So, you’re thinking about lending money to a friend, family member, or maybe even a business associate? That’s a generous move! But before you hand over the cash, it’s super important to protect yourself and ensure everyone’s on the same page. That’s where a simple money lending agreement template comes in handy. It’s basically a written record of the loan, outlining all the details, so there are no misunderstandings down the road. Think of it as a friendship preserver or a business relationship safeguard. It might feel a little awkward to bring up, but trust me, it’s far less awkward than dealing with a dispute later on.

This isn’t about distrust; it’s about clarity. Life happens! People forget things, circumstances change, and sometimes good intentions just aren’t enough. A well-written agreement acts as a clear reference point for everyone involved. It clearly spells out the amount borrowed, the repayment schedule, the interest rate (if any), and what happens if payments are late. This proactive approach minimizes the risk of conflict and ensures both the lender and borrower understand their responsibilities. It provides peace of mind knowing that the terms of the loan are clearly defined and legally sound.

Using a simple money lending agreement template doesn’t require you to be a lawyer or a financial expert. Many readily available templates online can be customized to fit your specific situation. The key is to understand what each section means and make sure it accurately reflects your agreement. Consider it like putting guardrails on a potentially tricky situation. You hope you’ll never need them, but you’re glad they’re there if things start to veer off course.

Why You Absolutely Need a Money Lending Agreement

Let’s face it: lending money, especially to people you care about, can be emotionally charged. Adding money into the mix has the potential to complicate existing relationships. Without a written agreement, things can get messy very quickly. Imagine a scenario where the borrower forgets the agreed-upon repayment schedule, or the lender feels uncomfortable constantly reminding them about the debt. This situation can cause friction and strain relationships. A written agreement can prevent these situations.

