Need to borrow some money from a friend or family member? Or maybe you’re the one doing the lending? Either way, it’s always a good idea to put things in writing. That’s where a simple personal loan agreement template comes in handy. Think of it as a friendly contract, ensuring everyone is on the same page and avoiding potential misunderstandings down the road. It doesn’t have to be complicated legal jargon. In fact, the simpler, the better! This article will guide you through what a simple personal loan agreement template is, why you need one, and what to include.

Personal loans between individuals are more common than you might think. Whether it’s helping a family member with a down payment on a car, funding a friend’s small business venture, or just bridging the gap between paychecks, these informal loans play a crucial role in many people’s lives. However, without a written agreement, memories can fade, interpretations can differ, and relationships can be strained. A simple personal loan agreement template provides a clear, documented record of the terms, protecting both the lender and the borrower.

So, before you hand over that cash or accept that loan, take the time to draft a simple personal loan agreement template. It’s an investment in your relationship and a safeguard for your finances. Let’s dive in and explore what makes up a good personal loan agreement and why it’s so important.

Why You Need a Simple Personal Loan Agreement

Let’s face it: lending or borrowing money from people you know can be awkward. Talking about finances isn’t always easy, but avoiding the conversation altogether can lead to even bigger problems later on. A simple personal loan agreement template takes the awkwardness out of the equation by providing a clear, objective framework for the loan. It ensures everyone is on the same page regarding the loan amount, interest rate (if any), repayment schedule, and other important details.

Without a written agreement, misunderstandings can easily arise. What one person considers a gift, the other might see as a loan. Or perhaps the repayment terms were never clearly discussed, leading to confusion and resentment. A simple personal loan agreement template eliminates these ambiguities by clearly outlining the terms of the agreement. It’s a written record of what was agreed upon, protecting both the lender and the borrower.

Furthermore, having a written agreement can be incredibly useful if things go wrong. While we all hope that our loans will be repaid as agreed, life happens. Unexpected expenses can arise, jobs can be lost, and circumstances can change. In such situations, a written agreement provides a framework for renegotiating the loan terms or pursuing legal recourse if necessary. It serves as evidence of the loan and the agreed-upon terms, which can be invaluable in resolving disputes.

Think of a simple personal loan agreement template as a safety net for your relationship and your finances. It’s a way to protect yourself and your loved ones from potential misunderstandings and disagreements. It’s also a sign of respect and good faith, demonstrating that you take the loan seriously and are committed to upholding your end of the bargain.

Essentially, using a simple personal loan agreement template is about building trust and maintaining healthy relationships. By putting the terms of the loan in writing, you’re showing that you value the other person and are committed to transparency and fairness. It’s a proactive step that can prevent misunderstandings, protect your interests, and strengthen your relationships.

