So, you’re looking to buy or sell some shares in a company? Fantastic! Maybe you’re a founder offloading a portion of your stake, or perhaps an investor jumping in on a promising venture. Either way, you’re going to need a simple share purchase agreement template. Think of it as the roadmap that ensures everyone is on the same page, avoiding potential headaches and misunderstandings down the line. It’s the legal backbone of your transaction, outlining the nitty-gritty details that protect both the buyer and the seller.

Navigating the world of legal documents can feel daunting, especially if you’re not a lawyer. But don’t worry, it doesn’t have to be a complicated ordeal. A well-crafted simple share purchase agreement template will clarify the terms of the sale, making the process smoother and more transparent for all involved. It’s all about clearly defining who’s selling what, for how much, and under what conditions. The right template can also help you anticipate potential issues and address them proactively.

This article will delve into the key elements of a share purchase agreement, explaining what each section means and why it’s important. We’ll explore the benefits of using a simple share purchase agreement template, and how it can streamline the process of buying and selling shares. By the end, you’ll have a better understanding of what to look for in a template and how to customize it to fit your specific needs.

Understanding the Essential Components of a Share Purchase Agreement

A share purchase agreement, at its core, is a legally binding contract. It formalizes the agreement between a seller (the shareholder) and a buyer (the individual or entity purchasing the shares) for the transfer of ownership of those shares. The agreement needs to be comprehensive, covering all the important details of the transaction to prevent disputes down the road.

