspect professionally and transparently. It is not about not trusting your friend, but more about having a clear, documented understanding that protects both parties and preserves the friendship for years to come. It can actually strengthen the bond by showcasing responsibility.

What to Include in Your Loan Agreement

Crafting a simple loan agreement template between friends doesn’t need to be an arduous task. The goal is to create a clear and concise document that outlines the key terms of the loan. It’s important to address the essentials to ensure everyone is on the same page and potential issues are proactively handled. It is a sign of consideration to everyone involved.

First and foremost, the agreement should clearly state the names and addresses of both the lender and the borrower. This establishes the parties involved in the transaction. Next, specify the loan amount. Be precise, including the exact numerical value and the currency. This leaves no room for ambiguity regarding the principal amount being lent. Also, mention the date the loan was issued to provide a timeline.

Then, carefully outline the repayment schedule. This should include the frequency of payments (e.g., monthly, quarterly), the amount due per payment, and the date each payment is due. If you’re charging interest, clearly state the interest rate and how it will be calculated. Even if you’re not charging interest, explicitly state that the loan is interest-free to avoid any future misunderstandings. It also shows a gesture of good faith from the loaner.

Consider including a section on late payment penalties. While you might not want to impose harsh penalties on a friend, specifying a reasonable late fee or a grace period can encourage timely repayment. You can also mention the consequences of default, such as potential legal action or adjustments to the repayment schedule. Remember, the aim is not to be punitive but to establish clear expectations.

Finally, include a clause addressing governing law. This specifies which jurisdiction’s laws will govern the agreement in case of a dispute. Both parties should sign and date the agreement, indicating their understanding and acceptance of the terms. It’s also a good idea to have a witness present during the signing to further validate the agreement. Even though you’re borrowing from a friend, having a witness helps ensure there will be no questioning of the agreement.

Lending money to friends might feel a bit awkward at first, but with open communication and a simple loan agreement template between friends, you can navigate the situation with confidence and preserve your relationships. Remember, clarity and transparency are the keys to success.

This approach not only protects your financial interests but also reinforces the foundation of trust and respect that defines a true friendship.