Thinking about sharing the wealth with your team? A profit sharing agreement can be a fantastic way to motivate employees, boost morale, and foster a sense of ownership in your company’s success. But wading through legal jargon and complex clauses can be daunting. That’s where a simple profit sharing agreement template comes in. It offers a straightforward framework for outlining how profits will be distributed, making the entire process more accessible and transparent.

This article aims to demystify the concept of profit sharing agreements and guide you through using a simple profit sharing agreement template effectively. We’ll explore the key elements that should be included, the benefits of having a clearly defined agreement, and common pitfalls to avoid. Whether you’re a small business owner or part of a larger corporation, understanding the fundamentals of profit sharing can significantly impact your company culture and financial outcomes.

By using a well-structured template, you can ensure that your profit sharing plan is fair, legally sound, and aligns with your company’s goals. It’s about creating a win-win scenario where both the company and its employees benefit from increased profitability and shared success. Let’s dive in and explore how to make profit sharing a reality for your business.

Understanding the Core Elements of a Profit Sharing Agreement

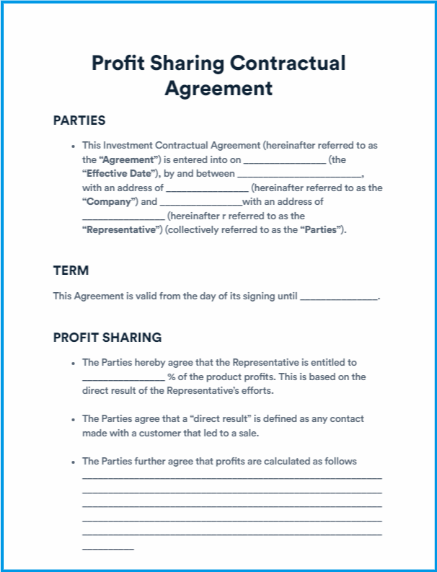

A profit sharing agreement, at its heart, is a contract. It outlines how a portion of your company’s profits will be distributed among eligible employees. The most important aspect is clarity. The agreement needs to be written in plain language, avoiding overly technical terms that might confuse employees. This fosters trust and transparency, making the entire process smoother.

The initial section of your agreement should clearly define who is eligible to participate in the profit sharing plan. Will it include all employees, or only those who have been with the company for a certain length of time? Are part-time employees eligible? Spell out the specific criteria to avoid any misunderstandings down the line. Think about factors like tenure, performance, and job title when establishing these criteria.

Next, the agreement must meticulously define how profits will be calculated for the purpose of profit sharing. Are you using net profit before or after taxes? Will certain expenses be deducted before the profit sharing calculation is made? A precise definition of profit is essential to prevent disputes and ensure everyone understands the basis of the distribution. Consult with your accountant to determine the most appropriate method for your business.

The agreement should also detail the percentage of profits that will be allocated for profit sharing. This percentage should be determined based on your company’s financial situation, the number of eligible employees, and your overall compensation philosophy. It’s crucial to strike a balance between rewarding employees and reinvesting in the growth of your business. Remember, the goal is to motivate your team without jeopardizing the financial stability of the company.

Finally, outline how the profit sharing funds will be distributed among eligible employees. Will it be based on salary, performance, or a combination of factors? Will employees receive the funds as a cash bonus, or will they be contributed to a retirement plan? The method of distribution should be clearly stated in the agreement. Consider the tax implications of each distribution method and communicate them to your employees. A simple profit sharing agreement template can help you organize and document these crucial elements effectively.

Benefits of Using a Simple Profit Sharing Agreement Template

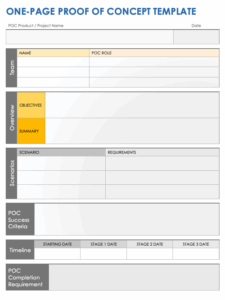

Using a simple profit sharing agreement template offers several advantages. The most obvious benefit is the time savings. Creating a profit sharing agreement from scratch can be time-consuming, requiring extensive legal research and drafting. A template provides a pre-built framework, allowing you to quickly customize it to your specific needs. This saves you valuable time and resources that can be better allocated to other aspects of your business.

Templates also reduce the risk of errors and omissions. A well-designed template will include all the essential clauses and provisions necessary for a legally sound agreement. This helps ensure that your profit sharing plan complies with all applicable laws and regulations. By using a template, you can avoid inadvertently omitting important information that could lead to future disputes or legal challenges. A simple profit sharing agreement template acts as a checklist, guiding you through the necessary steps.

Templates promote consistency. When multiple individuals are involved in drafting profit sharing agreements, using a template ensures that all agreements follow the same format and include the same key provisions. This promotes fairness and transparency, preventing any perception of favoritism or discrimination. Consistency also makes it easier to administer the profit sharing plan and track employee participation.

Furthermore, a simple profit sharing agreement template can improve communication. By providing a clear and concise framework, the template helps you communicate the details of the profit sharing plan to your employees in a straightforward manner. This fosters trust and understanding, leading to greater employee engagement and participation. Transparency is key to building a successful profit sharing program.

Finally, using a template can be cost-effective. Hiring an attorney to draft a profit sharing agreement can be expensive. A template provides a more affordable alternative, allowing you to create a legally sound agreement without breaking the bank. While it’s always advisable to have an attorney review your final agreement, using a template can significantly reduce legal fees. A simple profit sharing agreement template is a valuable tool for any business looking to implement a profit sharing plan efficiently and effectively.

A profit sharing agreement doesn’t have to be complicated. By using a well-designed template and understanding the key elements involved, you can create a plan that benefits both your company and your employees.

With careful planning and clear communication, profit sharing can be a powerful tool for building a stronger, more engaged workforce.