So, you’re thinking about buying or selling some stock in a company? That’s fantastic! It’s a big step, whether you’re an entrepreneur looking to offload some equity or an investor eager to get a piece of the pie. But before you dive headfirst into the world of stock transactions, there’s one crucial document you absolutely need to get right: the stock purchase agreement. Think of it as the rulebook for the whole game, ensuring everyone knows their rights and responsibilities. It might sound intimidating, but don’t worry, it doesn’t have to be complicated. A simple stock purchase agreement template can be your best friend in this process.

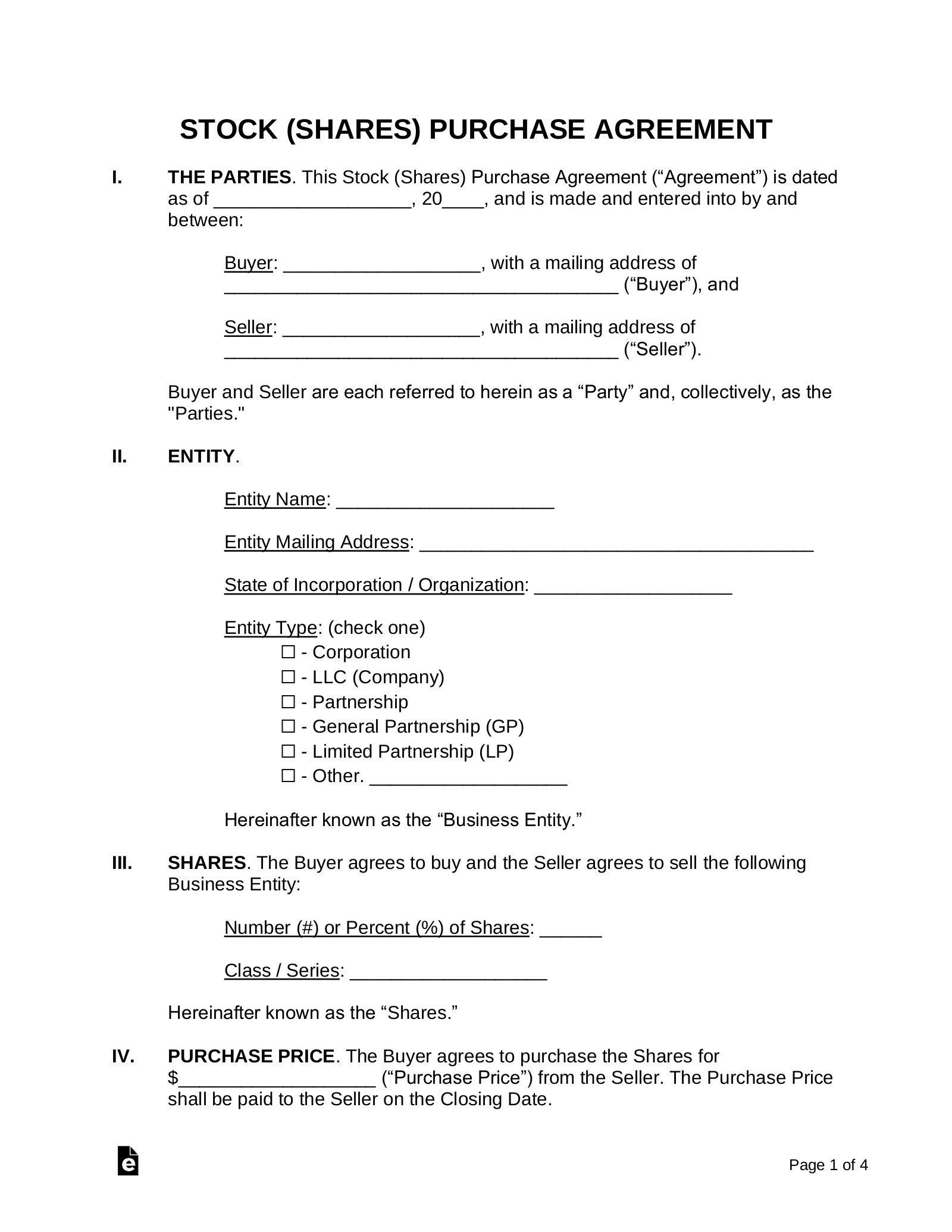

This agreement outlines everything, from the number of shares being sold and the price per share to the closing date and any warranties or representations made by the seller. Using a well-drafted template can save you a lot of headaches down the road, preventing misunderstandings and potential legal battles. It gives everyone peace of mind knowing that the deal is fair, transparent, and legally sound. Think of it like a roadmap that keeps everyone on the same page.