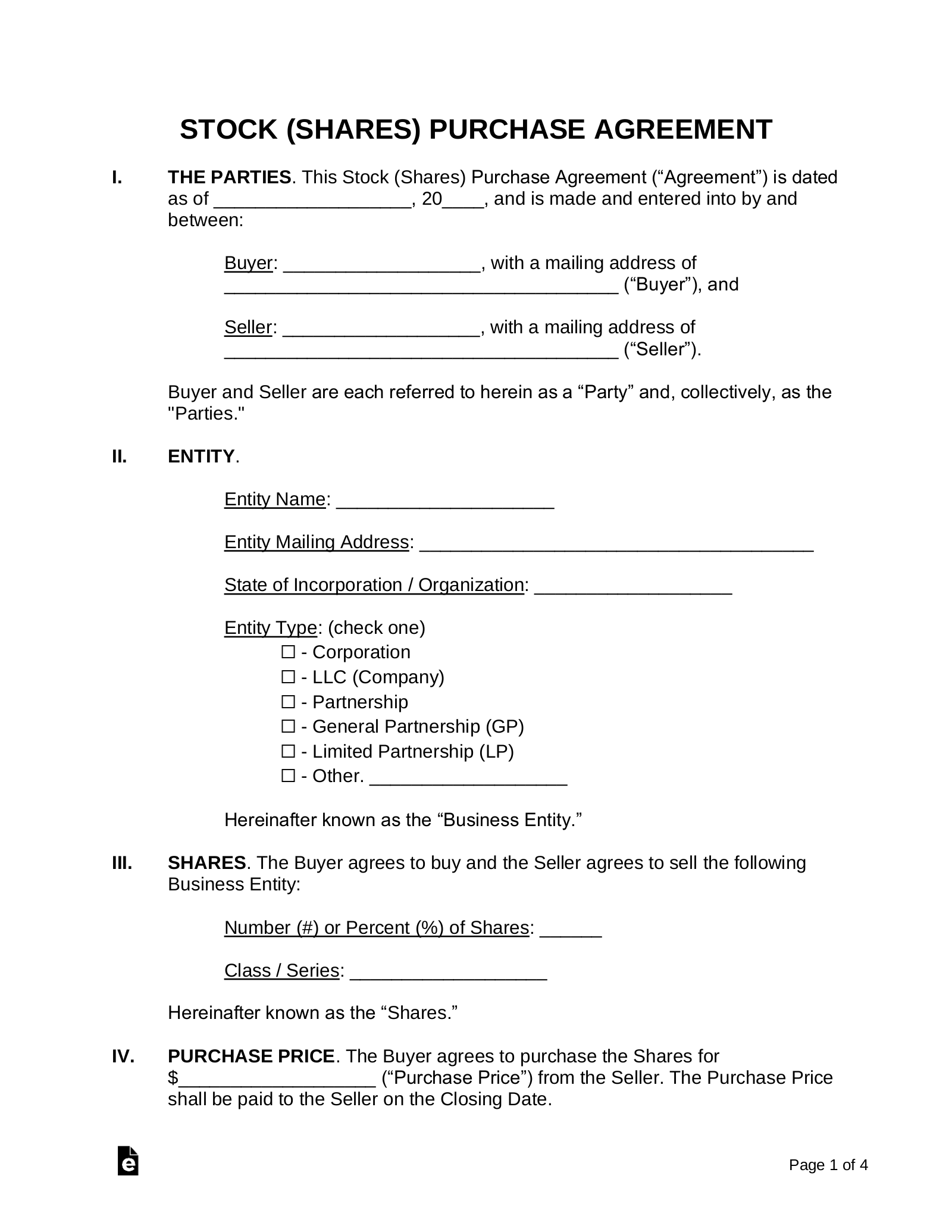

One of the most crucial elements is the specification of the shares being sold. This includes the number of shares, the class of shares (e.g., common or preferred), and the company issuing those shares. The agreement must also clearly state the purchase price per share and the total consideration being paid. This section should also include details on how the payment will be made, the currency, and any escrow arrangements.

Representations and warranties are another critical part of the agreement. These are statements made by the seller about the company and the shares being sold. For example, the seller might warrant that they have the full right to sell the shares, that the shares are free of any liens or encumbrances, and that the company’s financial statements are accurate. These representations provide the buyer with some assurance about the value and condition of the shares.

The agreement should also address the closing date and closing conditions. The closing date is the date on which the shares are officially transferred to the buyer, and the payment is made to the seller. Closing conditions are specific requirements that must be met before the closing can occur. These might include obtaining regulatory approvals, completing due diligence, or securing financing.

Finally, a comprehensive share purchase agreement will include provisions for dispute resolution. This section outlines how any disagreements arising from the agreement will be resolved, whether through mediation, arbitration, or litigation. It is very important to have this section. All these things are contained in a simple share purchase agreement template.

Why Use a Simple Share Purchase Agreement Template?

The primary reason to use a simple share purchase agreement template is to save time and money. Hiring a lawyer to draft a custom agreement can be expensive, especially for smaller transactions. A template provides a cost-effective alternative, giving you a solid foundation to work from without breaking the bank. It does, however, is still encouraged that you get it reviewed by your legal counsel.

Templates also provide a structure and guidance for the entire process. They ensure that you don’t overlook any essential clauses or terms. By walking you through each section of the agreement, a template helps you identify potential issues and address them proactively. This can be particularly helpful if you are new to buying or selling shares.

Furthermore, a good simple share purchase agreement template offers clarity and consistency. It uses clear, concise language that is easy to understand, minimizing the risk of misinterpretations. By using a standardized format, it also ensures that all parties are on the same page and that the agreement is consistent with industry best practices.

However, it’s crucial to remember that a template is just a starting point. Every share purchase transaction is unique, and you may need to customize the template to fit your specific circumstances. This might involve adding or modifying clauses to address specific risks or concerns. The simple share purchase agreement template can save you valuable time and money.

While a template can be a valuable tool, it’s always a good idea to seek legal advice, especially if you are dealing with a complex transaction or significant sums of money. An attorney can review the template, advise you on any necessary modifications, and ensure that the agreement adequately protects your interests. Don’t substitute the legal advice of a qualified counsel in your jurisdiction.

When embarking on a share transaction, remember that clear communication and transparency are key. By using a well-crafted agreement as a foundation, you can create a solid framework for a successful and mutually beneficial transaction. It’s about ensuring all parties understand their rights and obligations, paving the way for a smooth and efficient transfer of ownership.

Ultimately, the goal is to create a simple share purchase agreement template that protects your interests and minimizes the risk of future disputes. A well-documented agreement brings clarity, transparency, and peace of mind to everyone involved, setting the stage for a positive and productive business relationship.