What Should Be Included

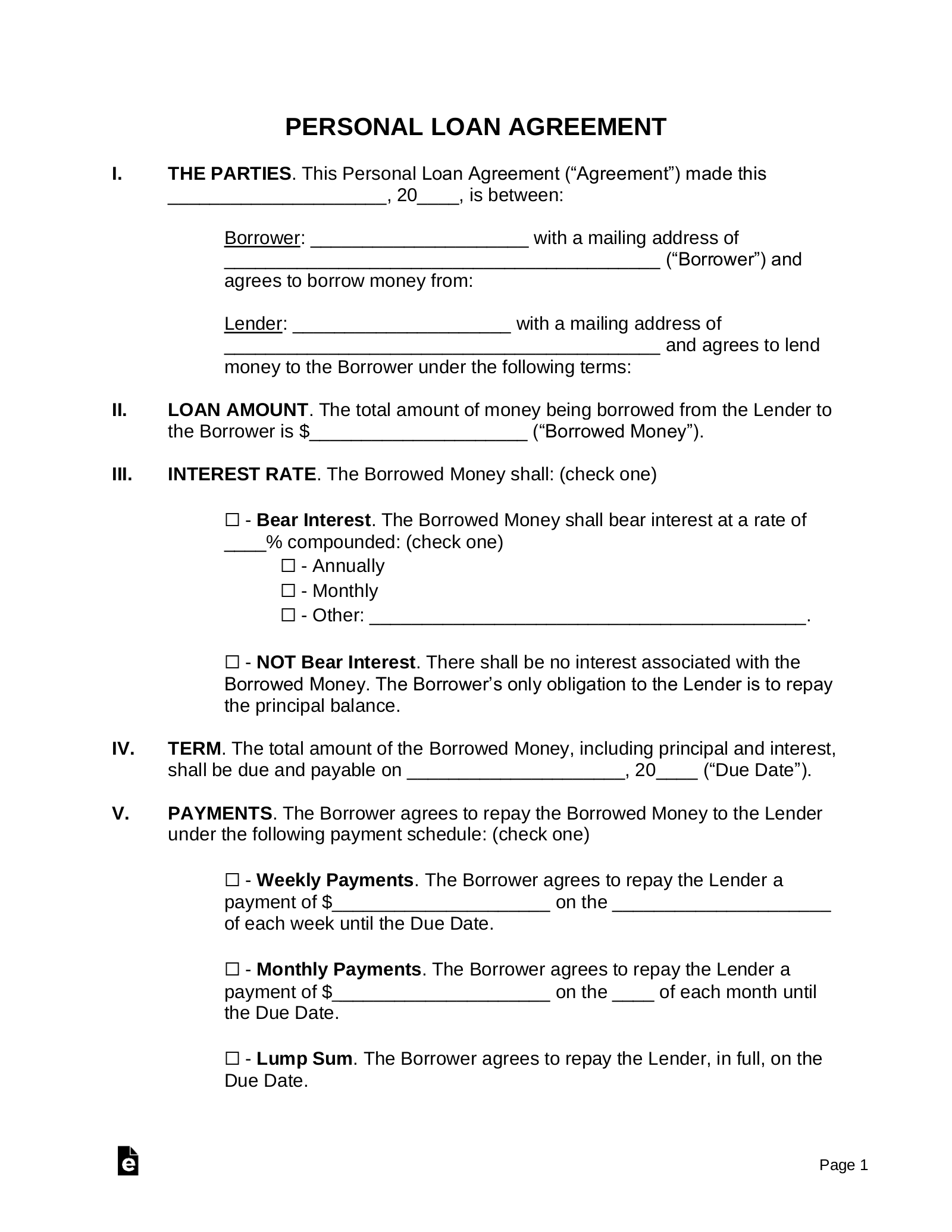

When creating a simple personal loan agreement template, make sure to include the names and addresses of both the lender and the borrower. Clearly state the principal loan amount, the interest rate (if any), and the repayment schedule. Specify the start date of the loan and the due date for each payment. Also, outline any late payment penalties or other fees that may apply. Finally, include a section for signatures and dates from both parties.

Essential Elements of a Strong Agreement

Now that you understand why a simple personal loan agreement template is important, let’s discuss the key elements that should be included to make it a robust and effective document. While the term “simple” implies ease of understanding, it doesn’t mean omitting crucial details. The goal is to strike a balance between clarity and comprehensiveness.

First and foremost, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the lender (the person providing the loan) and the borrower (the person receiving the loan). This information is essential for identification and contact purposes, particularly if legal action becomes necessary.

Next, the agreement should clearly state the principal loan amount. This is the total amount of money being lent. Be specific and avoid vague language. For example, instead of writing “approximately 5000 dollars,” write “$5,000.00.” Clarity is key to preventing disputes later on. If the loan is intended to be used for a specific purpose, it can be beneficial to state that purpose in the agreement as well. This can help to avoid misunderstandings about how the money should be used.

The interest rate, if any, should also be clearly stated. If the loan is interest-free, explicitly state that. If interest is being charged, specify the annual percentage rate (APR). Be sure to comply with any applicable usury laws in your jurisdiction, which may limit the amount of interest that can be charged. The agreement should also outline how interest is calculated and when it is compounded.

Finally, the repayment schedule is one of the most critical elements of the agreement. This section should specify the frequency of payments (e.g., weekly, bi-weekly, monthly), the amount of each payment, and the due date for each payment. It’s also a good idea to include a clause addressing what happens if a payment is late or missed entirely. This might include late payment penalties, a grace period, or other consequences. By clearly outlining the repayment terms, both parties can avoid confusion and ensure that the loan is repaid according to the agreed-upon schedule.

Crafting a simple personal loan agreement template doesn’t require a law degree. With a little care and attention to detail, you can create a document that protects your interests and strengthens your relationships. Remember to tailor the template to your specific circumstances and consult with a legal professional if you have any concerns.

Using a simple personal loan agreement template is a wise decision that protects everyone involved. It provides clarity and helps prevent future misunderstandings, ensuring the loan process is as smooth as possible.