In this article, we’ll break down what a simple stock purchase agreement template is, why you need one, and what key elements it should include. We’ll also explore where you can find reliable templates and offer some tips to ensure your agreement is tailored to your specific needs. Let’s take the mystery out of stock purchase agreements and empower you to navigate the process with confidence. Ready to get started?

Understanding Stock Purchase Agreements: The Basics

A stock purchase agreement, at its core, is a legally binding contract that details the terms and conditions of a stock sale. It’s the document that seals the deal between a seller, who’s transferring ownership of shares, and a buyer, who’s acquiring those shares. It’s not just a formality; it’s a crucial piece of paperwork that protects both parties by clearly defining the scope of the transaction. Without it, you’re essentially relying on a handshake deal, which can be risky business, especially when money and ownership are involved.

Why is it so important? Imagine this: you sell some stock, but the agreement doesn’t specify when the payment is due. Or perhaps the seller makes promises about the company’s future performance that aren’t put in writing. These kinds of ambiguities can lead to disputes, legal battles, and a lot of stress. A well-drafted stock purchase agreement eliminates these uncertainties by explicitly stating everything that’s been agreed upon. It provides a clear record of the transaction, ensuring that both the buyer and seller are on the same page.

The key components of a stock purchase agreement typically include things like the number of shares being sold, the price per share (and how it was determined), the closing date (when the ownership officially transfers), any representations and warranties made by the seller (assurances about the company’s financial health and legal compliance), and any conditions that must be met before the sale can be finalized. It also outlines the remedies available if either party breaches the agreement. In essence, it covers all the bases to protect everyone involved.

Think of it as the instruction manual for a complicated piece of machinery. You wouldn’t try to assemble something complex without clear instructions, right? The same goes for a stock transaction. A simple stock purchase agreement template provides that instruction, guiding you through the process and ensuring that everything is done correctly. It’s a tool for clarity, transparency, and ultimately, peace of mind. When done well, it minimizes the risk of disputes and helps ensure a smooth and successful transaction.

So, while the language of a stock purchase agreement might seem daunting at first, remember that its primary purpose is to protect you. By understanding the basics and utilizing a well-crafted template, you can navigate the world of stock transactions with confidence, knowing that you have a solid legal foundation to stand on. It’s about being proactive and setting yourself up for success, avoiding potential pitfalls and ensuring a fair and transparent deal for everyone involved.

Key Elements of a Simple Stock Purchase Agreement Template

When you’re staring at a simple stock purchase agreement template, it can look like a lot of legal jargon. But breaking it down into its essential parts can make the process much less intimidating. Each section plays a crucial role in protecting your interests and ensuring a clear understanding between the buyer and seller.

First, you’ll find the identification of the parties involved. This section clearly states the names and addresses of both the seller and the buyer. It might seem obvious, but getting this right is essential for legal clarity. Next comes the description of the stock being sold. This includes the number of shares, the class of stock (e.g., common or preferred), and the name of the company that issued the stock. This section leaves no room for ambiguity about what exactly is being transferred.

The purchase price and payment terms are arguably the most important part. This section spells out the agreed-upon price per share and the total purchase price. It also details how the payment will be made – whether it’s a lump sum, installment payments, or some other arrangement. The closing date is another critical element. This is the date on which the stock ownership officially transfers from the seller to the buyer. It’s important to specify a closing date that allows sufficient time for both parties to fulfill their obligations.

Representations and warranties are essentially promises made by the seller about the company’s financial condition, legal compliance, and other relevant matters. These warranties give the buyer assurance that they’re getting what they’re paying for. Indemnification clauses outline who is responsible for certain liabilities or losses that may arise after the sale. This section helps to protect both parties from unexpected financial burdens. Finally, the governing law section specifies which state’s laws will be used to interpret the agreement. This is important because laws vary from state to state.

Navigating a stock purchase can feel overwhelming, but remember that a well-structured simple stock purchase agreement template acts as your guide. It clearly defines the terms, protects your interests, and ensures a smooth transaction. Don’t hesitate to seek legal advice to customize the template to your specific situation, ensuring that all the important details are covered and that you’re making informed decisions throughout the process.

Navigating the world of stock transactions can feel daunting, but remember that knowledge is power. By understanding the importance of a solid stock purchase agreement and familiarizing yourself with its key elements, you’re well-equipped to make informed decisions and protect your interests. It’s about taking control of the process and ensuring a fair and transparent outcome for everyone involved.

Ultimately, a well-crafted stock purchase agreement is an investment in your peace of mind. It’s a tool that empowers you to navigate the complexities of stock sales with confidence, knowing that you have a clear and legally sound framework in place. Whether you’re a seasoned investor or a first-time seller, taking the time to create a comprehensive agreement is always a worthwhile endeavor.