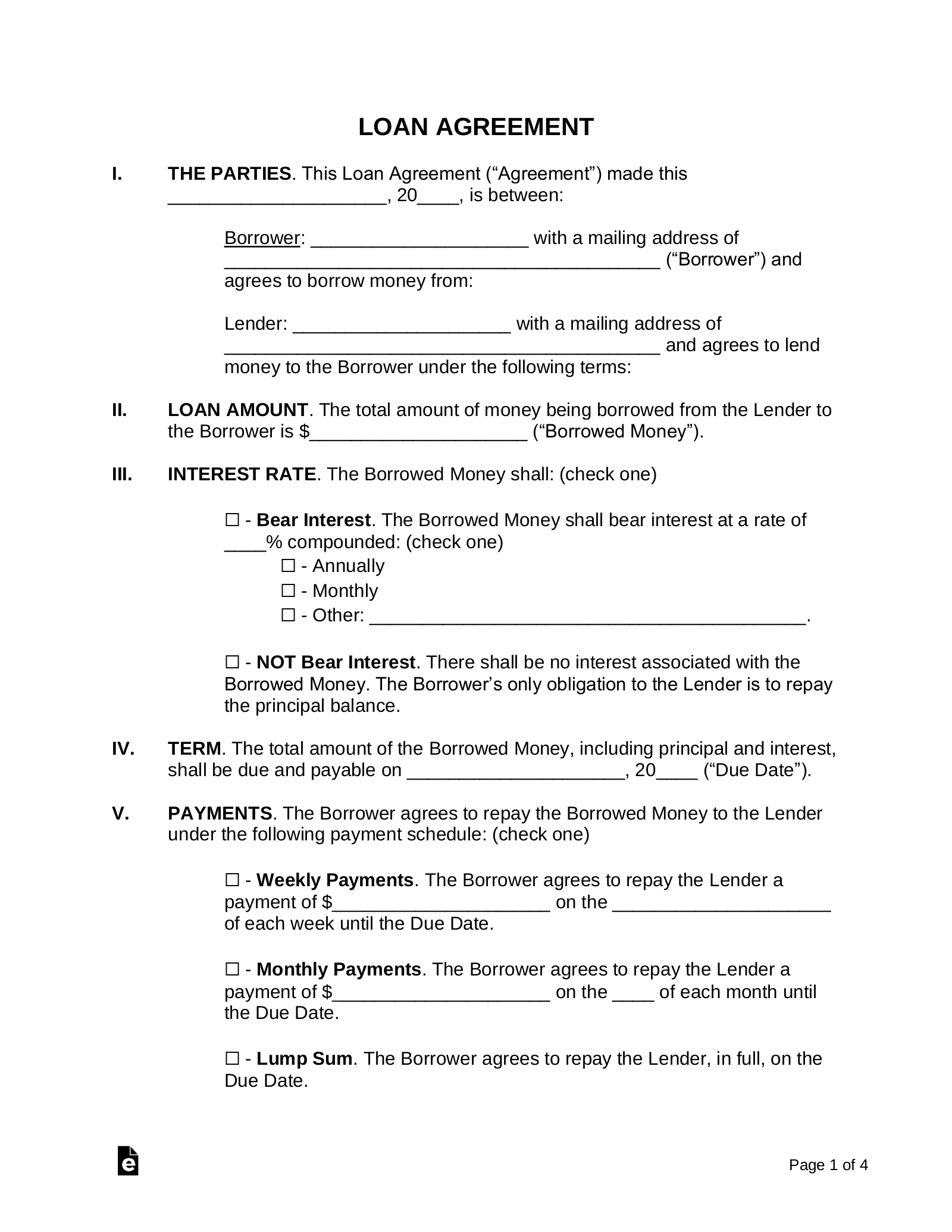

A comprehensive money lending agreement covers all the important aspects of the loan, leaving no room for ambiguity. It includes the principal amount (the amount being borrowed), the interest rate (if any), the repayment schedule (how often payments are due, and the amount of each payment), and any late payment penalties. It may also include details on collateral, if applicable, and the consequences of default. This clarity helps maintain transparency and prevents misunderstandings between the lender and the borrower. A simple money lending agreement template will help you to achieve this.

Furthermore, a written agreement provides legal protection for both parties. If a dispute arises, the agreement serves as evidence of the loan terms and can be used in court to resolve the issue. Without a written agreement, it can be very difficult to prove the existence of a loan, let alone its specific terms. This can leave the lender vulnerable to financial loss and the borrower without clear guidelines.

Think about it this way: even if you completely trust the person you’re lending money to, life is unpredictable. Circumstances can change unexpectedly, affecting their ability to repay the loan. They might lose their job, experience a medical emergency, or face other unforeseen challenges. A written agreement provides a framework for handling these situations, such as negotiating a revised repayment schedule or exploring alternative solutions.

Finally, having a money lending agreement promotes open and honest communication between the lender and borrower. By discussing and agreeing upon the terms of the loan upfront, both parties demonstrate their commitment to fulfilling their obligations. This fosters a sense of mutual respect and trust, strengthening the relationship and minimizing the risk of conflict. It’s a sign that you’re taking the loan seriously and that you value the relationship enough to protect it.

Key Elements of a Simple Money Lending Agreement Template

Creating a simple money lending agreement doesn’t have to be daunting. Most templates will guide you through the essential elements. However, it’s important to understand what these elements are and why they’re important. This knowledge will help you customize the template to your specific needs and ensure that the agreement accurately reflects the terms of your loan.

The first crucial element is identifying the parties involved: the lender and the borrower. Include their full legal names and addresses. This clarifies who is responsible for lending the money and who is responsible for repaying it. Next, clearly state the principal amount of the loan. This is the total amount of money being lent. Avoid any ambiguity in this section to prevent disputes down the line.

The agreement should also detail the interest rate, if applicable. If you’re charging interest, specify the percentage rate and how it will be calculated. Clearly define the repayment schedule, including the frequency of payments (e.g., weekly, monthly), the amount of each payment, and the due date. You might also want to include details on how the borrower can make payments (e.g., check, electronic transfer).

Another important element is addressing late payment penalties. Specify the consequences of late payments, such as late fees or an increase in the interest rate. This provides an incentive for the borrower to make timely payments and protects the lender from financial loss. Finally, if the loan is secured by collateral, clearly describe the collateral and the lender’s rights in the event of default. This section should include a detailed description of the asset being used as collateral, its value, and the process for claiming the collateral if the borrower fails to repay the loan.

In summary, a well-drafted simple money lending agreement template will cover all the essential details of the loan, providing clarity, protection, and peace of mind for both the lender and the borrower. It’s an investment in your financial security and the health of your relationships.

Having a written agreement can save you from lots of future headaches. It can definitely bring peace of mind.

Take the time to create a solid lending agreement. It will benefit you greatly in the long run, no matter who the money is being lent to.