Ever found yourself in that awkward spot where a friend or family member needs a little financial help? Or maybe you’re the one seeking a loan from someone you know? Navigating these situations can be tricky. You want to help, but you also want to protect yourself and maintain a healthy relationship. That’s where a simple money loan agreement template comes in handy. It’s not about distrust; it’s about clearly defining the terms of the loan to avoid any misunderstandings down the road. Think of it as setting clear expectations for everyone involved, just like you would with any other important agreement.

This isn’t just for large sums of money either. Even for smaller loans, having something in writing can prevent confusion and potential conflict. It’s a way to formalize the agreement and make sure everyone is on the same page regarding the amount, repayment schedule, and any interest involved. It’s also incredibly useful for your own financial tracking, whether you are lending or borrowing.

A well-crafted loan agreement can bring peace of mind to both parties. It provides a structured framework, clarifying the responsibilities of both the lender and the borrower. It doesn’t need to be overly complicated or filled with legal jargon. A simple money loan agreement template can be straightforward, easy to understand, and tailored to the specific needs of your situation. Let’s explore the essential components of such a template and how it can protect your interests.

Why Use a Simple Money Loan Agreement Template?

Okay, so you might be thinking, “Do I really need a formal agreement for lending money to a friend?” The answer is almost always yes. While you might trust the person completely, life happens. Circumstances change, memories fade, and informal agreements can easily become sources of tension. A simple money loan agreement template acts as a safeguard, ensuring that everyone understands their obligations and protects your relationship in the long run.

Think about it this way: a written agreement removes any ambiguity. It clearly states the loan amount, the interest rate (if any), the repayment schedule, and what happens if the borrower defaults. Without these details documented, it’s easy for misunderstandings to arise. Imagine you lent a friend some money with the vague understanding that they’d pay you back “when they could.” What if their definition of “when they could” differs drastically from yours? A written agreement prevents this kind of conflict.

Furthermore, having a formal agreement provides a record of the transaction. This can be incredibly useful for tax purposes, especially if you’re charging interest on the loan. It also helps you track your finances and ensures that you’re managing your money responsibly. Consider the impact to the borrower as well, as a template provides them with a set timeframe and responsibilities to uphold.

A simple loan agreement template also demonstrates professionalism and respect. It shows that you value the relationship and are taking the loan seriously. It’s a sign that you’re not just winging it and that you’ve thought through the potential implications. This can build trust and strengthen the bond between you and the borrower.

Ultimately, using a simple money loan agreement template is about protecting yourself, your relationships, and your financial well-being. It’s a proactive step that can prevent headaches and heartaches down the road. It’s also about establishing clear guidelines and expectations in a way that minimizes the chances of misinterpretation.

Key Elements of a Simple Money Loan Agreement Template

So, what should you include in your simple money loan agreement template? Let’s break down the essential components:

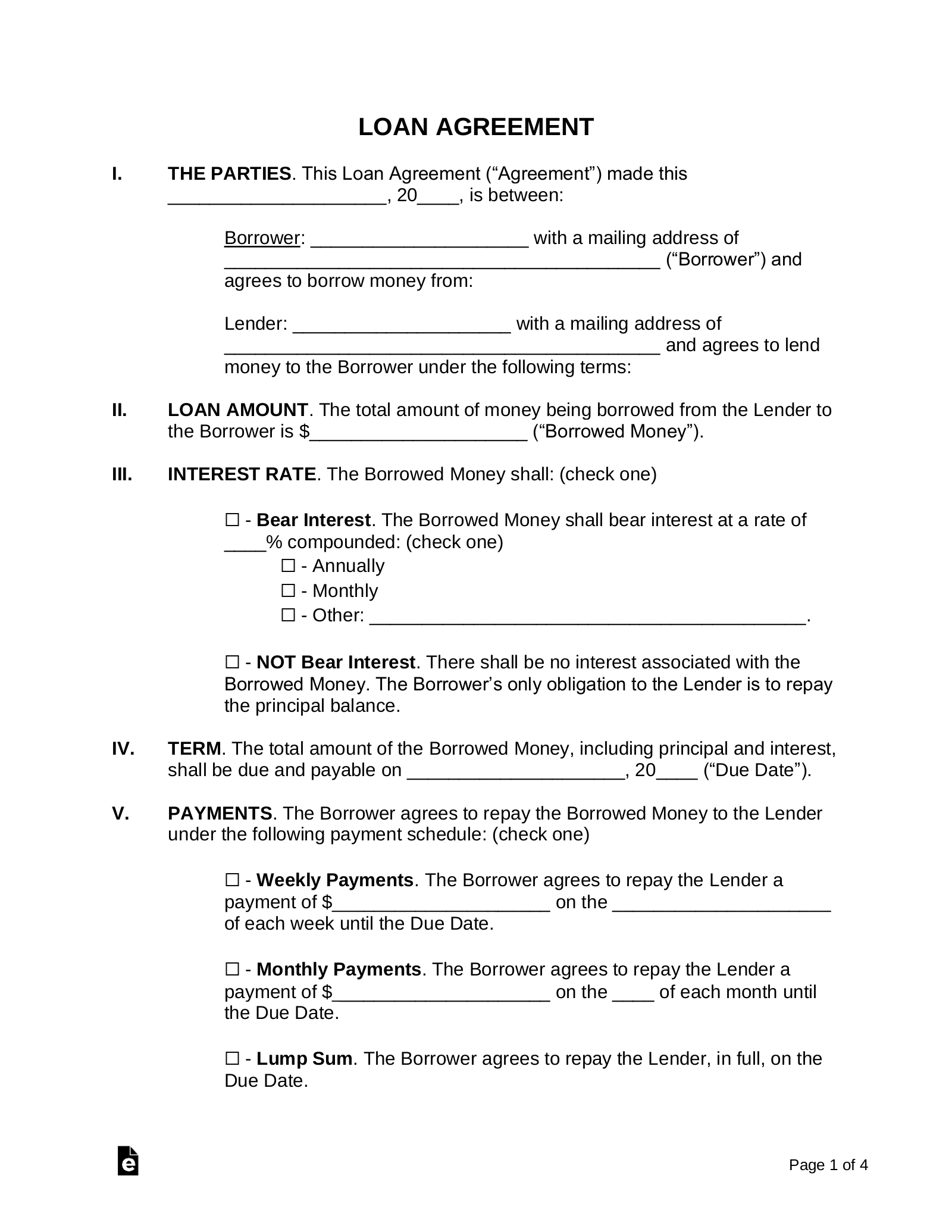

Parties Involved: Clearly identify the lender (the person giving the loan) and the borrower (the person receiving the loan). Include their full names and addresses.

Loan Amount: State the exact amount of money being lent. Be specific and avoid vague terms.

Interest Rate (if applicable): If you’re charging interest, specify the annual interest rate. Ensure you comply with local laws regarding interest rates.

Repayment Schedule: Outline how the loan will be repaid. Will it be a lump sum payment? Or will it be paid in installments? Specify the frequency of payments (e.g., monthly, quarterly) and the due dates.

Late Payment Penalties: Include a clause outlining the consequences of late payments. This could include late fees or an increase in the interest rate. Setting this expectation upfront will help encourage timely payments.

Default Clause: Define what constitutes a default on the loan. This could include missing multiple payments or failing to meet other obligations outlined in the agreement. Also, specify the remedies available to the lender in the event of a default.

Governing Law: State the jurisdiction whose laws will govern the agreement. This is important in case of any disputes.

Signatures: Both the lender and the borrower should sign and date the agreement. Consider having the signatures notarized for added security.

By including these key elements, you can create a comprehensive and legally sound simple money loan agreement template. Remember, the goal is to be clear, concise, and unambiguous.

In conclusion, using a simple money loan agreement template is a smart way to approach lending or borrowing money from people you know. It provides a framework for the agreement, minimizing the risk of misunderstandings and conflicts.

With a well-drafted agreement, you can confidently navigate the world of personal loans, knowing that you’ve taken the necessary steps to protect yourself and your relationships. Finding and using a template is easy and can save you a lot of stress down the road.